Global surge in solar PV inverter shipments highlights China''s

The top 10 PV inverter vendors, led by Chinese giants Huawei and Sungrow, controlled 81% of the global market. Huawei and Sungrow alone captured over 50% of the global share, thanks

Get Price

Which Inverter is Better: Sungrow or Huawei?

Sungrow and Huawei are two of the leading names in the inverter market, both offering high-quality products designed for residential, commercial, and industrial applications. But which

Get Price

PV Inverter Market Size, Share, Trends | Growth Report [2033]

PV Inverter Market is projected to reach USD 74.42 billion by 2033, growing at a CAGR of 18.9% from 2025-2033.

Get Price

Huawei FusionSolar Smart PV Solution

Huawei FusionSolar provides new generation string inverters with smart management technology to create a fully digitalized Smart PV Solution.

Get Price

HUAWEI Smart PV Community

Huawei provide FusionSolar certification and professional PV installation training and guidance manuals, videos, knowledge and other materials for PV communities, register installation

Get Price

Global PV inverter shipments grew by 56% in 2023 to

Industry leaders Huawei and Sungrow extended their market dominance and retained their first and second positions in the rankings,

Get Price

Solar (PV) Inverter Market Size, Share & Manufacturers

This report is about Solar (PV) Inverter market research provides a complete analysis, which includes a comprehensive analysis of the current and future trends in the market.

Get Price

Slovenia Solar PV Inverter Market (2025-2031) | Competitive

Our analysts track relevent industries related to the Slovenia Solar PV Inverter Market, allowing our clients with actionable intelligence and reliable forecasts tailored to emerging regional needs.

Get Price

PV inverter market share globally by shipments | Statista

In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market.

Get Price

Huawei and Sungrow retain inverter market dominance

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in shipments respectively compared with

Get Price

Huawei Digital Power East Africa Launches 150K

Huawei Digital Power East Africa unveiled its latest innovation in the commercial and industrial (C&I) solar market, the 150K series inverter, to a

Get Price

2024 Top 20 Global Photovoltaic Inverter Brands Revealed by PVBL

Preferential policies promoted the inverter market growth in 2023. Most of the major inverter companies won a large amount of orders and expanded their capacity with high

Get Price

Huawei Inverter Distributor | Buy Huawei Solar

Segen is proud to offer Huawei inverters, which have become the global supplier of PV inverters. Huawei Technologies is a multinational corporation

Get Price

Huawei Dominates the Solar Inverter Market in

Huawei, the Chinese technology giant, continues to dominate the solar inverter market in Europe, according to a new report by Wood

Get Price

Huawei, Sungrow Held 55% of Global Inverter Market in 2024:

Huawei delivered 176 GWac of PV inverters and extended its global lead with strong performances in China, Europe, Latin America and Africa. Sungrow delivered 148

Get Price

Huawei, Sungrow retain lead in 589-GW PV inverter

Huawei and Sungrow retained the top two positions for the 10th consecutive year, together accounting for 55% of the global market. Both

Get Price

Inverter Market Recent Size, Share and Industry

The global inverter market size was valued at USD 16.3 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 16.0% from

Get Price

Top 10 solar PV inverter vendors cornered 86% of the

Our latest ''Global Solar PV Inverter and Module-Level Power Electronics Market Share 2023'' report reveals a buoyant market in 2023, with

Get Price

China Leads 589 GW AC Global PV Inverter Shipments In 2024

Global PV inverter shipments rose by 10% year-on-year to reach 589 GW AC in 2024, according to Wood Mackenzie''s Global Solar Inverter Market Share Report 2025, led by

Get Price

Huawei, Sungrow retain lead in 589-GW PV inverter market in 2024

Huawei and Sungrow retained the top two positions for the 10th consecutive year, together accounting for 55% of the global market. Both companies achieved their highest ever

Get Price

Huawei Dominates the Solar Inverter Market in Europe

Huawei, the Chinese technology giant, continues to dominate the solar inverter market in Europe, according to a new report by Wood Mackenzie. The company has been

Get Price

How String Inverters Are Changing Solar Management on

Huawei is even more dominant in the country''s utility-scale market, and was responsible for more than 70 percent of inverters in the 5.5-gigawatt phase two of the Chinese government''s Top

Get Price

Huawei leads global inverter market as shipments hit 589 GW in

Chinese companies made up nine of the 10 largest global inverter suppliers in 2024, with total inverter shipments reaching 589 GW (AC), according to Wood Mackenzie. Chinese

Get Price

Global PV inverter shipments grew by 56% in 2023 to 536 GWac

Industry leaders Huawei and Sungrow extended their market dominance and retained their first and second positions in the rankings, respectively. Together they captured

Get Price

PV Inverter Market Size, Share & Forecast 2025 to 2035

PV Inverter Market Forecast and Outlook from 2025 to 2035 The PV inverter generators industry is valued at USD 1.7 billion in 2025. As per FMI''s analysis, the PV inverter

Get Price

HUAWEI INVERTER

Huawei s photovoltaic inverter market share In 2022, Huawei had the largest PV inverter market shipments worldwide, accounting for some 29 percent of the market.. In 2022, Huawei had the

Get Price

Huawei and Sungrow retain inverter market

Huawei and Sungrow were the top two suppliers and covered more than 50% of the market themselves, seeing 83% and 56% growth in

Get Price

2024 Top 20 Global Photovoltaic Inverter Brands

Preferential policies promoted the inverter market growth in 2023. Most of the major inverter companies won a large amount of orders and

Get Price

Huawei Solar Inverters | Huawei Solar Energy Systems

Huawei Solar Inverters Entering the global landscape in 1987, Huawei made their name as a global provider of information and communication technology, and are committed to improving

Get Price

Huawei leads global inverter market as shipments hit

Chinese companies made up nine of the 10 largest global inverter suppliers in 2024, with total inverter shipments reaching 589 GW (AC),

Get Price

More related information

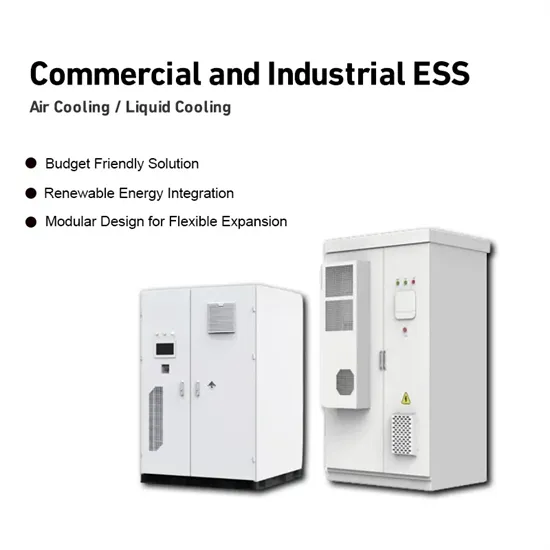

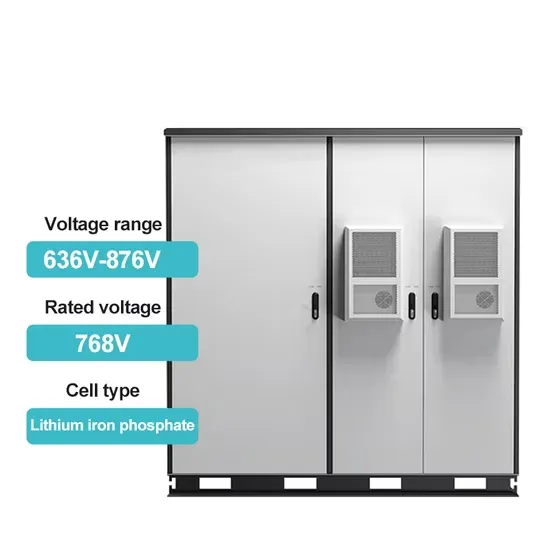

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

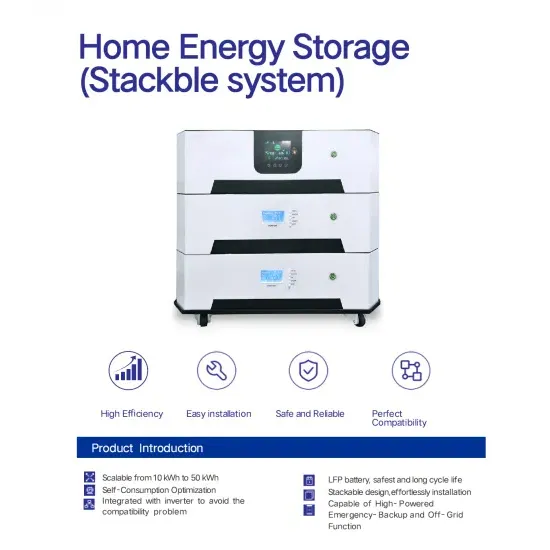

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.

Huawei Swaziland PV Inverter Market

Huawei Swaziland PV Inverter Market

Italy PV inverter market capacity

Italy PV inverter market capacity

PV inverter export volume

PV inverter export volume

PV panel inverter connection

PV panel inverter connection

Côte d Ivoire Micro PV Inverter

Côte d Ivoire Micro PV Inverter

Guatemala PV Inverter

Guatemala PV Inverter

Price of PV Energy Storage Inverter in Jordan

Price of PV Energy Storage Inverter in Jordan