A Joint Optimization Strategy for Demand Management and Peak-Valley

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get Price

Peak-valley arbitrage, as an "entry-level" profit model for industrial

Peak-valley arbitrage, as an "entry-level" profit model for industrial and commercial energy storage projects, has attracted much attention from industrial and commercial energy

Get Price

Energy storage peak-valley arbitrage case study

Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi-profit model of

Get Price

Peak Valley arbitrage and demand management

As a profit model of optical storage system, peak-valley arbitrage and demand management can not only help enterprises reduce electricity costs, but also

Get Price

Peak Shaving/Energy Arbitrage

Unlike all-electrochemical energy storage devices, hybrid supercapacitors are well-suited for peak shaving and other energy arbitrage programs. By using

Get Price

Energy storage peak-valley arbitrage case study

Analysis and Comparison for The Profit Model of Energy Storage The role of Electrical Energy Storage it is necessary to study the profit model of it. Therefore, this article analyzes three

Get Price

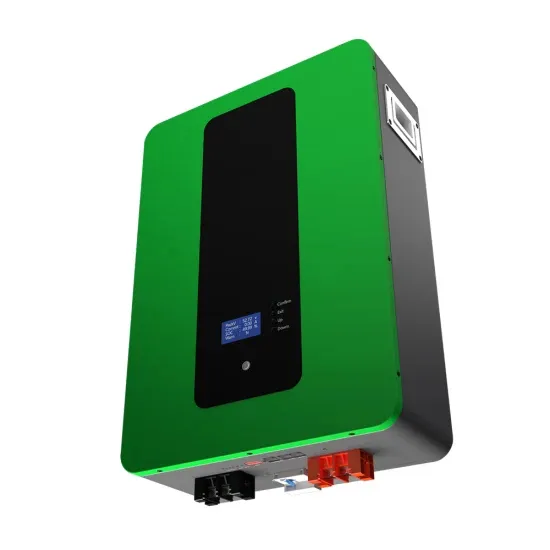

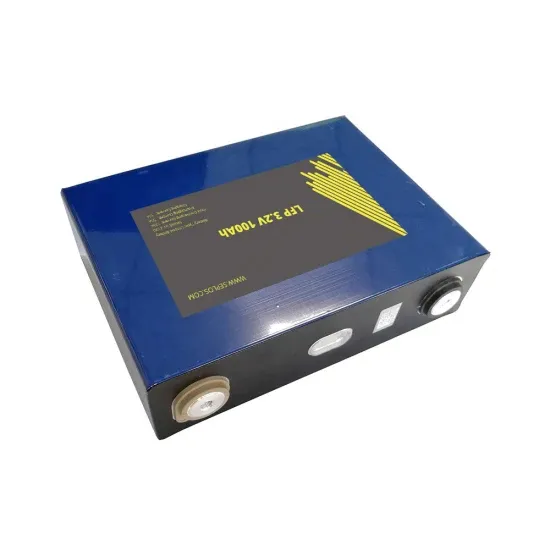

C&I energy storage, through peak and valley arbitrage electricity

C&I energy storage, through peak and valley arbitrage electricity prices, to reduce costs and increase efficiency for enterprises!#Demuda #energustorage #hybridinverter #battery

Get Price

The expansion of peak-to-valley electricity price difference results

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When the peak-to-valley spread reaches 7

Get Price

Optimized Economic Operation Strategy for Distributed Energy Storage

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic operation strategy of distributed energy

Get Price

Peak Valley arbitrage and demand management

As a profit model of optical storage system, peak-valley arbitrage and demand management can not only help enterprises reduce electricity costs, but also bring additional benefits to enterprises.

Get Price

The expansion of peak-to-valley electricity price

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When

Get Price

Peak-valley arbitrage, as an "entry-level" profit model for industrial

Peak-valley arbitrage, as an "entry-level" profit model for industrial and commercial energy storage projects, has attracted much attention from industrial and commercial energy storage

Get Price

fenrg-2022-907338 1..15

To comprehensively consider the direct income of peak-valley arbitrage and indirect income of energy storage con guration, a coordinated planning model of source-storage-transmission is

Get Price

Optimized Economic Operation Strategy for

Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and

Get Price

Peak-Valley Arbitrage

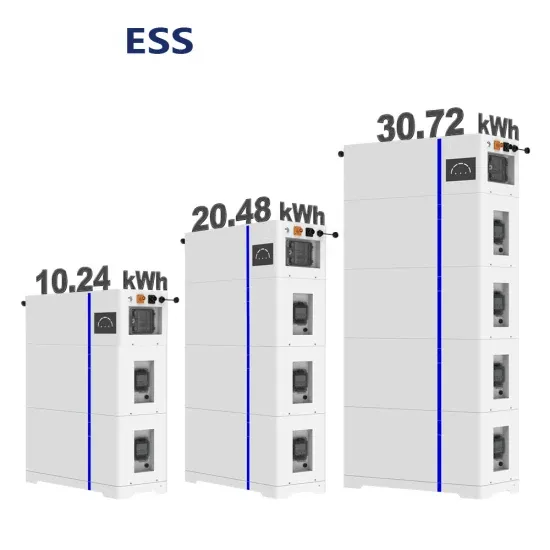

This scalable solution, ranging from 233 kWh to 7 MWh, is ideal for small to medium-sized businesses and industrial users implementing peak-valley arbitrage strategies.

Get Price

Energy Storage Arbitrage Under Price Uncertainty: Market Risks

We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization

Get Price

Optimized Economic Operation Strategy for

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic

Get Price

Dyness Knowledge | Solar and energy storage must-learn

During peak hours, electricity prices are higher, while during valley hours, electricity prices are lower. Therefore, the business model of energy storage peak-valley arbitrage is to

Get Price

Uganda Energy Transition Plan

The plan was developed by Uganda''s Ministry of Energy and Mineral Development, with support from the International Energy Agency, and provides the groundwork for the government''s

Get Price

Optimized Economic Operation Strategy for Distributed

This paper proposes a distributed energy storage optimization operation strategy considering demand management, peak-valley spread arbitrage and participating in demand response to

Get Price

Price Differences in Different Countries And Their Impact On Energy

In different European countries, the peak-valley price difference varies, and the impact on energy storage projects is also different. In the UK, the main revenue of its energy

Get Price

How does energy arbitrage work with energy storage

How Energy Arbitrage Works with Energy Storage Systems Price Analysis: Analyze market prices to identify opportunities where there are

Get Price

Peak-Valley Arbitrage

This scalable solution, ranging from 233 kWh to 7 MWh, is ideal for small to medium-sized businesses and industrial users implementing peak-valley

Get Price

Improved Deep Q-Network for User-Side Battery Energy Storage

Therefore, energy storage-based peak shaving and valley filling, and peak-valley arbitrage are used to charge the grid at peak-valley price differences or during flat periods.

Get Price

Operation steps for peak valley arbitrage of user side energy storage

Generally speaking, the electricity price during peak hours is higher than that during low periods. Develop an operational plan for peak valley arbitrage based on market conditions.

Get Price

Optimization analysis of energy storage application based on

The coupling system generates extra revenue compared to RE-only through arbitrage considering peak-valley electricity price and ancillary services. In order to maximize

Get Price

Smart Energy Storage | SAV

Benefits from Peak-valley Arbitrage: By charging during low electricity price periods and discharging during high electricity price periods, enterprises can maximize the benefits from

Get Price

Evaluation and optimization for integrated photo-voltaic and

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14].

Get Price

Operation steps for peak valley arbitrage of user side energy

Generally speaking, the electricity price during peak hours is higher than that during low periods. Develop an operational plan for peak valley arbitrage based on market conditions.

Get Price

A Joint Optimization Strategy for Demand Management and Peak

Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

Get Price

4 FAQs about [Uganda Energy Storage Peak-Valley Arbitrage Plan]

Does energy storage generate revenue?

Techno-economic analysis of energy storage with wind generation was analyzed. Revenue of energy storage includes energy arbitrage and ancillary services. The multi-objective genetic algorithm (GA) based on roulette method was employed. Both optimization capacity and operation strategy were simulated for maximum revenue.

What is the scale of the energy storage system and operation strategy?

The scale of the energy storage system and operation strategy was related to the technical and economic performance of the coupling system , . In order to reduce the extra cost of the BESS, it is necessary to conduct the optimization research of the BESS and RE coupling system .

What is the difference between Peak-Valley electricity price and flat electricity price?

Among the four groups of electricity prices, the peak electricity price and flat electricity price are gradually reduced, the valley electricity price is the same, and the peak-valley electricity price difference is 0.1203 $/kWh, 0.1188 $/kWh, 0.1173 $/kWh and 0.1158 $/kWh respectively. Table 5. Four groups of peak-valley electricity prices.

How can a large-scale energy storage system help a power surge?

Large-scale RE connected to the grid will bring a power surge or power failure. By constructing a suitable battery energy storage system (BESS) and RE coupling system, using the BESS to store and release RE to stabilize RE's volatility and intermittent, thereby increasing RE's penetration and resilience , , .

More related information

-

Percentage of peak-valley arbitrage profits for Honduras energy storage system

Percentage of peak-valley arbitrage profits for Honduras energy storage system

-

One-stop solution for peak-valley arbitrage of energy storage in Tajikistan

One-stop solution for peak-valley arbitrage of energy storage in Tajikistan

-

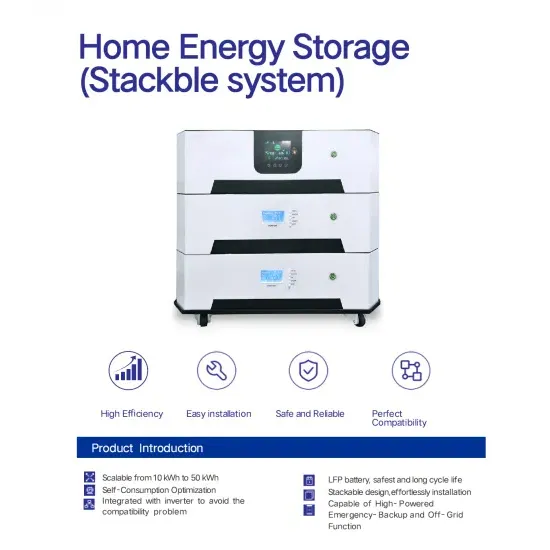

Home peak-valley energy storage cabinet

Home peak-valley energy storage cabinet

-

Pakistan s photovoltaic energy storage policy plan

Pakistan s photovoltaic energy storage policy plan

-

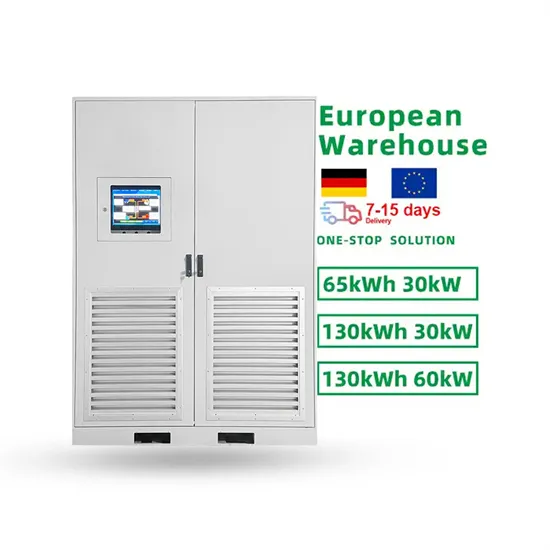

Battery Energy Storage Cabinet Cost Plan and Process

Battery Energy Storage Cabinet Cost Plan and Process

-

Huawei s energy storage deployment plan in Croatia

Huawei s energy storage deployment plan in Croatia

-

Portable Energy Storage Sales Plan

Portable Energy Storage Sales Plan

-

Malaysia s photovoltaic energy storage policy plan

Malaysia s photovoltaic energy storage policy plan

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.