SK Telecom

SK Telecom Co., Ltd., reviated as SKT (Korean: SK텔레콤 or 에스케이텔레콤) is a South Korean wireless telecommunications operator and former film distributor and is part of the SK

Get Price

South Korean carriers order 28GHz 5G base stations from Samsung

The South Korean carriers will begin their pilot projects in the B2B (Business to Business) space on the 28GHz spectrum later this year. The base stations will be used to experiment and

Get Price

Korean carriers order 28GHz 5G base stations from Samsung:

Korean telecommunications operators SK Telecom, KT and LG Uplus have ordered 28 GHz 5G base stations from compatriot company Samsung Electronics for the first time,

Get Price

How South Korea built 5G, and what it''s learning

The three South Korean carries, SK telecom, KT and LG Uplus, launched limited 5G commercial services in December 2018. The simultaneous launch, which spanned limited

Get Price

SK Telecom, Samsung use AI to optimize 5G base stations

The Korean operator had said that the revamp aims to transform the A. app into an AI personal assistant focused on enhancing daily convenience for customers. It added that the

Get Price

Country Profile: South Korea TowerXchange

Each of the three MNOs are said to have installed between 60,000 and 70,000 5G base stations over the past two and a half years, resulting in a

Get Price

5g south korea

Telecom operators in South Korea, such as SK Telecom, KT Corporation, and LG Uplus, have invested heavily in 5G infrastructure. They have deployed a large number of 5G

Get Price

South Korean Operators Launch Commercial 5G Services

LG Uplus has been deploying base stations to launch its commercial 5G offering since October. According to the operator said it will have more than 7,000 base stations by the end of

Get Price

Korean carriers order 28 GHz 5G base stations from Samsung:

Korean telecommunications operators SK Telecom, KT and LG Uplus have ordered 28 GHz 5G base stations from compatriot company Samsung Electronics for the first time, Korean press

Get Price

KT and LG Uplus lose their 28 GHz spectrum licenses

However, according to ZDNet, SK Telecom, which is South Korea''s largest operator, was given a bit of a reprieve. The operator will have

Get Price

South Korea''s capital Seoul ends March with 37,680 5G base stations

Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to the latest available figures from the country''s Ministry of

Get Price

South Korea has 24 million 5G subscribers and over 200K 5G base stations

Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to previous reports. This figure is equivalent to 23% of total 4G

Get Price

Korea''s leadership in 5G and beyond: Footprints and futures

These 5G subscribers accounted for 53.5% of the overall mobile base of the mobile network operators (MNO) at the end of 2022, up from 40.5% at the end of 2021 (RCR Wireless

Get Price

South Korea 5G Macro Base Station Market Overview: Key

The South Korea 5G macro base station market has experienced significant growth, driven by the rapid adoption of 5G technologies across various sectors.

Get Price

S. Korea Provides Incentives to Attract New 5G

The South Korean government laid out measures to enhance local competition in the communications market and break the over 20-year

Get Price

South Korea''s capital Seoul ends March with 37,680 5G base

Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to the latest available figures from the country''s Ministry of

Get Price

South Korea ends February with almost 203,000 5G base stations

Telcos in South Korea area currently providing 5G services via NonStandalone networks Korean mobile operators have deployed a total of 202,903 5G base stations as of

Get Price

Wi-Fi and 5G Status in South Korea

The three telecom operators had deployed 166,250 5G base stations as of November last year, which is just 19 percent of the number of 4G base stations, according to

Get Price

Understanding where and when users can experience

In South Korea, operators exceeded 90% 5G population coverage in early 2020 but Korean users still considered the 5G experience problematic

Get Price

KT mobile payment breach rattles users over new security threat

2 days ago· "All three telecom operators are now fully restricting new micro base stations from connecting to their networks.

Get Price

Understanding where and when users can experience 5G in South Korea

In South Korea, operators exceeded 90% 5G population coverage in early 2020 but Korean users still considered the 5G experience problematic and the number of base

Get Price

South Korean carriers order 28GHz 5G base stations

The South Korean carriers will begin their pilot projects in the B2B (Business to Business) space on the 28GHz spectrum later this year. The base stations will

Get Price

Wi-Fi and 5G Status in South Korea

The three telecom operators had deployed 166,250 5G base stations as of November last year, which is just 19 percent of the number of

Get Price

South Korea''s capital Seoul ends March with 37,680 5G base stations

The average number of 5G base stations per district in Seoul is estimated at 1,507 units South Korea''s capital Seoul ended March with a total of 37,680 5G base stations,

Get Price

Base station network operator. 5G. 4G, 3G mobile technologies

RM RCNAD6 – Seoul, South Korea. 16th Jan, 2019. Photo taken on Jan. 16, 2019 shows a KT Corp.''s 5G base station in Seoul, capital of South Korea. South Korean telecom operator KT

Get Price

SK Telecom tests 5G interoperability with Samsung,

South Korea''s largest mobile operator, SK Telecom, announced that it has successfully tested interoperability between a 5G Non Standalone

Get Price

Country Profile: South Korea TowerXchange

Each of the three MNOs are said to have installed between 60,000 and 70,000 5G base stations over the past two and a half years, resulting in a total count of 200,000 across

Get Price

Status of South Korea 5G network (Part 1)

Korea''s three major telecom operators have focused on building 5G sub-6GHz (3.5GHz) base stations and have gradually abandoned using the 5G 28GHz millimeter-wave

Get Price

6 FAQs about [South Korean telecom operator base stations]

How many 5G base stations are there in South Korea?

South Korean telecom operators currently provide 5G services via Non-Standalone (NSA) 5G networks, which depend on previous 4G LTE networks. Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to previous reports.

What are the 5G frequencies in South Korea?

This includes frequency ranges in the 3.5 GHz and 28 GHz bands. Telecom operators in South Korea, such as SK Telecom, KT Corporation, and LG Uplus, have invested heavily in 5G infrastructure. They have deployed a large number of 5G base stations to provide extensive coverage in urban and suburban areas.

What is 5G infrastructure in South Korea?

Telecom operators in South Korea, such as SK Telecom, KT Corporation, and LG Uplus, have invested heavily in 5G infrastructure. They have deployed a large number of 5G base stations to provide extensive coverage in urban and suburban areas. Massive MIMO technology is a key component of 5G networks in South Korea.

How many 4G subscribers are there in South Korea?

The number of 4G subscribers in South Korea reached 47 million as of the end of May. Also, mobile virtual network operators in the Asian nation had a combined 83,256 users as of the end of the month. South Korean telecom operators currently provide 5G services via Non-Standalone (NSA) 5G networks, which depend on previous 4G LTE networks.

What is massive MIMO technology in South Korea?

Massive MIMO technology is a key component of 5G networks in South Korea. This involves deploying a large number of antennas at base stations to enhance data throughput and improve network capacity. 5G networks in South Korea have adopted network virtualization and cloud-native architectures.

Does South Korea have 5G?

South Korea was the first country to launch commercial 5G networks in April 2019 and currently has 5G coverage across its 85 cities The total number of 5G subscribers in South Korea reached nearly 24 million in May, Korean press reported, citing data from the Ministry of Science and ICT.

More related information

-

How many base stations does Tonga Telecom have

How many base stations does Tonga Telecom have

-

Wind-solar hybrid power supply for communication base stations in South Sudan

Wind-solar hybrid power supply for communication base stations in South Sudan

-

Can solar panels affect telecom base stations

Can solar panels affect telecom base stations

-

Inverters are required for communication base stations in the Republic of South Africa

Inverters are required for communication base stations in the Republic of South Africa

-

What are the manufacturers of outdoor wind power base stations in South Ossetia

What are the manufacturers of outdoor wind power base stations in South Ossetia

-

How Many Telecom Base Stations Are There in Yemen EMS

How Many Telecom Base Stations Are There in Yemen EMS

-

South Korean companies engaged in energy storage power stations

South Korean companies engaged in energy storage power stations

-

Philippines Telecom builds 5G base stations

Philippines Telecom builds 5G base stations

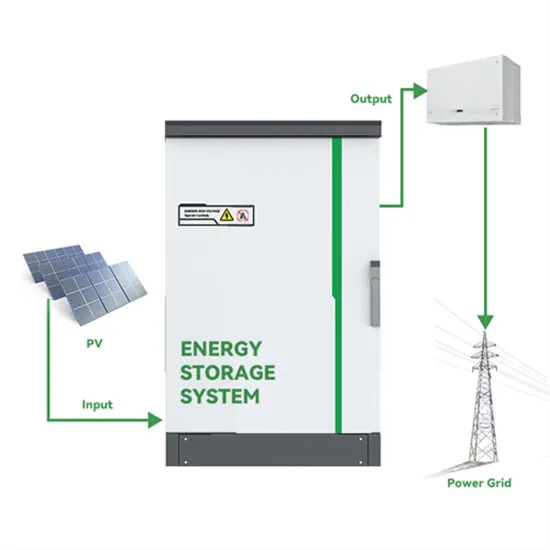

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.