Globe expands 5G network, rolls out 256 new cell sites

Globe Telecom Inc. said Friday it rolled out 256 new 5G sites in the first half of 2024, expanding its 5G network coverage across the country. The latest development brings

Get Price

Philippines Telecoms Industry Report – 2024-2031

This report provides analyses of revenue and market forecasts as well as statistics of the Philippines telecoms industry including market sizing, 5-year

Get Price

Globe Telecom Expands 5G Coverage Across the

The deployment builds on a three-year agreement signed in 2021 to upgrade Globe''s 4G network and extend 5G coverage across more than

Get Price

Globe expands 5G network with 27 new sites

Globe, the country''s mobile leader, deployed 27 new 5G sites across the Philippines in Q1 2024 as part of its commitment to providing cutting-edge technology and

Get Price

Technical Requirements and Market Prospects of 5G Base Station

With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

Get Price

China rolls out world''s first military-proof 5G that can

The military 5G also makes use of China''s latest civilian technologies. As of November 2024, China had built nearly 4.2 million civilian

Get Price

Three companies to own 74.5% of base station

Samsung continues to expand its influence in the U.S. telecommunications market, providing 5G equipment to Dish Network, the

Get Price

The Philippines is a Duopoly No More: Assessing

In Q1 2022, Smart reported its mobile data traffic grew 30% year-on-year to 1,010 petabytes. The number of its 5G base stations increased from

Get Price

Quick guide: components for 5G base stations and antennas

5G technology manufacturers face a challenge. With the demand for 5G coverage accelerating, it''s a race to build and deploy base-station components and antenna mast

Get Price

Li Zhengmao of China Telecom: build and share 5g base station

Li Zhengmao, general manager of China Telecom Group Co., Ltd., said that China Telecom adheres to co construction and sharing, conscientiously implements the new

Get Price

Globe Telecom activated almost 900 5G sites last year

Globe Telecom, which is the largest mobile network operator in the Philippines, said it deployed 894 new 5G sites nationwide during the course of 2023. During the first half of

Get Price

SK Telecom and Samsung Develop AI-Based 5G Base Station

On October 28, Korean telecom giant SK Telecom and Samsung Electronics announced the joint development of AI-based 5G base station quality optimization technology.

Get Price

Philippines Telecom Tower Expansion Transforms Access

While large cities remain primary targets, the Philippines telecom tower expansion is also improving connectivity in remote towns where signal gaps persist. Thanks to regulatory

Get Price

Ambitious 5G base station plan for 2025

China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

Get Price

Philippines Telecoms Industry Report

A large number of new entrants with over 20 towercos signed an MoU with DICT to participate in the build of 50,00 new towers. The Philippines has one of the

Get Price

Globe deploys 356 new 5G base stations in the Philippines

In February 2021, Nokia had announced that it was selected by Globe Telecom for a three-year deal to upgrade its existing 4G network, as well as expand the geographical

Get Price

Globe expands 5G network, rolls out 256 new cell sites

Globe Telecom Inc. said Friday it rolled out 256 new 5G sites in the first half of 2024, expanding its 5G network coverage across the country.

Get Price

Philippines 5G Infrastructure Market Size and Forecasts 2030

Major telecom operators and network equipment providers in Philippines are investing heavily in upgrading their infrastructure to 5G technology, including base stations,

Get Price

5G Network Equipment Manufacturers: Modem, Base Station,

Explore leading 5G equipment manufacturers for modems, base stations, RAN, and core networks. Discover vendors enhancing network speed and efficiency.

Get Price

Globe Telecom Expands 5G Coverage Across the Philippines in

The deployment builds on a three-year agreement signed in 2021 to upgrade Globe''s 4G network and extend 5G coverage across more than 1,000 sites in the Visayas and

Get Price

Globe expands 5G coverage, builds over 400 cell towers in Q1

As of March 2025, Globe''s 5G coverage reached 98.71 percent in Metro Manila and 97.97 percent in key Visayas and Mindanao cities, supported by 235 new 5G sites. These

Get Price

Cell site

Cell phone traffic through a single site is limited by the base station''s capacity; of -56 dBm signal there is a finite number of calls or data traffic that a base station

Get Price

The Philippines is a Duopoly No More: Assessing DITO''s

In Q1 2022, Smart reported its mobile data traffic grew 30% year-on-year to 1,010 petabytes. The number of its 5G base stations increased from 5,000 in 2020 to 7,300 in

Get Price

Philippines 5G Infrastructure Market Size and

Major telecom operators and network equipment providers in Philippines are investing heavily in upgrading their infrastructure to 5G

Get Price

PLDT trims capex, cuts 5G base statio

Philippines operator PLDT cut capex in the first six months of 2023 and reduced its number of 5G base stations by more than a third, as part of efforts to reduce network spending

Get Price

U.S.-Japan 5G initiative launches first academy in

TOKYO -- The U.S. and Japan are stepping up efforts to advance expertise on 5G base stations in Southeast Asia, responding to China''s growing influence

Get Price

PLDT trims capex, cuts 5G base statio

Philippines operator PLDT cut capex in the first six months of 2023 and reduced its number of 5G base stations by more than a third, as part of

Get Price

Globe expands 5G network with 27 new sites

Globe, the country''s mobile leader, deployed 27 new 5G sites across the Philippines in Q1 2024 as part of its commitment to providing

Get Price

Globe''s 5G network reaches 70 cities in the Philippines

Under the terms of the agreement, Nokia was expected to provide equipment and services from its comprehensive 5G AirScale portfolio to build

Get Price

6 FAQs about [Philippines Telecom builds 5G base stations]

Does Globe Telecom have 5G coverage in the Philippines?

Globe Telecom (Globe), the Philippines’ largest mobile network operator (MNO), has significantly widened its 5G coverage in the first quarter of 2025, reaching 98.71% of Metro Manila and 97.97% of key cities across Visayas and Mindanao, the company announced this week.

How many 5G sites are there in 2024?

Globe Telecom Inc. said Friday it rolled out 256 new 5G sites in the first half of 2024, expanding its 5G network coverage across the country. The latest development brings Globe’s 5G outdoor coverage in the National Capital Region (NCR) to 98.45 percent.

How many 5G sites did Globe deploy in Q1 2024?

Globe, the country’s mobile leader, deployed 27 new 5G sites across the Philippines in Q1 2024 as part of its commitment to providing cutting-edge technology and superior connectivity to its customers.

Where are 4G networks used in the Philippines?

The majority of devices (81%) are “latched” onto the operator’s 4G network. In the Philippines, up to one third of its population resides within Metro Manila, which comprises 16 cities, including the three most populous cities: Quezon (2.9 million), Manila (1.8 million), and Caloocan (1.6 million).

Will Globe's new 5G sites boost outdoor coverage in NCR & Mindanao?

Globe's 27 new 5G sites boost outdoor coverage to 98.35% in NCR and 92.86% in key Visayas and Mindanao cities, supporting over 6M devices in Q1 2024.

Why are telecom towers expanding in the Philippines?

While large cities remain primary targets, the Philippines telecom tower expansion is also improving connectivity in remote towns where signal gaps persist. Thanks to regulatory support and market competition, more towers are going up in rural Luzon, Visayas, and Mindanao. These moves are critical.

More related information

-

Austria Telecom cooperates on 5G base stations

Austria Telecom cooperates on 5G base stations

-

Power supply configuration of 5G base stations in the Philippines

Power supply configuration of 5G base stations in the Philippines

-

Power consumption of 5G base stations in the Democratic Republic of Congo

Power consumption of 5G base stations in the Democratic Republic of Congo

-

Paraguay switches power supply to 5G base stations

Paraguay switches power supply to 5G base stations

-

How many 5G base stations does Estonia Communications have

How many 5G base stations does Estonia Communications have

-

Guinea-Bissau supplies power to 5G network base stations

Guinea-Bissau supplies power to 5G network base stations

-

State Grid invests in 5G base stations

State Grid invests in 5G base stations

-

China Communications 40 000 5G base stations

China Communications 40 000 5G base stations

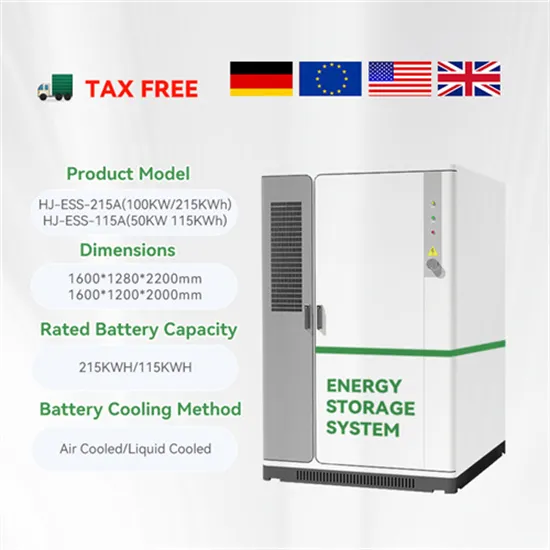

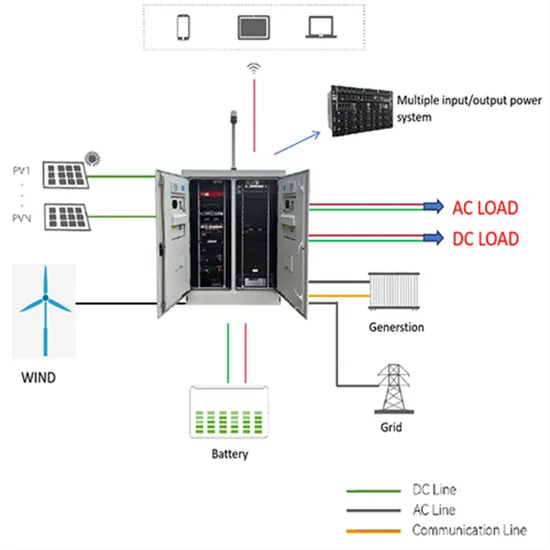

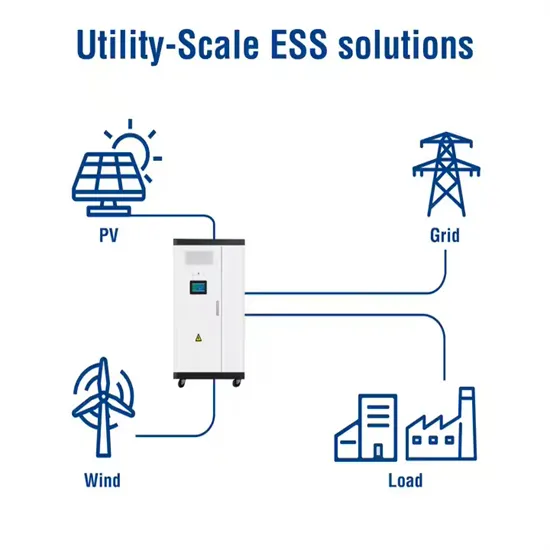

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.