Developer commissions first BESS in Japan to trade

Milestone reached in utility-scale battery storage market development in Japan, with Pacifico Energy trading energy from two new

Get Price

Japanese Energy Storage Box Market Price: Trends, Analysis,

With a mix of tech-savvy consumers, frequent natural disasters, and a booming outdoor culture, portable power solutions like energy storage boxes have shifted from "nice-to-have" to "must

Get Price

Japan Incentivizes Battery Storage Projects Amid Growing Demand

Noting the demand case and ever-growing renewables curtailment numbers nationwide, more and more firms are tapping into Japan''s battery storage opportunities. We

Get Price

Japan Energy Storage Policies and Market Overview

In the commercial space, Japan''s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial

Get Price

Is the Japanese energy storage market moving forward?

However, Japan''s planned grid-scale battery storage system will also require multiple revenue streams to remain viable, as well as a series of

Get Price

Decoding Japan''s Energy Storage Box Market: Prices, Trends

This scene encapsulates Japan''s energy storage reality - where cutting-edge tech meets natural disaster preparedness. The Japanese energy storage box market currently swings between

Get Price

Is the Japanese energy storage market moving forward?

However, Japan''s planned grid-scale battery storage system will also require multiple revenue streams to remain viable, as well as a series of market reforms to sustain its

Get Price

"Battery Storage Subsidies in Japan" | Atsumi & Sakai

Details Battery Storage Subsidies in Japan Introduction In the Sixth Strategic Energy Plan, published by the Japanese Government in October 2021, targets are set to (a)

Get Price

Top 10 Japanese battery companies in lithium industry

The field of lithium batteries used to be Japan''s strength, especially in core technologies such as the isolation layer of japan lithium ion batteries.

Get Price

Gurīn Energy selects Saft''s battery energy storage system for first

Saft has been selected to supply a fully integrated lithium-ion Battery Energy Storage Systems (BESS) to Gurīn Energy''s project in Japan The site will provide over 1 GWh

Get Price

Battery storage steals the spotlight in Japan''s

Battery storage steals the spotlight in Japan''s renewables race Japan''s latest long-term decarbonisation auction has drawn heavyweight investors including

Get Price

Japan''s Battery Market: The Future of Energy Storage

The scope of the report is to provide a 360-degree view of the market by assessing the entire value chain and analyzing the key Japan Battery market trends from 2021 to 2032

Get Price

Japan''s Battery Market: The Future of Energy Storage

The scope of the report is to provide a 360-degree view of the market by assessing the entire value chain and analyzing the key Japan

Get Price

Japan scales up batteries but companies worry rule changes may

2 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Get Price

Japan Incentivizes Battery Storage Projects Amid

Noting the demand case and ever-growing renewables curtailment numbers nationwide, more and more firms are tapping into Japan''s battery

Get Price

World-Leading Battery Technology Company | AESC

Today, AESC has become the partner of choice for the world''s leading OEMs and energy storage providers in North America, Europe, and Asia. Its advanced

Get Price

Top 10 Battery Manufacturers in Japan

Japan is a global player in the battery industry with its manufacturers supplying the needs of global customers and driving innovation

Get Price

Japan Battery Market Size, Share, Demand and Trends 2033

Market Overview: The Japan battery market size reached 79.2 GWh in 2024. Looking forward, IMARC Group expects the market to reach 229.9 GWh by 2033, exhibiting a growth rate

Get Price

27 grid-scale BESS projects secure 34.6B yen

4 days ago· A total of 27 projects was awarded 34.6 billion yen in subsidies through METI''s FY2024 program for supporting the expansion of renewable

Get Price

Japan Confirms Five New Battery Storage Projects

These projects were selected as part of Japan''s latest long-term auction focused on low-carbon energy. The selected developers will receive payments for maintaining capacity

Get Price

Japan: 1.67GW of energy storage wins in capacity auction

Over a gigawatt of bids from battery storage project developers have been successful in the first-ever competitive auctions for low-carbon energy capacity held in Japan.

Get Price

Japan Battery Market Size and Share | Statistics

The progress of cutting-edge technologies, encompassing smartphones, tablets, laptops, solar energy systems, and electric vehicles (EVs), has ushered in the era of robust batteries

Get Price

Japan: Large-scale battery storage opportunities in an evolving

Ancillary services revenues available for battery energy storage system (BESS) assets have been much higher in recent months than in other markets where GridBeyond is

Get Price

Company

The GS Yuasa Group was formed in 2004 following a merger between the Japan Storage Battery Co. Ltd (GS) and the Yuasa Corporation. Based in Kyoto Japan, GS Yuasa are a major force

Get Price

Japan: 1.67GW of energy storage wins in capacity

Over a gigawatt of bids from battery storage project developers have been successful in the first-ever competitive auctions for low-carbon

Get Price

Portable Energy Storage Boxes Market

What are the primary demand drivers for portable energy storage boxes in current global markets? The surge in demand for **portable energy storage boxes** is driven by a

Get Price

Japan Battery Market Growth, Size, Forecast to 2032

Japan Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Primary and Secondary), By Product Type (Lead Acid, Lithium Ion,

Get Price

6 FAQs about [Japanese battery energy storage box sales]

How big is Japan's battery storage market?

In the commercial space, Japan’s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial installations currently dominate revenues, industrial adoption is expected to scale faster. Utility-scale storage is also gaining ground.

Should you buy a battery storage system in Japan?

In addition, Japan’s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue stack may make investors cautious about purchasing large-scale battery storage systems.

Why are battery storage projects growing in Japan?

The ramp up of battery storage projects in Japan continues apace, aided by growing subsidy avenues and rising volumes on various electricity markets, from spot to balancing to capacity.

How much do Japanese companies spend on battery storage projects?

Since December 2023, companies have announced investments of at least $2.6 billion in Japanese battery storage projects, according to calculations by Reuters. That includes $677 million in spending by Japanese real estate firm Hulic (3003.T) announced in January and $1.3 billion by trading house Sumitomo (8053.T) last year.

How many battery storage projects will Stonepeak and CHC develop in Japan?

Stonepeak and CHC’s energy storage platform will develop five new battery storage projects in Japan. These projects have a combined capacity of 348 megawatts (MW). The deals were finalized under Japan’s Long-term Decarbonization Auction. These projects were selected as part of Japan’s latest long-term auction focused on low-carbon energy.

How much battery power does Japan have?

As of March, Japan had 0.23 GW of grid-connected BESS, according to METI. By comparison, China has 75 GW and the U.S. has installed nearly 26 GW of battery storage capacity, according to the Energy Institute.

More related information

-

Andorra battery energy storage box direct sales price

Andorra battery energy storage box direct sales price

-

Japanese battery energy storage box price

Japanese battery energy storage box price

-

North Asia battery energy storage box direct sales company

North Asia battery energy storage box direct sales company

-

Cameroon energy storage battery manufacturer direct sales

Cameroon energy storage battery manufacturer direct sales

-

Tajikistan flow battery energy storage container sales

Tajikistan flow battery energy storage container sales

-

Gabon lithium titanate battery energy storage container sales

Gabon lithium titanate battery energy storage container sales

-

Georgian battery energy storage box manufacturer

Georgian battery energy storage box manufacturer

-

Lead-acid battery energy storage container sales

Lead-acid battery energy storage container sales

Commercial & Industrial Solar Storage Market Growth

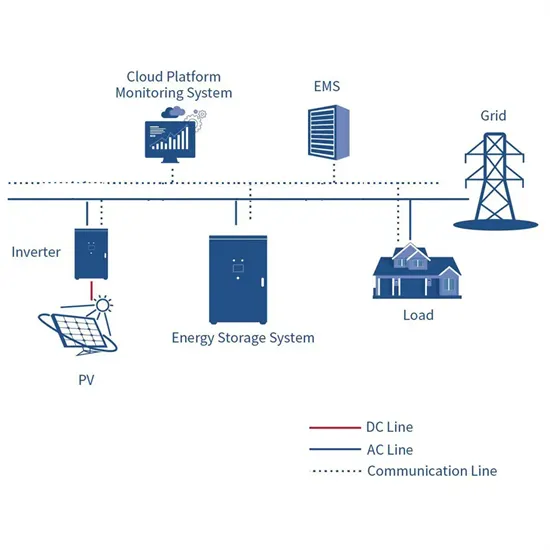

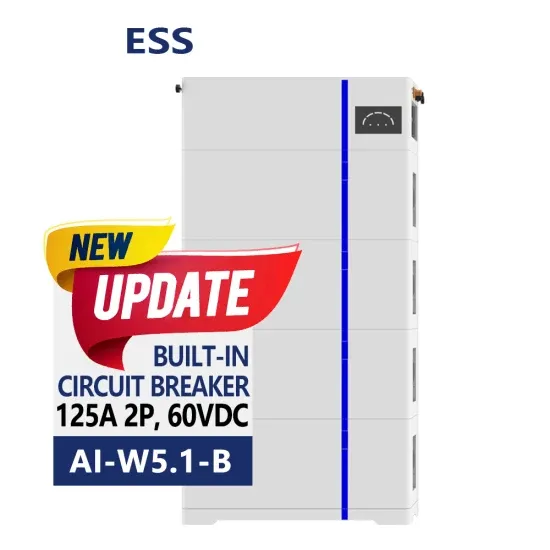

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.