Mapping MENA''s Renewable Energy Supply Chains

The Middle East and North Africa has the potential to become the world''s largest renewable energy-producing region. Compared to the immense scale of its resources,

Get Price

Pumped storage power stations in China: The past, the present,

The pumped storage power station (PSPS) is a special power source that has flexible operation modes and multiple functions. With the rapid economic development in

Get Price

Powering the Future: Energy Storage Solutions in the Middle East

From Jordan''s solar farms to Egypt''s wind energy projects, energy storage is the linchpin ensuring that these renewable sources can deliver consistent and reliable power.

Get Price

How Middle East Energy Transition Will Stimulate

Introduction The energy and electricity landscape in the Middle East (ME) is in a midst of transition as climate change, and energy security concerns took center hold in 2022. Extreme

Get Price

Middle East and Africa energy storage outlook 2025

The Middle East and Africa (MEA) Energy Storage Outlook analyses key market drivers, barriers, and policies shaping energy storage adoption across grid-scale and

Get Price

Powering the Future: Energy Storage Solutions in the

From Jordan''s solar farms to Egypt''s wind energy projects, energy storage is the linchpin ensuring that these renewable sources can deliver

Get Price

ADNOC to Launch First High-Speed Hydrogen

ADNOC, today announced that it has begun construction on the Middle East''s first high-speed hydrogen refueling station. The station, which is

Get Price

Middle East and Africa energy storage outlook 2025

The Middle East and Africa (MEA) Energy Storage Outlook analyses key market drivers, barriers, and policies shaping energy storage

Get Price

Desay Battery and DOS Sign Strategic Cooperation Agreement

The two parties will strategically deploy a 4GWh energy storage power station in the Middle East region.

Get Price

Energy Storage Market Developments in the Middle East

Egypt, the United Arab Emirates, Saudi Arabia, Jordan, and other countries in the region have all deployed energy storage systems. In the future, as renewable energy

Get Price

Middle East Archives

AMEA Power has completed commissioning of the first large-scale battery energy storage system (BESS) in Egypt, ahead of the start of commercial operations.

Get Price

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

Get Price

The case for utility-scale storage in the Middle East

Saudi Arabia''s large scale energy storage market is expected to developed at an unprecedented pace in the years to come, according to

Get Price

GE Vernova''s Gas Power business in the Middle East

GE Vernova''s Gas Power business in the Middle East Our presence in the Middle East, which began in the 1930s, continues to provide energy solutions with the speed, scale, and

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for

Get Price

Energy storage solutions for the Middle East

With countries in the Middle East pushing ahead with some of the most ambitious renewable energy schemes in the world, attention is now turning to the potential for storing

Get Price

Energy Storage Market Developments in the Middle East

At present, this is the largest energy storage power station project in the Middle East. Construction is expected to be completed and commercial operations to begin in the 4th

Get Price

Scaling Energy Storage in the MENA Region Amidst Renewables

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and

Get Price

ACWA Power wind and battery storage plant to power

Signing of the agreement between the International Finance Corporation and ACWA Power. Image: Future Investment Initiative. ACWA

Get Price

10 Exciting Up-and-Coming Renewable Energy Projects in the Middle East

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025. Read more here.

Get Price

10 Exciting Up-and-Coming Renewable Energy

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025.

Get Price

Middle East: Energy Transition Unlocks Huge Market

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and

Get Price

Battery Storage in the Middle East: Powering the Energy Shift

As the Middle East intensifies its shift to renewable energy, battery storage is becoming a vital part of its infrastructure. Countries like Saudi Arabia and the United Arab

Get Price

WFES 2024

AN EXCLUSIVE REPORT FOR THE WORLD FUTURE ENERGY SUMMIT BY Grid connected solar PV capacity in the Middle East is expected to grow at a CAGR of 12.9% by 2030, one of

Get Price

Middle East Energy 2025 in Dubai spotlights energy

Middle East Energy (MEE) 2025 launched at the Dubai World Trade Centre (DWTC), showcasing the future of energy storage and battery

Get Price

Role of Energy Storage

The energy storage market in Oman and Kuwait, including batteries, is expected to grow in the coming years due to the increasing demand for renewable energy and the need for backup

Get Price

Applicability of Hydropower Generation and Pumped

There is also an emphasis on installations in the Middle East and North Africa (MENA) in terms of available capacity as well as past and future

Get Price

Major Renewable Energy Projects Happening In The

Middle East Energy Transition recently highlighted that no contracts were awarded for oil-powered or gas-fuelled power stations in the Middle East and

Get Price

6 FAQs about [Are there energy storage power stations in the Middle East ]

Is energy storage gaining traction in the Middle East?

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and storage technologies are well-established, the Middle East remains in the early stages of development.

Is large-scale energy storage a viable option in the Middle East?

Until recently, large-scale energy storage was barely a consideration in the Middle East, where fossil fuels have long dominated power generation. With renewable energy projects expanding across the region, energy storage has started gaining traction.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

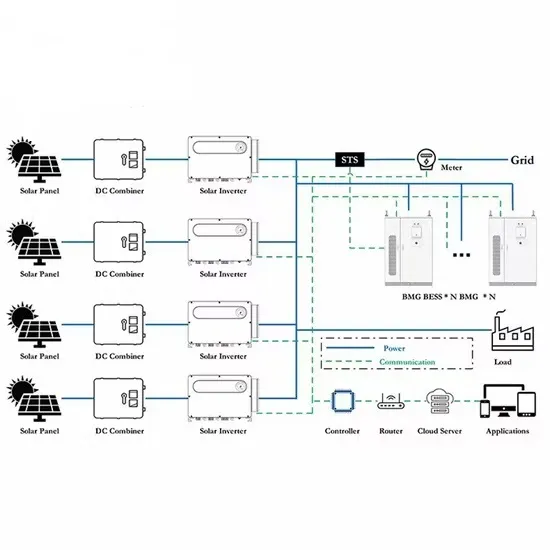

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Will energy storage expand in MENA?

The current utility business model limits the prospects of energy storage expansion opportunities, unless driven by direct governmental support. Auctions in MENA have been a major driver for renewable energy deployment, most notably for solar and wind, but only a few have included energy storage.

More related information

-

Middle East Energy Storage Power Station Franchise Agent

Middle East Energy Storage Power Station Franchise Agent

-

Retail price of energy storage power supply in the Middle East

Retail price of energy storage power supply in the Middle East

-

Middle East Energy Storage Power Station Subsidies

Middle East Energy Storage Power Station Subsidies

-

The price of charging and discharging energy storage power stations

The price of charging and discharging energy storage power stations

-

What are the high-end energy storage power stations

What are the high-end energy storage power stations

-

Advantages and Disadvantages of Solar Energy Storage Power Stations

Advantages and Disadvantages of Solar Energy Storage Power Stations

-

What battery energy storage power stations are there in Algeria

What battery energy storage power stations are there in Algeria

-

What are the lithium battery energy storage power stations in Bolivia

What are the lithium battery energy storage power stations in Bolivia

Commercial & Industrial Solar Storage Market Growth

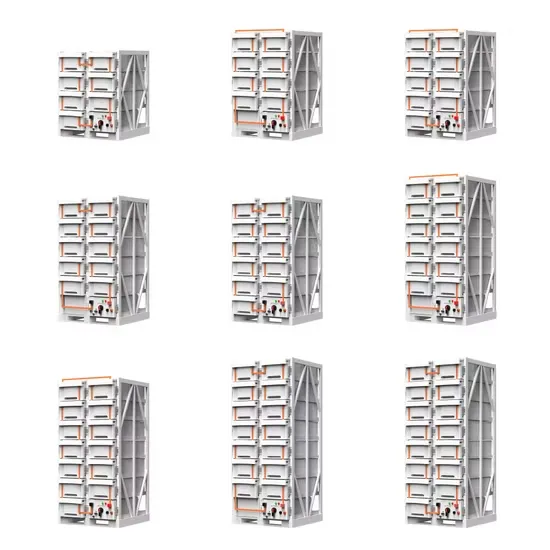

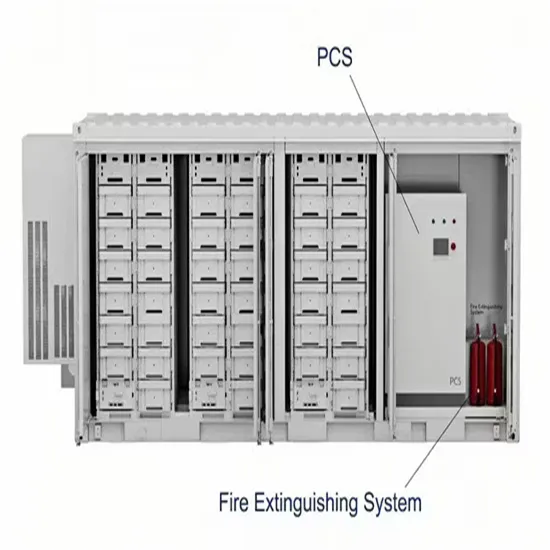

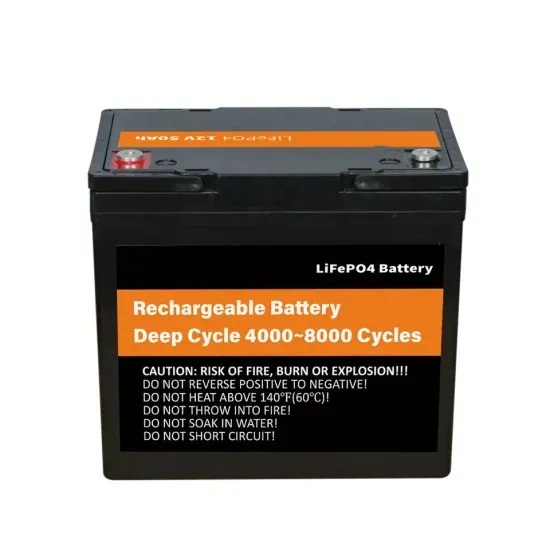

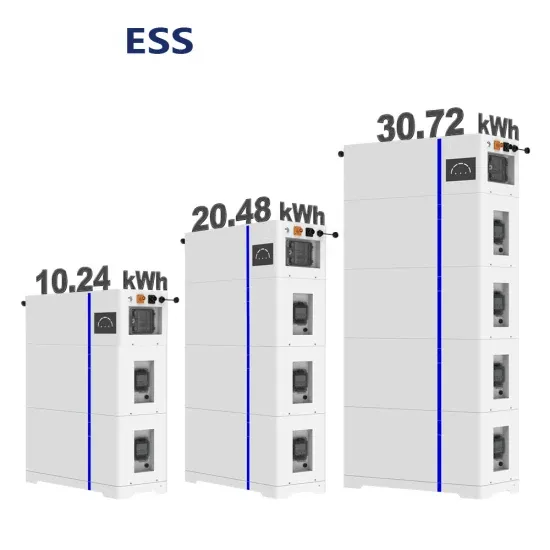

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.