The Middle East Is Bracing for a Solar Energy Boom

Countries like Oman, UAE, Qatar, and Saudi Arabia are leading the solar charge with ambitious targets and large-scale solar power plant projects.

Get Price

Energy development and management in the Middle East: A

The Middle East (ME) has undergone substantial changes in the energy landscape in recent years due to considerable variations in energy demand trends, economic/political

Get Price

Middle East Residential Energy Storage Status and Outlook!

The residential energy storage market in the Middle East has developed rapidly in recent years, driven by energy transformation, policy drive, and technological progress.

Get Price

The Energy Transition in the Middle East: Navigating

This article explores the Middle East''s shift away from oil dependence towards renewable energies, highlighting how this energy

Get Price

The Middle East''s Solar Shift: From Oil to Energy Powerhouse

Costs have plummeted, with solar now the cheapest source of new power generation in most countries. The Middle East, blessed with abundant sunlight and vast desert

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get Price

MENA Solar and Renewable Energy Report

The dramatic drop in the price of solar energy coupled with increasing competitivity of storage solutions will allow solar energy for a number of usages that have traditionally been large

Get Price

MENA region''s solar energy capacity to exceed 180

The share of solar energy in the Middle East and North Africa''s (MENA) energy mix has grown significantly in recent years. Solar capacity in

Get Price

MENA''s Renewable Energy Boom: Solar Capacity to

Advances in solar module mounting structures, tracking systems, and battery storage are reducing the Levelized Cost of Electricity (LCOE),

Get Price

Solar PPAs viable in Saudi Arabia at prices above

Saudi scientists have determined the current price threshold for power purchase agreements (PPA) that could make large-scale PV and wind

Get Price

Powering the Future: Energy Storage Solutions in the Middle East

With its global expertise in solar power inverters and energy storage systems, Sungrow is contributing significantly to the region''s energy storage solutions 4.

Get Price

MENA Energy Recap, Q1 2025: Tariffs and

The MENA Energy Recap is a quarterly review of key energy developments that took place in the Middle East and North Africa region from

Get Price

Powering Progress: Trends and Challenges in Solar

The declining costs of solar photovoltaic technology have sparked a surge in installations across the region. Leading countries like the UAE,

Get Price

Power surge: Solar PV to help meet soaring Middle

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the

Get Price

The Middle East''s Solar Shift: From Oil to Energy

Costs have plummeted, with solar now the cheapest source of new power generation in most countries. The Middle East, blessed with

Get Price

Middle East Solar PV Market Size | Industry Report, 2033

Middle East Solar PV Market Summary The Middle East solar PV market size was estimated at USD 6.73 billion in 2024 and is projected to reach USD 14.11 billion by 2033, growing at a

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get Price

Middle East Investments Surge as Global Energy Storage Market

With an increase in midday generation, electricity prices during these hours are expected to decrease further, expanding the potential for arbitrage between peak and off-peak

Get Price

Middle East Investments Surge as Global Energy

With an increase in midday generation, electricity prices during these hours are expected to decrease further, expanding the potential for

Get Price

Powering Progress: Trends and Challenges in Solar and Storage

The declining costs of solar photovoltaic technology have sparked a surge in installations across the region. Leading countries like the UAE, Saudi Arabia, and Jordan are

Get Price

Middle East Archives

Commercial and industrial (C&I) energy storage can significantly lower electricity costs, increase efficiency, and aid decarbonisation, but

Get Price

What is going on with Middle Eastern solar prices, and what does

As this future increasingly appears to be one of previously unimaginably cheap energy, we conclude with a discussion of the ways in which the region and the world can seek

Get Price

MENA''s Renewable Energy Boom: Solar Capacity to Hit 180 GW

Advances in solar module mounting structures, tracking systems, and battery storage are reducing the Levelized Cost of Electricity (LCOE), making renewables even more

Get Price

Middle East and North Africa 2024 Energy Industry Outlook

tives for developers to invest in energy storage systems. Instead, the auction systems typically preferred tend to focus on securing the lowest possible price for electricity, Among other

Get Price

ACWA Power wind and battery storage plant to power

Signing of the agreement between the International Finance Corporation and ACWA Power. Image: Future Investment Initiative. ACWA

Get Price

Power surge: Solar PV to help meet soaring Middle East power

With nearly 40% of its power consumed by a growing residential sector, the Middle East faces surging power demand. This, coupled with the need for economic

Get Price

Middle East Energy | Market Outlook Report 2024

What to expect: Chapter 1: The Middle East and North Africa Outlook Highlights current trends, challenges, and opportunities in the region''s energy sector. Chapter 2: Renewable Energy in

Get Price

Batteries: The Key to Reliable Renewable Energy – IRENA

3 days ago· Since 2018, energy shifting has been the primary use of electricity storage, accounting for 67% of capacity additions by 2024. BESS stores renewable energy during low

Get Price

6 FAQs about [Middle East energy storage solar power prices]

Is solar power the cheapest source of power in the Middle East?

Costs have plummeted, with solar now the cheapest source of new power generation in most countries. The Middle East, blessed with abundant sunlight and vast desert landscapes, has seized this opportunity. Governments have set net-zero targets, launched mega-projects, and created favorable investment environments that are driving rapid expansion.

Is the Middle East embracing solar energy?

The Middle East’s embrace of solar energy is unfolding at an unprecedented scale. Once almost entirely reliant on oil and gas, the region is now pouring billions into solar infrastructure, setting some of the most ambitious renewable energy targets in the world. Saudi Arabia has placed solar energy at the center of its economic transformation.

How much energy does the Middle East use?

The Middle East's power generation is heavily reliant on fossil fuels, making up 93% of the total at the end of 2023. Renewables accounted for 3% and nuclear and hydro for 2% each. Natural-gas power represented almost three-quarters of the region's electricity generation, making up 40% of the overall gas demand.

How will investment shape the future of Middle Eastern energy?

As investment pours into the sector, the companies leading this transformation will not only shape the future of Middle Eastern energy but also influence global trends in renewable power. The Middle East is now home to some of the world’s largest and most advanced solar power projects.

Is the Middle East a solar superpower?

By leveraging its natural solar resources, financial capital, and technological innovation, the Middle East is poised to lead the next chapter of the clean energy revolution, cementing its place as a solar superpower for decades to come. The Middle East, long defined by its oil wealth, is now emerging as a global leader in solar power.

Will the Middle East be able to use renewables in 2040?

Renewables capacity in the Middle East is set to soar in the coming years, with green energy sources outpacing fossil fuel usage in the power sector by 2040, according to Rystad Energy's latest research.

More related information

-

Are there energy storage power stations in the Middle East

Are there energy storage power stations in the Middle East

-

Algeria solar power generation and energy storage prices

Algeria solar power generation and energy storage prices

-

Retail price of energy storage power supply in the Middle East

Retail price of energy storage power supply in the Middle East

-

Middle East Wind Solar and Energy Storage Project

Middle East Wind Solar and Energy Storage Project

-

Czech wind solar and energy storage power generation prices

Czech wind solar and energy storage power generation prices

-

Middle East Energy Storage Power Station Subsidies

Middle East Energy Storage Power Station Subsidies

-

Wind and solar energy storage power station prices

Wind and solar energy storage power station prices

-

Timor-Leste Wind and Solar Energy Storage Power Station

Timor-Leste Wind and Solar Energy Storage Power Station

Commercial & Industrial Solar Storage Market Growth

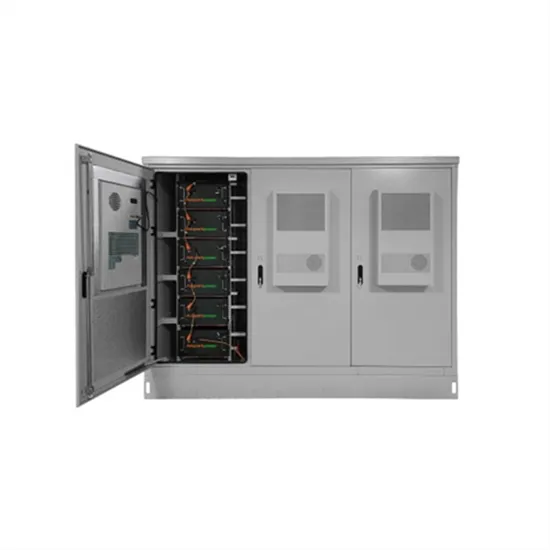

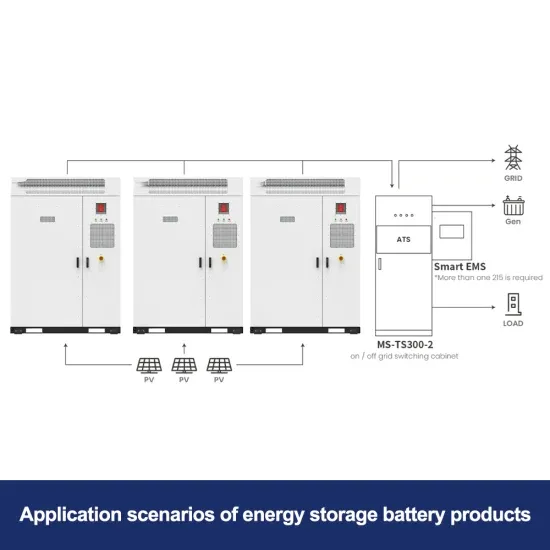

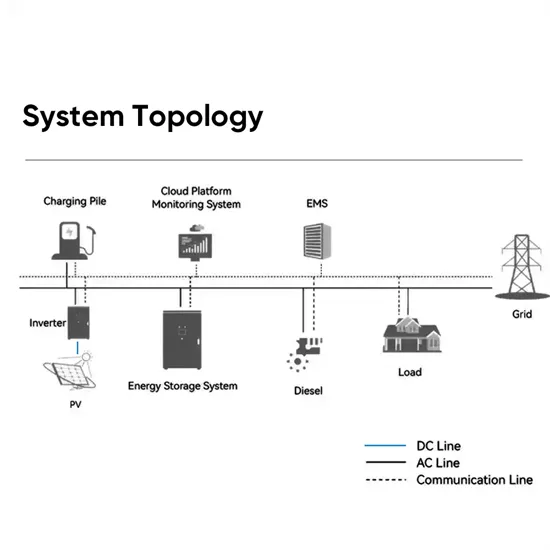

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.