TS 138 113

The EMC requirements have been selected to ensure an adequate level of compatibility for apparatus at residential, commercial and light industrial environments. The levels, however, do

Get Price

Measurement and analysis of base transceiver stations power

Depending on the congestion of conversations, Base Transceiver Station (BTS) for mobile communication includes several single phase rectifiers to feed batteries and amplifiers

Get Price

The power supply design considerations for 5G base stations

Pulse power leverages 5G base stations'' ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don''t warrant it, such as transmitting reference signals

Get Price

Multi‐objective interval planning for 5G base station virtual

As an emerging load, 5G base stations belong to typical distributed resources [7]. The in‐depth development of flexi-bility resources for 5G base stations, including their internal energy

Get Price

Murata-Base-station-app-guide

To design efective and long-lasting 5G infrastructure, the architecture of the base stations should be considered right down to the level of components. When selecting a manufacturer, the

Get Price

Power Supply for 5G Infrastructure | Renesas

Renesas'' 5G power supply system addresses these needs and is compatible with the -48V Telecom standard, providing optimal performance, reduced energy consumption, and robust

Get Price

A Voltage-Level Optimization Method for DC Remote Power

The optimal voltage level for different supply distances is discussed, and the effectiveness of the model is verified through examples, providing valuable guidance for

Get Price

5G Transmit Power and Antenna radiation

The total EMF limits have to be taken into account during site deployments to ensure high performance but also provide the required safety, in order to reassure the public opinion on 5G

Get Price

A Voltage-Level Optimization Method for DC Remote Power Supply of 5G

The optimal voltage level for different supply distances is discussed, and the effectiveness of the model is verified through examples, providing valuable guidance for

Get Price

A technical look at 5G energy consumption and performance

How can 5G increase performance and ensure low energy consumption? Find out in our latest Research blog post.

Get Price

High voltage direct current remote power supply structure for base

Download scientific diagram | High voltage direct current remote power supply structure for base stations. from publication: A Voltage-Level Optimization Method for DC Remote Power Supply

Get Price

Selecting the Right Supplies for Powering 5G Base Stations

It includes everything needed to power 5G base station components, including software design and simulation tools like LTpowerCAD and LTspice. These tools simplify the task of selecting

Get Price

Supply

Abstract—This paper presents a broadband efficient power amplifier (PA) targeting sub-6-GHz 5G base station applications. Due to the demanding requirements in both peak-to-average power

Get Price

Study on Power Feeding System for 5G Network

HVDC systems are mainly used in telecommunication rooms and data centers, not in the Base station. With the increase of power density and voltage drops on the power transmission line in

Get Price

Modeling and aggregated control of large-scale 5G base stations

A significant number of 5G base stations (gNBs) and their backup energy storage systems (BESSs) are redundantly configured, possessing surplus capacit

Get Price

(PDF) Research and Prospect of 5G Power Application

This paper investigates the 5G power application status in China, and compares the mainstream communication technologies of the existing

Get Price

Frontiers

With the rapid development of 5G base station construction, significant energy storage is installed to ensure stable communication. However, these storage resources often remain idle, leading

Get Price

A Voltage-Level Optimization Method for DC Remote Power Supply of 5G

Unlike the concentrated load in urban area base stations, the strong dispersion of loads in suburban or highway base stations poses significant challenges to traditional power supply

Get Price

A Review on 5G Sub-6 GHz Base Station Antenna

Modern wireless networks such as 5G require multiband MIMO-supported Base Station Antennas. As a result, antennas have multiple ports to

Get Price

Building a Better –48 VDC Power Supply for 5G and Next

Telecom and wireless networks typically operate on –48 V DC power, but why? The short story is that –48 V DC, also known as a positive-ground system, was selected because it provides

Get Price

#5GCheckTheFacts > 5G masts and base stations

All mobile operators ensure that their radio base stations, and masts are designed and built so that the public are not exposed to radiofrequency fields above the strict safety guidelines which

Get Price

SHARING BEST PRACTICES AND REGULATORY

Operators can use technology in industries to generate revenue of around $619 billion by 2026. In the period from 2020 to 2035, the share of the total world GDP is expected to be around seven

Get Price

Improving RF Power Amplifier Efficiency in 5G Radio Systems

A crucial aspect of the evolution to 5G is solving difficult base-station hardware challenges. Existing towers must provide higher performance in order to carry many more channels at

Get Price

Building a Better –48 VDC Power Supply for 5G and

Telecom and wireless networks typically operate on –48 V DC power, but why? The short story is that –48 V DC, also known as a positive-ground system,

Get Price

6 FAQs about [Voltage levels of 5G base stations in Iran]

How much power does a 5G system need?

To keep the power density per MHz similar to LTE systems, the 100MHz 3.5GHz spectrum will require 5x 80 W, which is not easy to be achieved. 5G trials need to define a realistic output power trade-off between coverage, power consumption, EMF limits, and performance.

What is HVDC system for 5G network?

With the increase of power density and voltage drops on the power transmission line in macro base, it is recommended to use HVDC system for the 5G network. Requirements to ICT equipment Power Supply Unit (PSU) and supporting facilities. -42V. It means that if the voltage drop is more than 6V, the ICT equipment will be protected.

How to calculate sectional area of 5G power supply cable?

The Sectional area of the 4G power supply cable is calculated by 6mm2 The Sectional area of the 5G power supply cable is calculated by 16mm2. installed a DC/DC converter to increase the system 57V or 60V.

How can a 5G network increase capacity?

The key to a capacity increase lies in the densification of the network topology. A crucial aspect of the evolution to 5G is solving difficult base-station hardware challenges. Existing towers must provide higher performance in order to carry many more channels at higher data rates.

What is the coverage area of 5G high-frequency base stations?

The radius of coverage area of 5G high-frequency base stations will be less than one-tenth of that of 4G base stations, and the coverage area of 5G high-frequency base stations will be less than one percent of that of 4G base stations. The deployment of macro base stations is difficult and the site resources are not easy to obtain.

What makes a 5G network a good choice?

High-speed data transmission, support for a large number of connected devices, low latency, low power consumption and extremely high reliability are essential. The key to a capacity increase lies in the densification of the network topology. A crucial aspect of the evolution to 5G is solving difficult base-station hardware challenges.

More related information

-

5g base stations are not affected by voltage levels and power consumption

5g base stations are not affected by voltage levels and power consumption

-

Communication 5G base stations are too concentrated

Communication 5G base stations are too concentrated

-

Which companies built Azerbaijan s 5G base stations

Which companies built Azerbaijan s 5G base stations

-

5g base stations consume too much power

5g base stations consume too much power

-

Lithium iron phosphate battery specifications for 5G base stations

Lithium iron phosphate battery specifications for 5G base stations

-

Which 5G baseband is suitable for 5G communication base stations

Which 5G baseband is suitable for 5G communication base stations

-

How many 5G network base stations are there in Greece

How many 5G network base stations are there in Greece

-

How many 5G base stations does Japan have now

How many 5G base stations does Japan have now

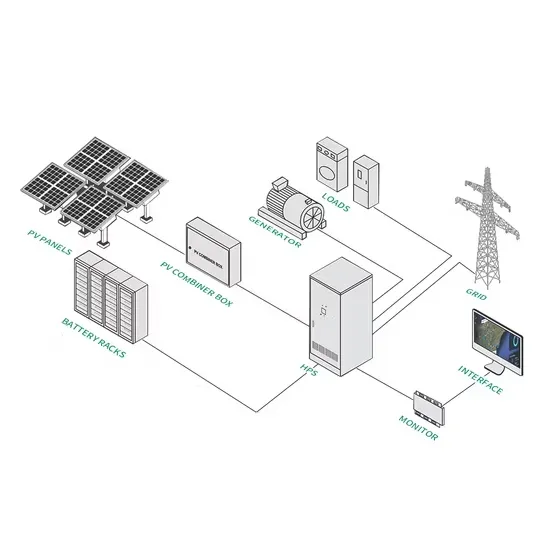

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.