JAPAN BATTERY ENERGY STORAGE MARKET REPORT

What is the market price of battery energy storage box Investmentin Designing and Manufacturing of BESS Devices to Play a Significant Role in Industry Dynamics Various industry players are

Get Price

Mastering the Future of Energy: How Japanese Innovation Leads

Japan''s leadership in battery technology is perhaps the most significant aspect of its dominance in energy storage. Lithium-ion batteries, which are ubiquitous in everything from

Get Price

Is the Japanese energy storage market moving forward?

In addition, Japan''s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue stack may make investors cautious

Get Price

BESS costs increased to 76,000 yen/kWh in FY2023 including

Installation costs increased by 16.7% from 12,000 yen/kWh to 14,000 yen/kWh. Their proportion of the overall BESS installed cost decreased from 24% to 22% due to the

Get Price

Developer commissions first BESS in Japan to trade

Milestone reached in utility-scale battery storage market development in Japan, with Pacifico Energy trading energy from two new

Get Price

Japanese Energy Storage Box Market Price: Trends, Analysis,

Price Breakdown: What You''re Really Paying For Ever wonder why some storage boxes cost as much as a week in a Kyoto ryokan while others are priced like convenience store snacks?

Get Price

1.39 GWh: Two More Chinese Firms Secure Overseas Energy Storage

12 hours ago· Recently, two more Chinese energy storage companies have secured overseas orders totaling 1.39 GWh, covering Europe, Australia, North America, and other regions.

Get Price

Japan''s Battery Market: The Future of Energy Storage

Our analysts are monitoring the situation globally to help you understand how COVID-19 will affect the Japan Battery Market Advancements

Get Price

Japan scales up batteries but companies worry rule changes may

3 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Get Price

Battery storage steals the spotlight in Japan''s

Battery storage steals the spotlight in Japan''s renewables race Japan''s latest long-term decarbonisation auction has drawn heavyweight investors including

Get Price

Tokyo utilities put home battery storage in Japan

Home battery storage aggregation projects have launched with participation of Tokyo Electric Power Co, and Tokyo Gas, two major utility

Get Price

Japan: panel on BESS market growth, opportunities

Japan is one of the most talked-about emerging grid-scale BESS markets in Asia and featured prominently at the Energy Storage Summit Asia.

Get Price

BNEF finds 40% year-on-year drop in BESS costs

Around the beginning of this year, BloombergNEF (BNEF) released its annual Battery Storage System Cost Survey, which found that global

Get Price

Large-scale energy storage business

What&How Building a large storage battery system with reused batteries Beginning more than a decade ago, Sumitomo Corporation was among the first to work on social implementation of

Get Price

Booming Battery Storage Pipeline Gives New Impetus

The results of the first round convinced METI to double the capacity allocated for battery storage. As Japan takes a leading role in Asia''s grid-scale

Get Price

Japan''s Daiwa Takes 49% Stake in Enfinity Global Battery Storage

Daiwa Energy & Infrastructure (DEI) has acquired a minority interest in two major battery energy storage system (BESS) projects developed by independent power producer

Get Price

Japan: Large-scale battery storage opportunities in an evolving

Sho''s colleague, Eku Energy Japan managing director Kentaro Ono, explains that the METI subsidy covers up to 30% of the Capex cost for large-scale BESS. The Tokyo

Get Price

Is Japanese BESS market is ready for scale-up

As a result, the battery energy storage system (BESS) market in Japan is poised for substantial growth. This article examines the current state of the BESS market in Japan,

Get Price

Japan poised for a battery boom

Household battery systems have been helped by an amendment to the regulation relating to the feed-in-premium (FiP) paid for solar electricity. The FiP bonus payment, on top

Get Price

Japan Energy Storage Policies and Market Overview

In the commercial space, Japan''s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial

Get Price

Japan poised for a battery boom

Household battery systems have been helped by an amendment to the regulation relating to the feed-in-premium (FiP) paid for solar electricity.

Get Price

Decoding Japan''s Energy Storage Box Market: Prices, Trends

This scene encapsulates Japan''s energy storage reality - where cutting-edge tech meets natural disaster preparedness. The Japanese energy storage box market currently swings between

Get Price

BESS costs increased to 76,000 yen/kWh in FY2023

Installation costs increased by 16.7% from 12,000 yen/kWh to 14,000 yen/kWh. Their proportion of the overall BESS installed cost decreased

Get Price

Is Japanese BESS market is ready for scale-up

As a result, the battery energy storage system (BESS) market in Japan is poised for substantial growth. This article examines the current state

Get Price

Japan''s FIP scheme and battery storage subsidy are

The government is also reforming its battery energy storage system (BESS) regulations, with batteries set to play an important role in

Get Price

1MWh Battery Energy Storage System Prices

The price of 1MWh battery energy storage systems is a crucial factor in the development and adoption of energy storage technologies. As the demand for reliable and

Get Price

Is the Japanese energy storage market moving forward?

In addition, Japan''s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue

Get Price

6 FAQs about [Japanese battery energy storage box price]

What is the future of battery energy storage in Japan?

The energy landscape in Japan is undergoing a significant transformation, driven by the country’s ambitious renewable energy targets and the need to reduce emissions. As a result, the battery energy storage system (BESS) market in Japan is poised for substantial growth.

How big is Japan's battery storage market?

In the commercial space, Japan’s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial installations currently dominate revenues, industrial adoption is expected to scale faster. Utility-scale storage is also gaining ground.

Is battery storage a revenue source in Japan?

At present, revenue streams for battery storage in Japan are relatively limited but are gradually expanding. Energy arbitrage, which involves charging batteries during periods of low electricity prices and discharging during peak demand, has been a key revenue source.

What is the Japan battery market report?

The Japan battery market report covers our half-yearly updated projections for wholesale energy arbitrage spreads, balancing market prices, capacity market prices, and revenue stack build-up of BESS in different regions with interaction between the wholesale and balancing markets over 20 years of BESS lifespan time horizon.

Should you buy a battery storage system in Japan?

In addition, Japan’s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue stack may make investors cautious about purchasing large-scale battery storage systems.

How much will Japan's energy storage system cost in 2023?

The $593 million worth of commercial energy storage systems recorded in Japan in 2023 could balloon to $4.15 billion by 2030, InfoLink reckons, with “industrial adoption expected to scale faster,” according to the data company.

More related information

-

Andorra battery energy storage box direct sales price

Andorra battery energy storage box direct sales price

-

Chile battery energy storage box wholesale price

Chile battery energy storage box wholesale price

-

Energy storage cabinet battery price

Energy storage cabinet battery price

-

Lithium battery energy storage price in Côte d Ivoire

Lithium battery energy storage price in Côte d Ivoire

-

How much is the price of lithium battery for energy storage in Albania

How much is the price of lithium battery for energy storage in Albania

-

West Asia Photovoltaic Power Generation Energy Storage Battery Price Device

West Asia Photovoltaic Power Generation Energy Storage Battery Price Device

-

Mongolia home energy storage battery price quote

Mongolia home energy storage battery price quote

-

Huawei UAE high voltage energy storage lithium battery price

Huawei UAE high voltage energy storage lithium battery price

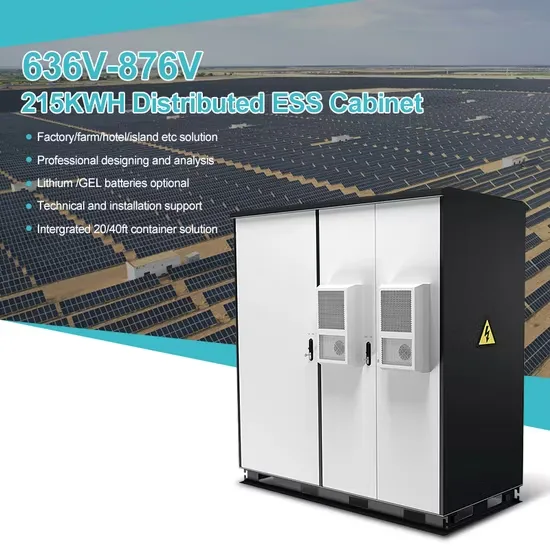

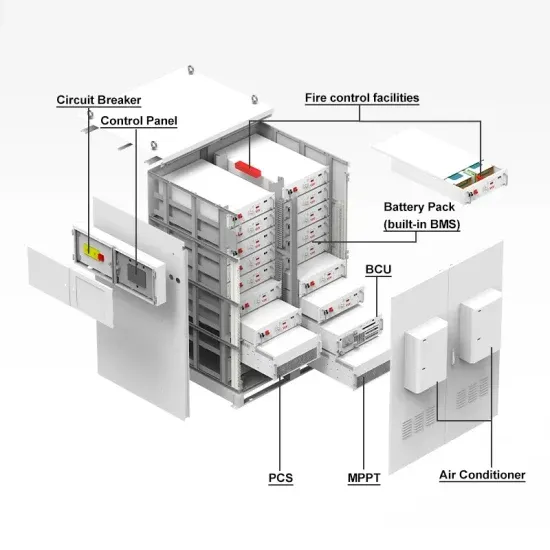

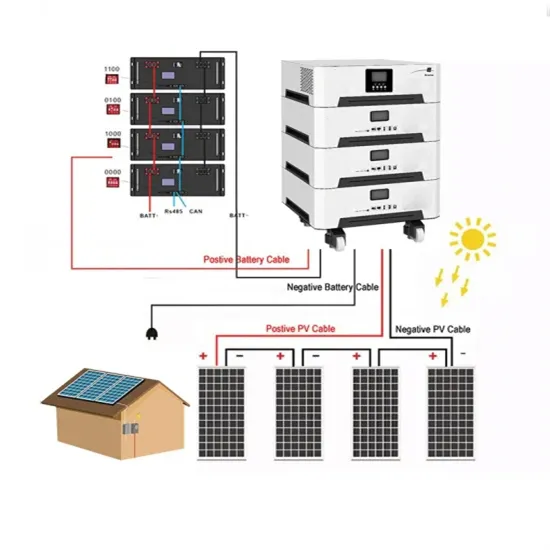

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.