Moscow cracks down on lead exports as batteries sanctions have

June 2, 2022: Russia said on May 14 it was introducing controls on lead exports amid fears sanctions could disrupt the country''s heavy reliance on battery imports — but analysts warn

Get Price

Russia investment deal to boost gigafactory production – Batteries

June 23, 2023: Russian energy storage firm Renera says a special investment contract providing incentives and financial backing for domestic production of batteries for EVs and stationary

Get Price

Russia storage of li ion batteries

Russian state-owned Rosatom State Nuclear Energy (Rosatom) has announced it will build its 3 GWh lithium-ion battery manufacturing facility in Kaliningrad,in Russia''s province of the same

Get Price

What US tariffs on Chinese batteries mean for

Chinese li-ion battery exports are largely bound for the European Union and North America. Source: PRC General Administration of Customs,

Get Price

Mutlu Akü battery exports take hit over Russia sanctions

This in turn hurt the wider performance of Metair''s energy storage division, which also includes Romanian lead and lithium company Rombat and South Africa''s First National

Get Price

Russia''s lithium ambitions: A strategic move to challenge global energy

Lithium is a critical mineral for EV batteries and renewable energy storage, with global demand surging as nations transition away from fossil fuels. Russia''s move aligns with

Get Price

Russian Nasal Vaccine Seeks Export Markets

This time the Russian nasal vaccine seems to be leading the pack. With the wily Russian leader center stage of the marketing drive.

Get Price

Gazprom Energy Storage and Battery Initiatives for 2025: Key

Will Gazprom diversify into energy storage? Explore potential investments, partnerships, and the role of geopolitics in Russia''s energy future.

Get Price

Russia Sanctions and Export Controls: U.S. Agencies Should

4 days ago· The U.S. and its allies have frozen billions in Russian assets and controlled exports of important technologies to Russia in response to the war in

Get Price

Battery energy storage in russia

June 2, 2022: Russia said on May 14 it was introducing controls on lead exports amid fears sanctions could disrupt the country''''s heavy reliance on battery imports -- but analysts warn

Get Price

April 2025 — Monthly analysis of Russian fossil fuel exports and

By Vaibhav Raghunandan and Petras Katinas Vessel sanctions bite Russian oil, with G7+ vessels responsible for almost half of all oil deliveries in April Key findings In April,

Get Price

Russian EV, ESS battery prototypes ''ready this year''

In April 2022, Batteries International reported that the introduction of tougher new EU rules to restrict trade with Russia were likely to include

Get Price

Russian EV, ESS battery prototypes ''ready this year'' – Energy Storage

In April 2022, Batteries International reported that the introduction of tougher new EU rules to restrict trade with Russia were likely to include exports of lead batteries and

Get Price

What now for Russia''s exports after the Ukraine invasion? | World

Russia plans to halt exports of raw materials in response to sanctions because of its war on Ukraine. What will that mean for it and the rest of the world?

Get Price

Sanctions by The Numbers: The Russian Energy

Since 2010, Russia used Nord Stream 1, owned by Gazprom, as the primary means of exporting natural gas to Europe. Beginning in 2011, EU

Get Price

New Federal Rules Limit Imports of EV Batteries from

Biden administration restricts China and other countries from supplying battery components and materials for electric vehicles to receive tax

Get Price

Russia''s Gas Export Strategy: Adapting to the New Reali

By Anne-Sophie Corbeau and Dr. Tatiana Mitrova Unlike Russian crude oil exports, which in 2023 exceeded the volumes of 2021,1 Russia''s natural gas exports have dwindled by an estimated

Get Price

Russia''s natural gas and coal exports have been decreasing and

Since Russia''s full-scale invasion of Ukraine in February 2022, both Russia''s natural gas and coal exports have declined when compared with 2021. Russian exports to

Get Price

Russia Battery Market is expected to reach $7.13 Bn by 2030

Key Insights from the Russia Battery Market Report: The information related to key drivers, restraints, and opportunities and their impact on the Russia battery market is provided

Get Price

Russian Energy Storage Batteries: Powering the Future with

Why Russian Batteries Are Winning the Cold War 2.0 Forget vodka; Russia''s real secret sauce is arctic-optimized energy storage. While Western batteries sulk at -20°C,

Get Price

Today in Energy

Since Russia''s full-scale invasion of Ukraine in February 2022, both Russia''s natural gas and coal exports have declined when compared with 2021.

Get Price

Russia to initiate large-scale lithium production in

Russia has announced plans to commence large-scale lithium production by the end of this decade, amid efforts to reduce its dependence

Get Price

Russia''s Big Push Into Lithium Is Hitting Roadblocks

Russia sits on an estimated one million tons of lithium, an amount comparable to the US. Lithium is used to make lithium-ion batteries, and has been in increasing demand

Get Price

energy storage batteries exported to russia

By interacting with our online customer service, you''ll gain a deep understanding of the various energy storage batteries exported to russia - Suppliers/Manufacturers featured in our

Get Price

Moscow cracks down on lead exports as batteries

June 2, 2022: Russia said on May 14 it was introducing controls on lead exports amid fears sanctions could disrupt the country''s heavy reliance on battery

Get Price

Russia''s lithium ambitions: A strategic move to

Lithium is a critical mineral for EV batteries and renewable energy storage, with global demand surging as nations transition away from fossil

Get Price

Russia to initiate large-scale lithium production in 2030

Russia has announced plans to commence large-scale lithium production by the end of this decade, amid efforts to reduce its dependence on imports and strengthen its

Get Price

6 FAQs about [Russia exports energy storage batteries]

Will Russia's EV battery market be affected by sanctions?

June 2, 2022: Russia said on May 14 it was introducing controls on lead exports amid fears sanctions could disrupt the country’s heavy reliance on battery imports — but analysts warn the global energy storage and EV batteries market is set to suffer too.

Is Russia a big importer of batteries?

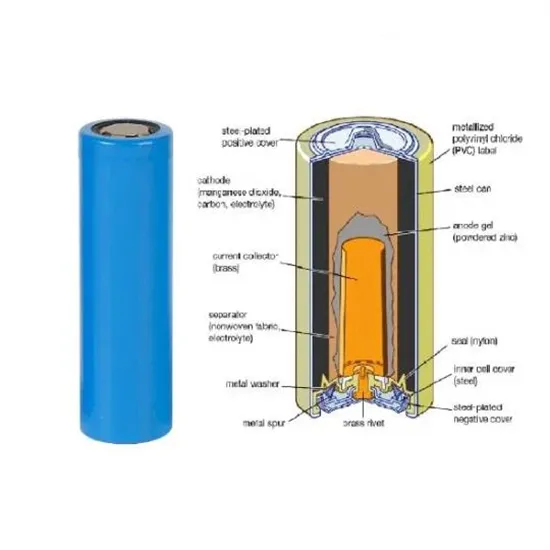

Russia is also a “far bigger importer of finished batteries than it is an exporter”, typically 160ktpa in versus 20ktpa out”. CRU’s lead analyst, Neil Hawkes, confirmed that all Russia’s lead output comes from recycling, with no primary smelters.

How much lithium does Russia use?

Russia sits on an estimated one million tons of lithium, an amount comparable to the US. Lithium is used to make lithium-ion batteries, and has been in increasing demand since the EV boom. With oil and gas sanctions weighing on Russia's economy after its full-scale invasion of Ukraine, mining lithium is becoming more attractive.

Does Russia have a lithium reserve?

Russia's plan to develop one of its vast untapped lithium reserves is hitting major roadblocks. Russia sits on an estimated one million tons of lithium, an amount comparable to the US. Lithium is used to make lithium-ion batteries, and has been in increasing demand since the EV boom.

How will Russia and Ukraine affect electric vehicle batteries?

“Russia and Ukraine hold significant reserves of metals such as cobalt, nickel, platinum and palladium. Although for the prior commodities — save for palladium, at 40% world mined supply — neither are the world’s foremost suppliers, prices will be impacted and could impact electric vehicle batteries.”

Could polar lithium Spook China's involvement in Russia's energy sector?

On January 10, the outgoing administration of former President Joe Biden imposed a slew of sanctions on Russia's energy sector. On its list was Polar Lithium, an inclusion that could spook China's involvement.

More related information

-

Bahrain exports energy storage batteries

Bahrain exports energy storage batteries

-

Russia converts to off-grid energy storage batteries

Russia converts to off-grid energy storage batteries

-

Brazil s backup energy storage batteries

Brazil s backup energy storage batteries

-

Mozambique buys energy storage batteries

Mozambique buys energy storage batteries

-

The difference between batteries and energy storage products

The difference between batteries and energy storage products

-

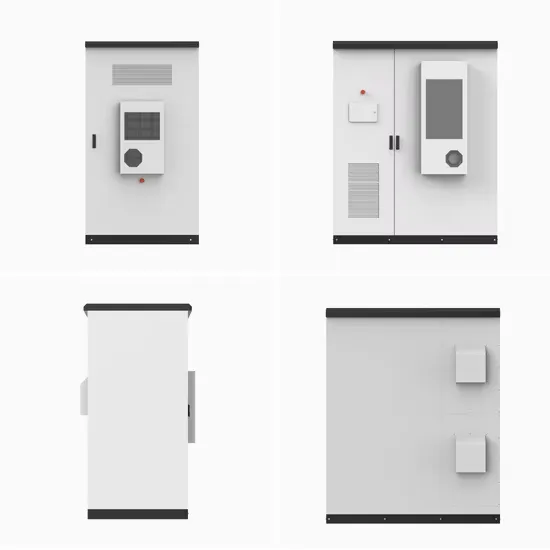

Better than energy storage cabinet batteries

Better than energy storage cabinet batteries

-

The purpose of energy storage batteries being loaded into containers

The purpose of energy storage batteries being loaded into containers

-

Do energy storage batteries need heat dissipation

Do energy storage batteries need heat dissipation

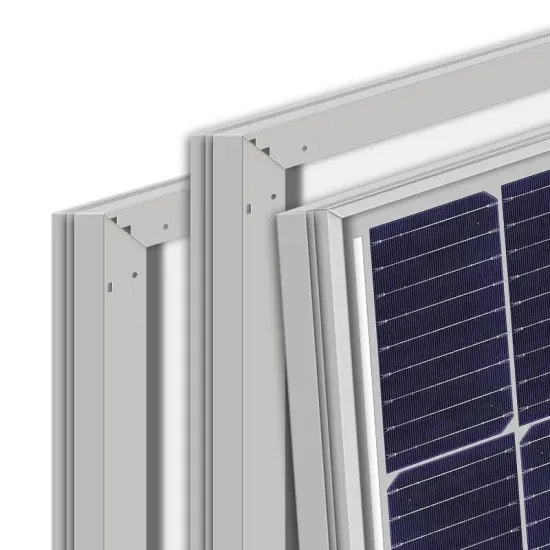

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

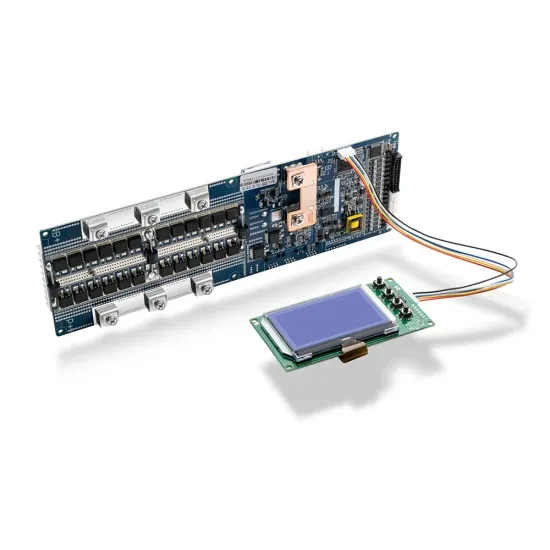

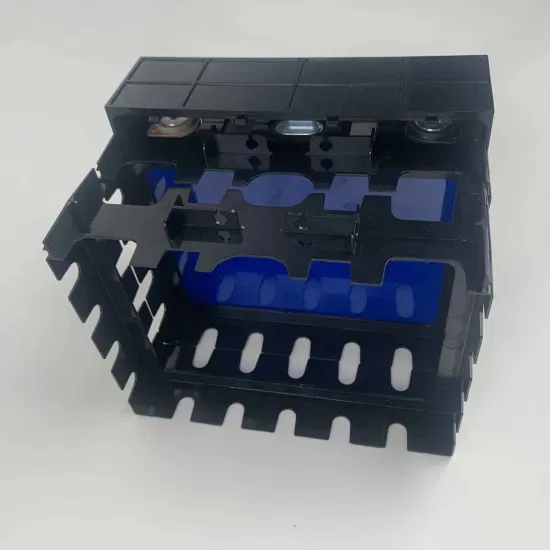

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.