The expansion of peak-to-valley electricity price difference results

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When the peak-to-valley spread reaches 7

Get Price

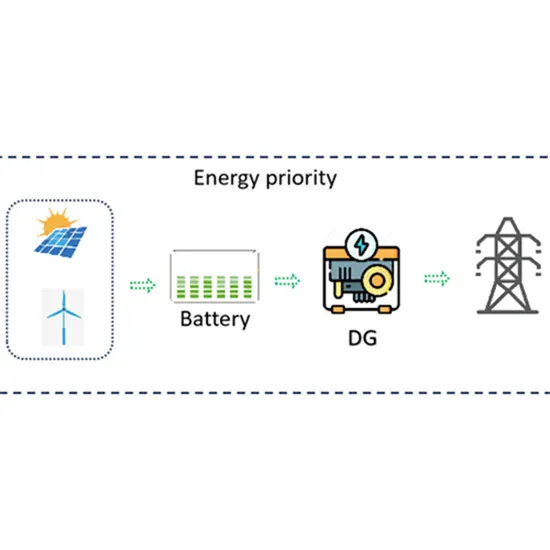

Energy storage peak-valley arbitrage profit model

The peak-valley price variance affects energy storage income per cycle, and the division way of peak-valley period determines the efficiency of the energy storage system.

Get Price

2MW/4MWh Energy Storage Project(New Materials

The energy storage power station exploits peak - valley arbitrage, charging and discharging twice a day to supply electricity to the factory area load. It ensures the reliable operation of the

Get Price

The expansion of peak-to-valley electricity price

The widening of the peak-to-valley price gap has laid the foundation for the large-scale development of user-side energy storage. When

Get Price

Energy Storage Systems: Profitable Through Peak-Valley Arbitrage

Learn how energy storage systems profit through peak-valley arbitrage and distributed energy management.

Get Price

Double-Layer Optimal Scheduling for Wind-PV-Hydro-Hybrid Energy Storage

1 day ago· In this framework, pumped storage prioritizes peak-valley arbitrage, while battery energy storage is allocated to fast-response frequency regulation. The effectiveness of the

Get Price

Energy Storage Arbitrage Under Price Uncertainty: Market

Abstract—We investigate the profitability and risk of energy storage arbitrage in electricity markets under price uncertainty, exploring both robust and chance-constrained optimization ap-proaches.

Get Price

Arbitrage analysis for different energy storage technologies and

The result provides a new perspective to understand the value of energy storage to power grids, and how storage capacity and overall efficiency of different storage technologies

Get Price

How much is the peak-to-valley price difference for energy

The peak-to-valley price difference for energy storage to yield a profit is considerably influenced by various factors, including market dynamics, technology

Get Price

fenrg-2022-1029479 1..8

At present, the peak-valley arbitrage of energy storage is mostly the peak-valley price arbitrage, and the peak price is about four times that of the valley price.

Get Price

Peak-valley arbitrage energy storage

In addition to reducing the peak-valley difference of transformer stations, additional centralised energy storages will be allocated to realise peak-valley price arbitrage when the investment of

Get Price

Optimal User‐Side Energy Arbitrage Strategy in Electricity Market

In this paper, the optimal operation and arbitrage strategies for user-side energy storage systems are studied considering an accurate battery model to capture the charging

Get Price

Energy Arbitrage and Battery Storage: Revolutionizing

The future of battery storage technology is undoubtedly heading towards better performance, lower cost, more extensive energy storage,

Get Price

A Beginner''s Guide to Energy Storage Arbitrage

Energy storage arbitrage, like a financial wizardry trick with batteries, involves storing electricity when it''s abundant and cheap to release it

Get Price

Peak-Valley Arbitrage

Peak-Valley Arbitrage For Industry electricity saving Maximize Factory Savings with Peak and Valley Energy Arbitrage In today''s dynamic energy market,

Get Price

Economic benefit evaluation model of distributed energy storage

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic

Get Price

Dyness Knowledge | Solar and energy storage must-learn

Therefore, the business model of energy storage peak-valley arbitrage is to buy cheap electricity during valley hours, store it in energy storage equipment, and then sell the

Get Price

How much is the peak-to-valley price difference for energy storage

The peak-to-valley price difference for energy storage to yield a profit is considerably influenced by various factors, including market dynamics, technology

Get Price

6 Emerging Revenue Models for BESS: A 2025 Profitability Guide

Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Get Price

Profitability analysis and sizing-arbitrage optimisation of

Optimising the initial state of charge factor improves arbitrage profitability by 16 %. The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. The

Get Price

Industrial and commercial energy storage profit one of

Arbitrage behavior encourages the investment and construction of energy storage equipment and promotes the application and development of

Get Price

Peak and Valley Arbitraجرامe_تشغيلe Profit For C & I Energy Storage

Grid peak-valley spread arbitrage refers to the coمترmercial behavior of purchasبوصةg electricity at lower valley tariffs in the electricity market and then selling electricity at higher peak tariffs to

Get Price

Schematic diagram of peak-valley arbitrage of energy storage.

An energy storage system transfers power and energy in both time and space dimensions and is considered as critical technique support to realize high permeability of renewable energy in

Get Price

Energy storage peak-valley arbitrage case study

Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi-profit model of

Get Price

Energy Storage Systems: Profitable Through Peak

Learn how energy storage systems profit through peak-valley arbitrage and distributed energy management.

Get Price

Economic benefit evaluation model of distributed energy storage system

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic

Get Price

Optimized Economic Operation Strategy for Distributed Energy Storage

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic operation strategy of distributed energy

Get Price

DOES ARBITRAGE VALUE MAXIMIZE THE ENERGY TRADE

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic and foreign time-of

Get Price

Optimized Economic Operation Strategy for

In order to further improve the return rate on the investment of distributed energy storage, this paper proposes an optimized economic

Get Price

More related information

-

Uganda Energy Storage Peak-Valley Arbitrage Plan

Uganda Energy Storage Peak-Valley Arbitrage Plan

-

One-stop solution for peak-valley arbitrage of energy storage in Tajikistan

One-stop solution for peak-valley arbitrage of energy storage in Tajikistan

-

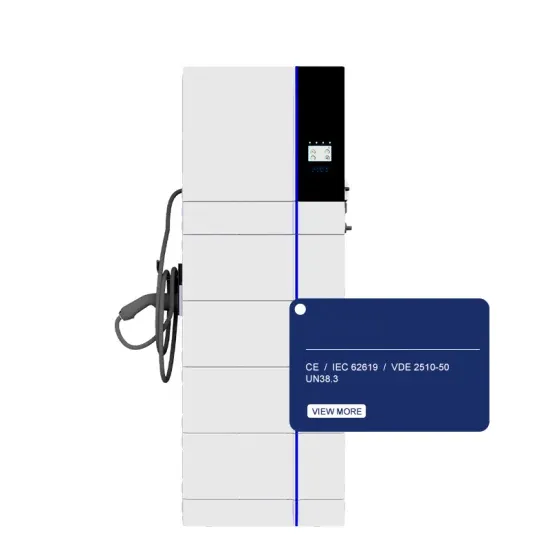

Honduras Smart Energy Storage Cabinet Solution

Honduras Smart Energy Storage Cabinet Solution

-

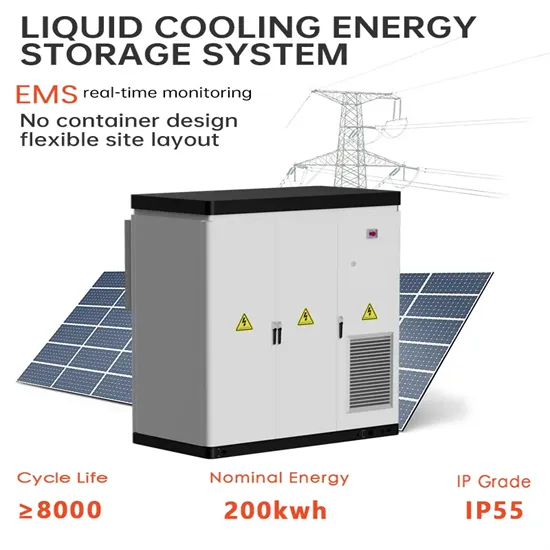

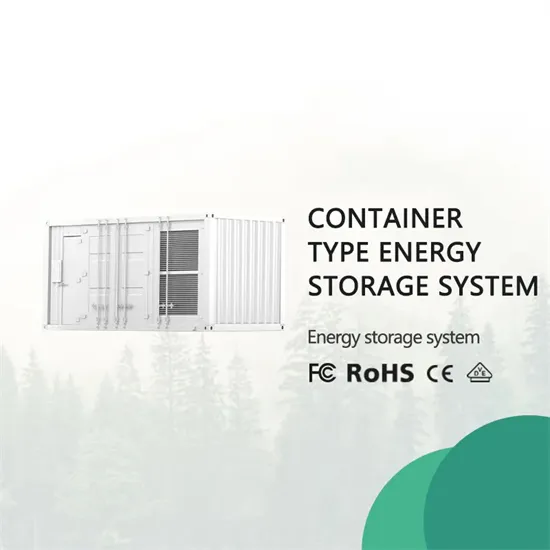

Liquid-cooled energy storage container installation in Honduras

Liquid-cooled energy storage container installation in Honduras

-

Recommended sources of industrial energy storage batteries in Honduras

Recommended sources of industrial energy storage batteries in Honduras

-

Honduras develops solid-state batteries for energy storage equipment costs

Honduras develops solid-state batteries for energy storage equipment costs

-

Gravity energy storage project in Honduras

Gravity energy storage project in Honduras

-

Honduras Battery Energy Storage Company

Honduras Battery Energy Storage Company

Commercial & Industrial Solar Storage Market Growth

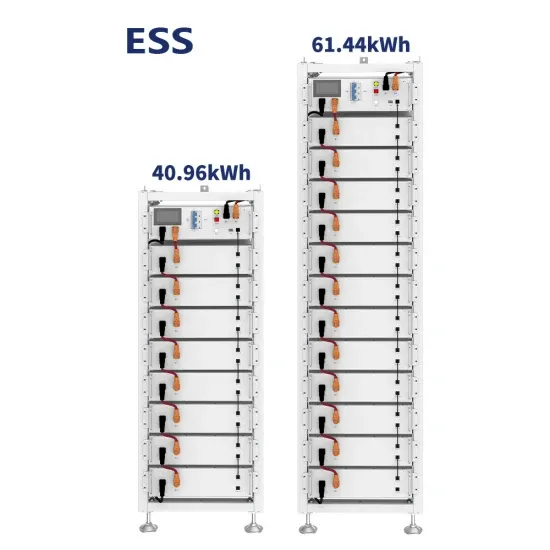

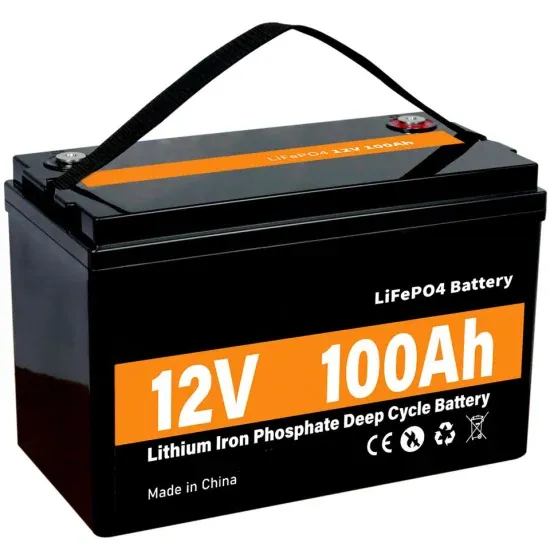

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.