Best Solar Inverters 2025

We review the best grid-connect solar inverters from the worlds leading manufacturers Fronius, SMA, SolarEdge, Fimer, Sungrow, Huawei, Goodwe, Solis and many

Get Price

Global surge in solar PV inverter shipments highlights China''s

The top 10 PV inverter vendors, led by Chinese giants Huawei and Sungrow, controlled 81% of the global market. Huawei and Sungrow alone captured over 50% of the global share, thanks

Get Price

Top five solar inverter vendors accounted for

The top 10 global solar inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-on-year since 2021, according to

Get Price

Active Safety and Grid Forming, Accelerating PV

Huawei offers intelligent FusionSolar PV+ESS solutions for utility-scale, commercial & industrial (C&I) and residential scenarios in power generation, transmission, distribution and

Get Price

Huawei leads global inverter market as shipments hit 589 GW in

Chinese companies made up nine of the 10 largest global inverter suppliers in 2024, with total inverter shipments reaching 589 GW (AC), according to Wood Mackenzie. Chinese

Get Price

Swaziland Photovoltaic Inverter Market (2025-2031) | Companies

Historical Data and Forecast of Swaziland Photovoltaic Inverter Market Revenues & Volume By > 110,000 W for the Period 2021- 2031 Swaziland Photovoltaic Inverter Import Export Trade

Get Price

2025 Top 20 Global Solar Inverter Brands Revealed by PVBL

4 days ago· Huawei''s inverter segment also delivered an outstanding performance, with the two companies dominating the global market by a wide margin. Other enterprises, such as TBEA,

Get Price

Top 5 inverter companies dominate 85% of Q1 2024 bids

The top five companies securing bids— Sungrow, Huawei, Sineng Electric, Zhuzhou Converter, and TBEA—accounted for nearly 85% of the

Get Price

Huawei, Sungrow retain lead in 589-GW PV inverter

Huawei and Sungrow retained the top two positions for the 10th consecutive year, together accounting for 55% of the global market. Both

Get Price

2024年十大趋势白皮书-英文版 dd

Foreword As the world moves closer to carbon neutrality, the global PV and energy storage capacity additions of 2023 are expected to exceed 400 GW and 100 GWh, respectively. In

Get Price

Huawei Solar Inverters | Huawei Solar Energy

Huawei Solar Inverters Entering the global landscape in 1987, Huawei made their name as a global provider of information and communication technology, and

Get Price

Huawei, Sungrow Held 55% of Global Inverter Market in 2024:

Joseph Shangraw, research associate at Wood Mackenzie, said: "Both vendors consolidated the market and achieved their highest ever market shares in 2024. Huawei

Get Price

Huawei Unveils Top 10 Trends of Smart PV for a Greener Future

At the conference, Chen Guoguang, President of Huawei Smart PV+ESS Business, shared Huawei''s insights on the 10 trends of Smart PV from the perspectives of

Get Price

Huawei leads global inverter market as shipments hit

Chinese companies made up nine of the 10 largest global inverter suppliers in 2024, with total inverter shipments reaching 589 GW (AC),

Get Price

PV Inverter Market

The global PV inverter market is expected to grow at a CAGR of 13.54% during 2022 to 2028. In 2020, Sungrow Power Supply (Sungrow) surpassed Huawei to become the no.1 industry

Get Price

Huawei launches smart PV solutions for all scenarios of African

Huawei Technologies has launched the smart photovoltaic (PV) solutions for all scenarios of the African residential market at the Solar Power Africa Conference 2023 held in

Get Price

WoodMac: 536GW of solar PV inverters shipped

China accounted for more than half of the 536GW of solar PV inverters shipped globally in 2023, due to the country''s solar growth last year.

Get Price

HUAWEI INVERTER

Huawei s photovoltaic inverter market share In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market.. In 2022, Huawei had the

Get Price

Swaziland Solar PV Inverter Market (2024-2030) | Industry, Share

Market Forecast By Inverter Type (Central Inverters, String Inverters, Micro Inverters), By Application (Residential, Commercial and Industrial (C&I), Utility-scale) And Competitive

Get Price

Huawei and Sungrow retain inverter market dominance

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in shipments respectively compared with

Get Price

Huawei and Sungrow retain inverter market

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in

Get Price

Huawei Inverter Review – Are They Good?

Huawei is famous for manufacturing digital appliances and communication technologies. However, this technology brand also offers a

Get Price

Huawei s photovoltaic inverter revenue share

Are Huawei & Sungrow able to expand production capacity? Joseph Shangraw,research associate at Wood Mackenzie,said: "In an industry growing as quickly as the PV inverter

Get Price

Huawei, Sungrow retain lead in 589-GW PV inverter market in 2024

Huawei and Sungrow retained the top two positions for the 10th consecutive year, together accounting for 55% of the global market. Both companies achieved their highest ever

Get Price

Huawei s photovoltaic inverter revenue share

The PV inverter market achieved record shipments, growing by 19% to 126 GW in 2019 driven by booming shipments in key markets such as United States, Spain, Latin America, Ukraine and

Get Price

PV inverter market share globally by shipments | Statista

In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market.

Get Price

3 FAQs about [Huawei Swaziland PV Inverter Market]

Where can I buy a Huawei solar inverter?

Shop Huawei solar inverter for your PV system. Huawei solar inverters for every system size at the best price with worldwide delivery on Europe-SolarStore.com

Where are Huawei inverters used?

Their products are used in more than 170 countries, by over three billion people. Huawei inverters are used at the world's largest single PV plant, tracking system PV plant and rooftop-mounted PV plant. Huawei’s parent company is Huawei Investment & Holding.

Who has the largest PV inverter market shipments in 2022?

In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market. Huawei was followed by Sungrow Power Supply and Ginlong Solis in the second and third position respectively, based on shipments. Get notified via email when this statistic is updated. * For commercial use only

More related information

-

Huawei Canadian PV Inverter Market

Huawei Canadian PV Inverter Market

-

Huawei Slovenia PV Inverter Market

Huawei Slovenia PV Inverter Market

-

Huawei PV 2000 Inverter

Huawei PV 2000 Inverter

-

Huawei communication base station inverter grid-connected domestic market share

Huawei communication base station inverter grid-connected domestic market share

-

Italy PV inverter market capacity

Italy PV inverter market capacity

-

Huawei Middle East Inverter

Huawei Middle East Inverter

-

Huawei photovoltaic inverter sales

Huawei photovoltaic inverter sales

-

PV inverter accounts for the component cost

PV inverter accounts for the component cost

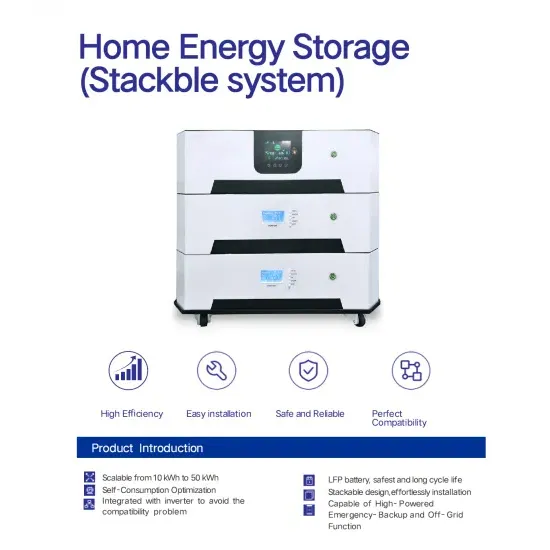

Commercial & Industrial Solar Storage Market Growth

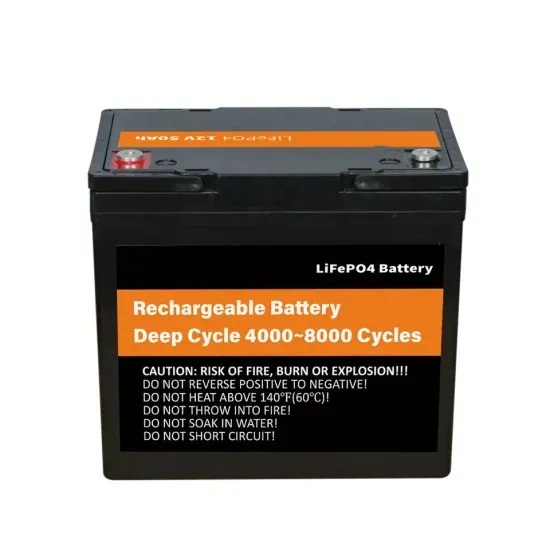

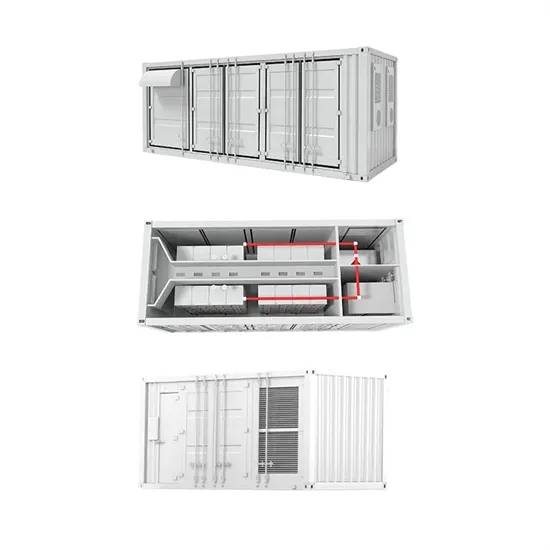

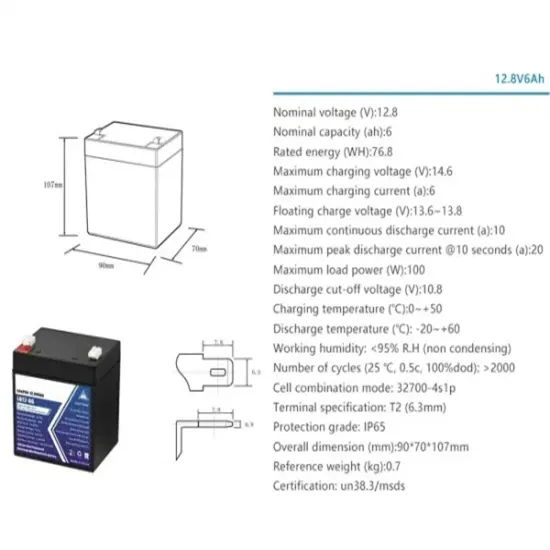

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

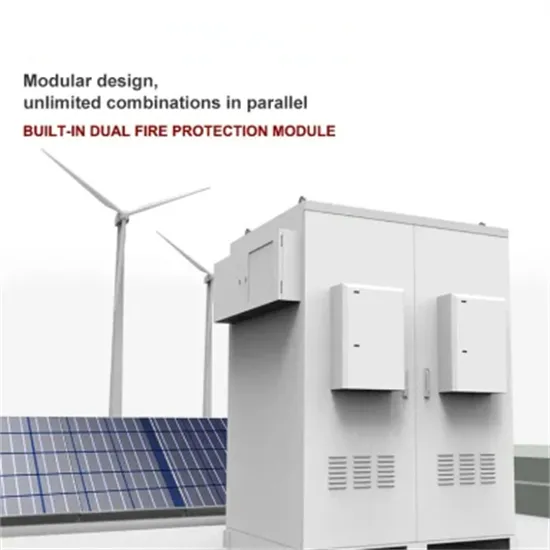

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.