MENA region on track for 75 GW of solar by 2030

Dii Desert Energy, an energy transition think tank, has reported the Middle East and North Africa (MENA) region will have a cumulative solar capacity of 75 GW at the end of the

Get Price

The Top 5: Game-Changing Renewable Energy Projects In The Middle East

It''s worth noting some of the game-changing Renewable Energy Projects In the Middle East. We look at the top projects which have the potential to give a significant push to

Get Price

Saudi: Huawei to power ''world''s 1st fully clean-energy

Saudi Arabia''s Red Sea Project will feature the world''s largest photovoltaic-energy storage microgrid with a 400MW solar PV system and

Get Price

Middle East''s Renewable Energy Bet: Big Wins, Tough Truths

Taken together, the many projects and momentum toward new low-carbon energy in the Middle East and North Africa are impressive. Renewable energy and storage

Get Price

5 Renewable Energy Projects Driving Change In The Middle East

From solar and wind to nuclear and green hydrogen, countries across the region are investing heavily in renewable energy. Here''s a closer look at some of the most ambitious

Get Price

AMEA Power – Dubai-based developer, owner and

AMEA Power is one of the fastest growing renewable energy companies in the region with a clean energy pipeline of over 6GW across 20 countries.

Get Price

Middle East: Energy Transition Unlocks Huge Market

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East.

Get Price

Middle East becomes fastest-growing renewables

In front of the UAE president, it announced it would build a $6bn 5 gigawatt solar plant backed with more than 19GWh of battery storage — the

Get Price

Saudi Arabia Plans to Deploy 48GWh of Battery Storage by 2030

The list of successful bidders includes prominent companies from the Middle East and abroad, such as Masdar, headquartered in Dubai, Saudi Arabia''s ACWA Power, and

Get Price

Chinese New Energy Enterprises "Going Abroad" Series:

As China and the Middle East collaborate to build a community with a shared future, both sides are expected to deepen cooperation in the new energy sector, including by jointly building

Get Price

Sungrow 760MWh BESS, inverter deal for Saudi off-grid project

The site of the AMAALA project on Saudi Arabia''s northwest coast under construction. Image: Larsen & Toubro. Sungrow has agreed a partnership to deploy

Get Price

Power surge: Solar PV to help meet soaring Middle East power

Renewables capacity in the Middle East is set to soar in the coming years, with green energy sources outpacing fossil fuel usage in the power sector by 2040, according to

Get Price

Middle East''s Renewable Energy Bet: Big Wins,

Taken together, the many projects and momentum toward new low-carbon energy in the Middle East and North Africa are impressive. Renewable

Get Price

ACWA Power wind and battery storage plant to power

The Saudi Arabian power producer and developer has signed a joint development agreement with Gotion Power, Chinese battery

Get Price

Saudi Arabia joins top 10 global energy storage

Currently, 26 GWh of energy storage projects are in various stages of development in Saudi Arabia. These projects are vital for stabilizing

Get Price

ACWA Power wind and battery storage plant to power Middle East

The Saudi Arabian power producer and developer has signed a joint development agreement with Gotion Power, Chinese battery manufacturer Gotion High-Tech''s subsidiary in

Get Price

Biggest renewable energy projects in the Middle East

A collaboration of NEOM, ACWA Power and Air Products, it combines onshore solar, wind and energy storage, targeting 600 tons of daily green hydrogen output by 2026.

Get Price

1300 MWh! Huawei Wins Contract for the World''s Largest Energy Storage

This 1300 MWh off-grid energy storage project is the largest of its kind in the world and represents a milestone in the global energy storage industry. The Red Sea Project has

Get Price

10 Exciting Up-and-Coming Renewable Energy Projects in the Middle East

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025. Read more here.

Get Price

Solar and Wind Energy Driving the Middle East''s Energy Transition

Masdar and Saudi Arabia''s ACWA Power have invested in several solar and wind projects across the Middle East and North Africa, helping to drive the region''s energy transition

Get Price

MENA Solar and Renewable Energy Report

Round 3 projects consisting of 150 MW of solar and 50 MW of wind power, including a storage option, are being carried out in Ma''an and are planned to be completed in 2020.

Get Price

The world''s largest solar + storage project will deliver

The United Arab Emirates is building the world''s largest solar and battery storage project that will dispatch clean energy 24/7.

Get Price

10 Exciting Up-and-Coming Renewable Energy

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025.

Get Price

Energy Series Advancing Energy Storage in the MENA Region

To date, the most popular way to store excess energy has been pumped storage hydropower plants, but battery energy storage systems (BESS) and thermal storage in the form of molten

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get Price

The Top 5: Game-Changing Renewable Energy

It''s worth noting some of the game-changing Renewable Energy Projects In the Middle East. We look at the top projects which have the

Get Price

Why battery storage investment is vital to the Middle

With the global solar energy and battery storage market size projected to reach $26.08 billion by 2030, growing at a CAGR of 16.15 percent

Get Price

Sungrow and Algihaz Join Forces for 7.8 GW Energy Storage in

Sungrow Power Supply, a Chinese photovoltaic inverter manufacturing giant recently announced to partner with Saudi Arabia''s Algihaz Holding for a massive energy

Get Price

6 FAQs about [Middle East Wind Solar and Energy Storage Project]

Will the Middle East be able to use renewables in 2040?

Renewables capacity in the Middle East is set to soar in the coming years, with green energy sources outpacing fossil fuel usage in the power sector by 2040, according to Rystad Energy's latest research.

Why is the Middle East transforming its energy sector?

The Middle East's energy sector is at a turning point. Although traditionally an oil and gas powerhouse, the region is shifting its focus to renewables as a response to rapid industrial growth, increasing population, and a global drive to reduce carbon emissions.

How much energy does the Middle East use?

The Middle East's power generation is heavily reliant on fossil fuels, making up 93% of the total at the end of 2023. Renewables accounted for 3% and nuclear and hydro for 2% each. Natural-gas power represented almost three-quarters of the region's electricity generation, making up 40% of the overall gas demand.

How does the Middle East & North Africa strategy affect renewables?

Within the Middle East and North Africa (MENA) region, the increased industrial activity and drive towards renewables is reflected in each country’s strategy. Continuous population growth and economic develop-ment have placed pressure on existing power assets and in some cases, created a significant gap between electricity production and demand.

Will Uzbekistan be able to deploy 25GW of solar PV and wind?

Uzbekistan is aiming to deploy 25GW of solar PV and wind by 2030. In addition to its agreement with Saudi Arabia’s ACWA Power, the country’s government also has a joint development agreement with the UAE’s Masdar for 2GW of wind energy and 1,150MWh of battery storage.

How much solar power will the Middle East have in 2023?

The total solar capacity in the Middle East at the end of 2023 exceeded 16 gigawatts (GW) and is expected to approach 23 GW by the end of 2024. Projections indicate that by 2030, the capacity will surpass 100 GW, with green hydrogen projects contributing to an annual growth rate of 30%.

More related information

-

Huawei Cambodia Wind Solar Energy Storage Project

Huawei Cambodia Wind Solar Energy Storage Project

-

Middle East Industrial and Commercial Energy Storage Project

Middle East Industrial and Commercial Energy Storage Project

-

Huawei St Kitts and Nevis Wind Solar Energy Storage Project

Huawei St Kitts and Nevis Wind Solar Energy Storage Project

-

How much does it cost to develop a wind solar and energy storage project

How much does it cost to develop a wind solar and energy storage project

-

Middle East energy storage solar power prices

Middle East energy storage solar power prices

-

Huawei Lebanon Wind Solar and Energy Storage Project

Huawei Lebanon Wind Solar and Energy Storage Project

-

Belarus Wind Solar and Energy Storage Project

Belarus Wind Solar and Energy Storage Project

-

Middle East Sodium Battery Energy Storage Project

Middle East Sodium Battery Energy Storage Project

Commercial & Industrial Solar Storage Market Growth

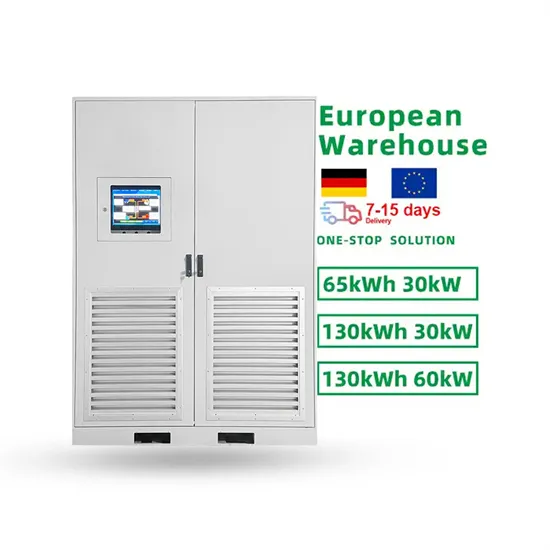

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.