Energy storage and new energy revenue model

In recent years, analytical tools and approaches to model the costs and benefits of energy storage have proliferated in parallel with the rapid growth in the energy storage market.

Get Price

Optimal scheduling strategies for electrochemical

Introduction: This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim

Get Price

An introduction: Revenue streams for battery storage

Energy storage is monetised through several business models and ownership structures: * Front of the meter encompasses utility-sided, central applications; behind the meter comprises

Get Price

Energy Storage Business Model Analysis: Key Trends, Revenue

Let''s face it – the global energy storage market has become the rockstar of the clean energy transition. With a whopping $33 billion valuation and capacity to generate 100 gigawatt-hours

Get Price

Life Cycle Cost-Based Operation Revenue Evaluation of Energy Storage

The simulation results show that 22.2931 million CNY can be earned in its life cycle by the energy storage station equipped in Lishui, which means energy storage equipment

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

Tesla Unveils Megapack 3 and Megablock at Las Megas Event

2 days ago· At an event in Las Vegas, Tesla unveiled the next generation of its utility-scale energy storage business, revealing the new, more powerful Megapack 3, and an integrated,

Get Price

Daily revenue: | C&I Energy Storage System

Articles related (50%) to "daily revenue:" Liquid Flow Energy Storage Power Station Cost: What You Need to Know If you''re an energy enthusiast, project developer, or just someone curious

Get Price

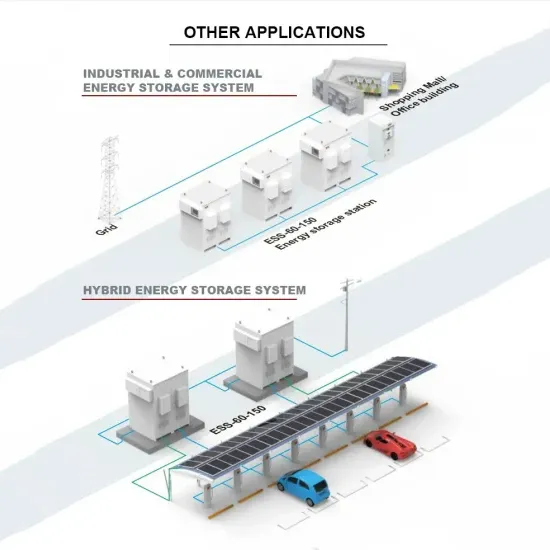

Three Investment Models for Industrial and

1. Owner Self-Investment Model The energy storage owner''s self-investment model refers to a model in which enterprises or individuals

Get Price

Life Cycle Cost-Based Operation Revenue Evaluation of Energy Storage

Therefore, a life cycle cost-based operation revenue evaluation strategy of energy storage equipment is presented for renewable energy aggregation stations.

Get Price

A two-step optimization model for virtual power plant participating

A two-step optimization model for virtual power plant participating in spot market based on energy storage power distribution considering comprehensive forecasting error of

Get Price

Capital Cost and Performance Characteristics for Utility

To accurately reflect the changing cost of new electric power generators in the Annual Energy Outlook 2025 (AEO2025), EIA commissioned Sargent & Lundy (S&L) to evaluate the overnight

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

Optimal scheduling strategies for electrochemical energy storage power

Introduction: This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim of analyzing its full life-cycle

Get Price

Introduction

This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim of analyzing its full life-cycle economic benefits under the electricity

Get Price

Maximising BESS Earnings: 5 Key Revenue Models

Maximising the value of Battery Energy Storage Systems (BESS) depends on more than just cutting-edge technology; it also requires clear financial insight and commercial

Get Price

Financial Models

The System Advisor Model (SAM) is a performance and financial model designed to estimate the cost of energy for grid-connected power projects.

Get Price

Five revenue models for industrial and commercial energy

The results show that the case study energy storage plant has the highest revenue in the spot market, followed by the capacity market, and relatively low revenue in the secondary service...

Get Price

Study on profit model and operation strategy optimization of energy

With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency modulation and

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get Price

Utility Scale Battery Optimization and Valuation

The unique characteristics of Battery Energy Storage Systems (BESS) enable such projects to solve for multiple applications such as peak shaving and load

Get Price

Energy storage optimal configuration in new energy stations

The energy storage revenue has a significant impact on the operation of new energy stations. In this paper, an optimization method for energy storage is proposed to solve

Get Price

Tolling agreements and floor pricing for BESS

Andras has more than 10 years of experience in the energy industry and is trained in different roles from TSO and power plant operation to asset optimization and development.

Get Price

What are the revenues of energy storage power stations?

By storing excess energy during times of low demand and deploying it when the demand peaks, energy storage systems establish a continuous revenue stream. Increasingly,

Get Price

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

4 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get Price

Life Cycle Cost-Based Operation Revenue Evaluation of Energy

Therefore, a life cycle cost-based operation revenue evaluation strategy of energy storage equipment is presented for renewable energy aggregation stations.

Get Price

6 FAQs about [Energy Storage Power Station Revenue Model]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

More related information

-

Independent energy storage power station revenue in Canada

Independent energy storage power station revenue in Canada

-

Guangqian Energy Storage Power Station Project Revenue

Guangqian Energy Storage Power Station Project Revenue

-

Independent Energy Storage Power Station Application Development Model

Independent Energy Storage Power Station Application Development Model

-

Swiss energy storage power station revenue and cost

Swiss energy storage power station revenue and cost

-

Icelandic energy storage power station profit model

Icelandic energy storage power station profit model

-

Huawei Energy Storage Power Station Cost Model

Huawei Energy Storage Power Station Cost Model

-

Profit model of mobile energy storage power station

Profit model of mobile energy storage power station

-

Business model of industrial and commercial energy storage power station

Business model of industrial and commercial energy storage power station

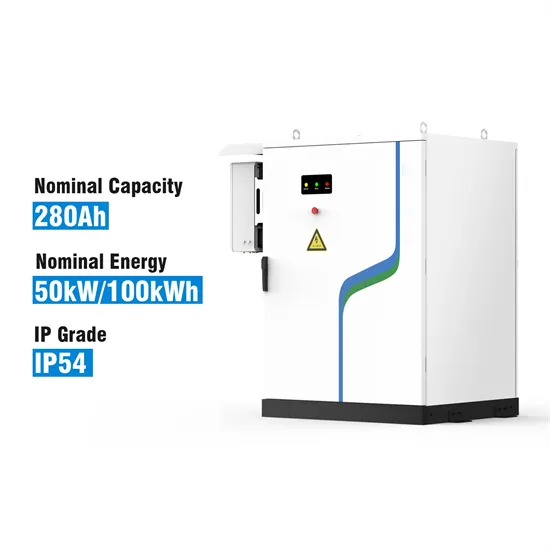

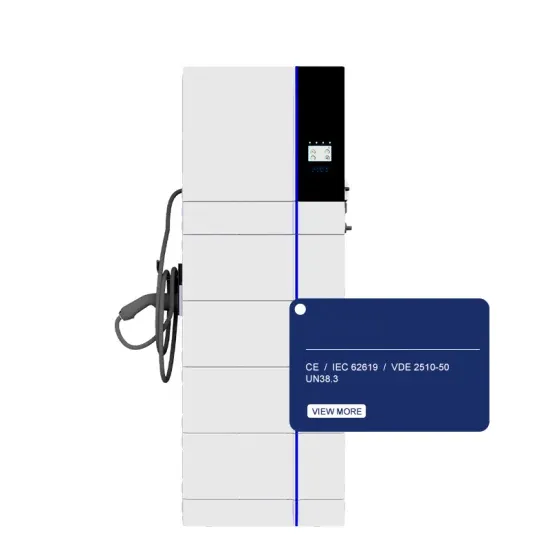

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.