Solutions for energy storage systems (ESS)

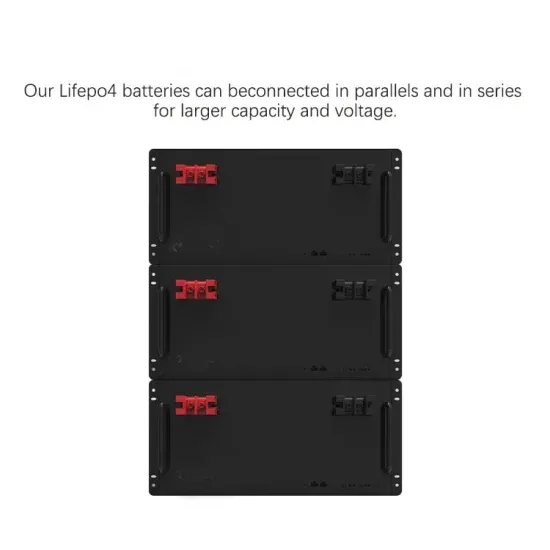

Electrochemical energy storage devices with CATL battery solutions are successfully used in large industrial and commercial enterprises, residential

Get Price

United Arab Emirates

SEWA has commissioned and inaugurated the Al Khan power transmission and distribution station in 2016, to ensure the reliability of power supply throughout areas such as Al Khan, Al

Get Price

United Arab Emirates | Imports and Exports

What did United Arab Emirates export in 2023? United Arab Emirates''s Top Exports in 2023: 28% ($162 billion): 2709 - Petroleum oils and oils obtained from bituminous

Get Price

Top Energy Companies in United Arab Emirates

Information about Energy in United Arab Emirates The energy industry in the United Arab Emirates (UAE) is characterized by its rapid growth and significant investment in both

Get Price

About Us

Powernsun is a part of the Orange Overseas Group, which was founded in 2013 under Hamriyah Free Zone, United Arab Emirates, by Mr. LK Verma. The group initially focused on power and

Get Price

United Arab Emirates (UAE) Power Companies

This report lists the top United Arab Emirates (UAE) Power companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors

Get Price

AMEA Power – Dubai-based developer, owner and operator of

AMEA Power is one of the fastest growing renewable energy companies in the region with a clean energy pipeline of over 6GW across 20 countries. Founded in 2016, AMEA Power has

Get Price

UAE Launches World''s Largest Integrated Solar & Battery Storage

5 days ago· In a remarkable advancement for renewable energy, the United Arab Emirates, under the auspices of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the

Get Price

Solutions for energy storage systems (ESS)

Currently, StorEn has concluded a list of agreements and is implementing them within the framework of a joint production and service enterprise in the UAE,

Get Price

UAE Launches World''s Largest Integrated Solar

5 days ago· In a remarkable advancement for renewable energy, the United Arab Emirates, under the auspices of His Highness Sheikh Mohamed bin Zayed Al

Get Price

UAE Power Market Size & Share Analysis

Abu Dhabi National Energy Company PJSC (TAQA), Dubai Electricity and Water Authority (DEWA), Emirates Water and Electricity Company (EWEC), ACWA Power Company

Get Price

United Arab Emirates Trade | WITS Data

Merchandise Trade summary statistics for a country including imports, exports, tariffs, export and import partners, top exported products and development indicators

Get Price

AMEA Power – Dubai-based developer, owner and operator of

AMEA Power has more than 2.6GW of clean energy projects in operation or under/near construction in Burkina Faso, Djibouti, Egypt, Ivory Coast, Jordan, Morocco, Togo and Tunisia.

Get Price

The United Arab Emirates'' AI Ambitions

Executive Summary The United Arab Emirates (UAE) is placing enormous bets on artificial intelligence (AI) to diversify its economy and become the world''s next technological

Get Price

Solutions for energy storage systems (ESS)

Currently, StorEn has concluded a list of agreements and is implementing them within the framework of a joint production and service enterprise in the UAE, an exclusive distribution

Get Price

Solar Energy Company Dubai, UAE | Solar Panels in Dubai

ADNEC Group signs Solar Power Purchase Agreement with Positive Zero to accelerate clean energy transition 16 January 2025 – Abu Dhabi, United Arab Emirates (UAE): ADNEC Group,

Get Price

International Trade Relations Dashboard

The International Trade Relations Dashboard is the interactive platform of the Ministry of Economy & Tourism to provide detailed information about the non-oil foreign trade relations of the UAE

Get Price

Eurasian

The volume of trade between Central Asian countries and the Gulf states (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) reached $3.3 billion in 2024, an increase

Get Price

Masdar, EWEC announce 5 GW/19 GWh solar-plus

Emirati state-owned renewable investment company Masdar is partnering with EWEC to build a giant solar and battery energy storage

Get Price

Solar Companies in UAE | Solar Plant | Shams Power

At Shams Power Plant, our mission is to deliver sustainable, affordable and reliable solar energy that supports sustainable development and the UAE''s

Get Price

United Arab Emirates (UAE) Energy Storage Systems Market

UAE Energy Storage Systems Market Synopsis The UAE Energy Storage Systems Market stands at the forefront of the nation`s transition towards sustainable energy solutions. With a growing

Get Price

United Arab Emirates (UAE) Energy Storage Systems Market

In the UAE Energy Storage Systems Market, key players like PowerVault Technologies, EnergyStore UAE, and Emirates Energy Solutions have played pivotal roles in the adoption of

Get Price

ALEC Energy

ALEC Energy and Swedish company Azelio has signed a Memorandum of Understanding (MoU) that covers a collaboration over 49 MW installed capacity of Azelio''s

Get Price

5 FAQs about [United Arab Emirates Energy Storage Power Station Foreign Trade Export Company]

What is the United Arab Emirates (UAE) power market report?

The United Arab Emirates (UAE) Power Market Report is Segmented by Power Generation Sources (Thermal, Nuclear, and Renewables), End-User Sector (Residential, Commercial and Industrial, and Utilities), and Transmission and Distribution (Qualitative Analysis Only). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

How is the UAE power market segmented?

The UAE power market is segmented by power generation source and transmission and distribution (T&D). By power generation source, the market is segmented into thermal, renewables, and other sources. Only qualitative analysis is provided for power transmission and distribution.

How does the UAE's energy strategy shaped capacity expansion?

Capacity expansion is shaped by sustained population growth, electrification of industry, and the UAE Energy Strategy 2050, which commits to a 50% clean-energy mix by mid-century. Gas-fired plants continue to anchor baseload supply, yet solar additions and the 5.6 GW Barakah nuclear plant are steadily lowering the carbon intensity of generation.

Will UAE's solar-plus-storage project redefining capacity-credit assumptions?

The emirate’s 5.2 GW solar-plus-storage project couples with 19 GWh of batteries to dispatch 1 GW of baseload renewable energy, a first-of-a-kind undertaking that is redefining capacity-credit assumptions in the UAE power market (1).

What are CATL battery-powered energy storage systems?

CATL battery-powered energy storage systems provide energy storage and flexibility in power generation. Instant utilization and energy output due to battery electrochemical technology and the technology of electricity production using gas-piston units can be combined into a single most efficient system.

More related information

-

The largest energy storage power station project in the United Arab Emirates

The largest energy storage power station project in the United Arab Emirates

-

United Arab Emirates power station energy storage

United Arab Emirates power station energy storage

-

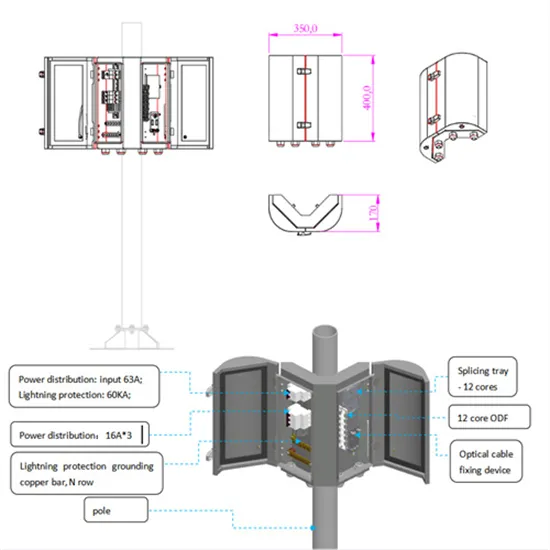

United Arab Emirates Kenya Base Station Energy Storage Power Supply

United Arab Emirates Kenya Base Station Energy Storage Power Supply

-

United Arab Emirates Photovoltaic Power Generation and Energy Storage Manufacturer

United Arab Emirates Photovoltaic Power Generation and Energy Storage Manufacturer

-

United Arab Emirates energy storage power supply custom manufacturer

United Arab Emirates energy storage power supply custom manufacturer

-

Armenia Foreign Trade Export Energy Storage Company

Armenia Foreign Trade Export Energy Storage Company

-

Power Station Energy Storage Equipment Company

Power Station Energy Storage Equipment Company

-

Heishan Energy Storage Power Station Investment Company

Heishan Energy Storage Power Station Investment Company

Commercial & Industrial Solar Storage Market Growth

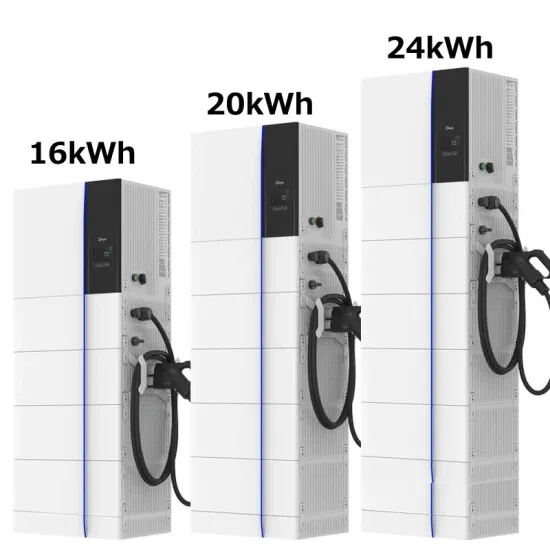

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.