Chart: The US battery market is on track for its best

In the first quarter of 2024, nearly 1. 3 gigawatts (GW) of battery storage was installed at power plants, homes, and commercial facilities across

Get Price

United States energy storage industry

Batteries and pumped hydro are the main storage technologies in use in the U.S., according to the number of storage projects in the country in 2023.

Get Price

2025 Energy Predictions: Battery Costs Fall, Energy Storage

Experts predict what 2025 holds for U.S. energy policy: EV battery costs fall, energy storage demand surges, carbon removal hits scale, permitting reform in D.C.

Get Price

U.S. Energy Storage Market Size, Forecast 2025-2034

The U.S. battery energy storage system market size was estimated at USD 711.9 million in 2023 and is expected to grow at a compound annual growth rate

Get Price

Chart: The US battery market is on track for its best year yet

In the first quarter of 2024, nearly 1. 3 gigawatts (GW) of battery storage was installed at power plants, homes, and commercial facilities across the nation, according to new

Get Price

US battery energy storage market soars despite

While renewable energy investment faces policy headwinds as legislators weigh rolling back tax incentives for low-carbon energies, the grid

Get Price

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

Get Price

United States (USA) Battery Energy Storage System Market

DELRAY BEACH, Fla., April 9, 2025 /PRNewswire/ -- The US Battery Energy Storage System market is expected to reach USD 7.02 billion by 2029, up from USD 2.13 billion in 2024, at a

Get Price

The Expanding Battery Storage Market in the United States

The battery storage market in the United States is undergoing a remarkable transformation. In the first half of 2024, the U.S. power grid added 4.2 gigawatts (GW) of

Get Price

Autel Energy Launches EV Battery Storage Solutions

1 day ago· Autel Energy completes its first U.S. integrated EV charging and battery storage project. The company now offers nationwide turnkey design services for scalable, grid-friendly

Get Price

Eolus Completes Sale of 100 MW/400MWh Pome

Eolus has closed the sale of the 100 MW/400 MWh stand-alone battery energy storage project, Pome, located in Poway, California, USA. The

Get Price

The U.S. Energy Storage Market: Why and Where it is

Grid-scale storage continues to dominate the U.S. market, with key regions like ERCOT and CAISO leading the charge. These areas,

Get Price

US battery energy storage market soars despite federal policy shifts

While renewable energy investment faces policy headwinds as legislators weigh rolling back tax incentives for low-carbon energies, the grid-scale BESS market remains

Get Price

Battery industry in the United States

Batteries became the main energy storage technology in the United States in 2024, surpassing hydro pumped storage. After showing a year-over-year increase of 80

Get Price

U.S. Battery Energy Storage System Market Report, 2030

The U.S. battery energy storage system market size was estimated at USD 711.9 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 30.5% from 2024 to 2030.

Get Price

Battery Makers Pivot To Energy Storage As EV

Yet, installations of energy-storage batteries in the U.S. more than tripled from 2021 to 2024, with projections showing 34% growth in 2025, per

Get Price

Battery Storage in the United States: An Update on Market

Energy storage plays a pivotal role in enabling power grids to function with more flexibility and resilience. In this report, we provide data on trends in battery storage capacity

Get Price

Battery industry: $100B US investment hinges on

April 29 — Manufacturers and developers of U.S. energy storage projects said their industry will invest $100 billion this decade to create a wholly domestic

Get Price

EIA Expects Explosive Growth in U.S. Battery Storage—Can

According to the latest report from the U.S. Energy Information Administration (EIA), till July 2024, operators added 5 gigawatts (GW) of new capacity to the U.S. power grid,

Get Price

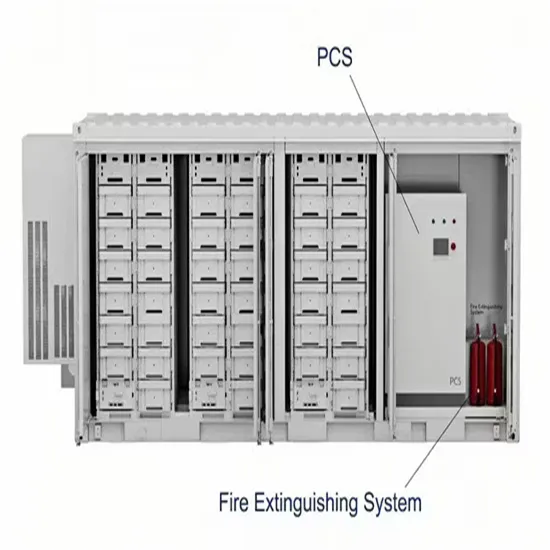

The HBD-A Series from MPMC is an all-in-one, liquid-cooled battery

1 day ago· The HBD-A Series from MPMC is an all-in-one, liquid-cooled battery energy storage system, covering 100kW–1000kW with capacities from 241.2kWh–2090kWh. Applications: 🔹Self-consumption optimization – maximize solar energy utilization 🔹Peak shaving & load shifting – reduce

Get Price

Battery industry in the United States

Batteries became the main energy storage technology in the United States in 2024, surpassing hydro pumped storage. After showing a

Get Price

US Battery Energy Storage System Market Analysis

The US Battery Energy Storage System (BESS) market represents a pivotal sector within the broader energy storage industry, playing a crucial role in facilitating the integration of

Get Price

The Future of Energy Storage: Five Key Insights on Battery

Breakthroughs in battery technology are transforming the global energy landscape, fueling the transition to clean energy and reshaping industries from transportation to utilities.

Get Price

LG Energy Solution scaling back expansion as profits

The company''s plant in Michigan, US. Image: LG Energy Solution. Lithium-ion OEM LG Energy Solution will slow its expansion to focus on

Get Price

Batteries are a fast-growing secondary electricity source for the grid

Utility-scale battery energy storage systems have been growing quickly as a source of electric power capacity in the United States in recent years. In the first seven months of

Get Price

U.S. Energy Storage Market Size, Forecast 2025-2034

Energy storage systems are widely used as EV battery storage systems such as lithium ion batteries. Additionally, EV sales in U.S. is rising due to the political shifts, consumer

Get Price

What the Home Battery Market Needs to Scale

Globally, a rapid expected scale-up in renewable energy will require power storage to balance daily fluctuations in output from solar and

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

The same is true for solar power and related next-gen battery technology. Energy storage systems are increasingly in demand to increase

Get Price

6 FAQs about [U S energy storage battery sales]

What is a battery energy storage value chain?

In the U.S. market, the value chain is characterized by equipment suppliers, battery energy storage manufacturers, and end-use markets. Battery energy storage system utilizes batteries, module packs, connectors, cables, and bus bars as a part of the manufacturing process. Batteries form a major key component of battery energy storage systems.

Which states have the most battery storage capacity?

And almost all of this 993 MW of new utility-scale storage capacity was built in three states: Texas, arguably the hottest grid battery market in the country; California, the state with the most storage capacity; and Nevada, a state with ample solar and some momentum in battery deployments.

Are batteries a key component of battery energy storage systems?

Batteries form a major key component of battery energy storage systems. Large-scale renewable energy installation in the U.S. economy will lead to enhanced deployment of battery energy storage systems in order to prevent intermittent power supply from renewable sources.

Are lithium-ion batteries the future of energy storage?

Lithium-ion batteries delivered 82% of 2024 deployments, cementing their role as the backbone of the United States energy storage market. Cost drops below USD 300 per kWh, and cycle lives exceeding 5,000 cycles reinforce their suitability across duration bands.

Which energy storage technology is most popular in 2024?

Batteries became the main energy storage technology in the United States in 2024, surpassing hydro pumped storage. After showing a year-over-year increase of 80 percent in 2023, the capacity of battery storage installations in the U.S. was projected to reach almost 30 gigawatts by the end of 2024.

What is the future of energy storage?

The United States energy storage market share of assets exceeding 100 MWh is poised to rise fastest at a projected 36% CAGR. Falling cell prices and enhanced revenue stacking make gigawatt-hour-scale parks such as Moss Landing economically attractive. Capital-light software optimizes charge cycles to shield warranties.

More related information

-

Sales of lead-acid battery energy storage containers on the power consumption side

Sales of lead-acid battery energy storage containers on the power consumption side

-

Turkmenistan energy storage battery manufacturer direct sales

Turkmenistan energy storage battery manufacturer direct sales

-

Battery energy storage box direct sales

Battery energy storage box direct sales

-

Bahamas energy storage battery production and sales

Bahamas energy storage battery production and sales

-

Huawei energy storage battery direct sales

Huawei energy storage battery direct sales

-

Tajikistan flow battery energy storage container sales

Tajikistan flow battery energy storage container sales

-

U S energy storage battery sales

U S energy storage battery sales

-

Japanese battery energy storage box sales

Japanese battery energy storage box sales

Commercial & Industrial Solar Storage Market Growth

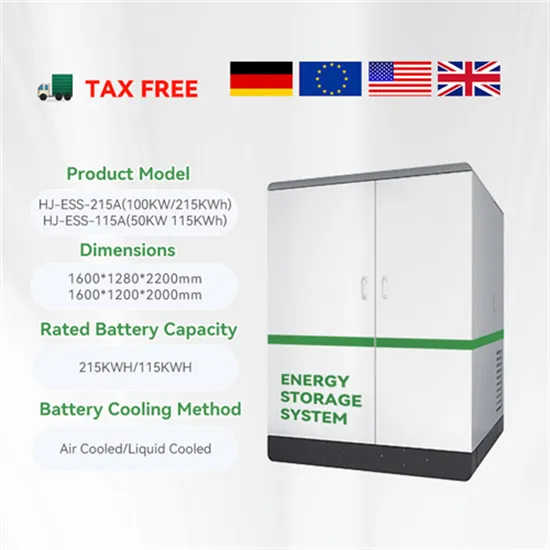

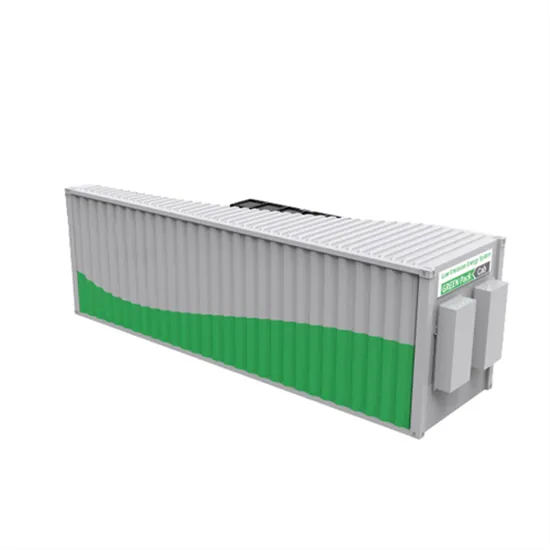

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.