Armenia

A 25-35 MW-4h BESS offers a cost-effective solution to enhance system resilience. Armenia imports 81% of its primary energy supply and 100% of its fossil and nuclear fuels. These

Get Price

How about selling energy storage batteries in foreign trade

The burgeoning demand for renewable energy sources has transformed the landscape of energy storage solutions. Consumers and businesses alike are eager to harness

Get Price

Armenia

Armenia is a small market that has faced long-term geographical and geopolitical challenges to its economy, including the closure of two of its four international borders. Yet

Get Price

Armenia Market & Department for International Trade

Armenia consistently expands its export destinations, showcasing a multi-vector approach. Neighboring countries and EAEU members receive nearly half of the Armenian exports.

Get Price

Energy industry in Armenia

Armenia has no proven crude oil and natural gas reserves, all fossil fuels need to be imported whereby natural gas represents the largest share of

Get Price

GET_ARM_PS_01_2025_EN

A 25-35 MW-4h BESS offers a cost-effective solution to enhance system resilience. Armenia imports 81% of its primary energy supply and 100% of its fossil and nuclear fuels. These

Get Price

Foreign trade figures of Armenia

Learn about the business environment of Armenia through key figures on international trade and main imports and exports of goods and services.

Get Price

Re-exporting Armenia: Why Has the Foreign Trade Landscape

The indirect consequences of the conflict have affected Armenia''s foreign trade, resulting in a drastic shift in the structure of Armenia''s foreign trade turnover.

Get Price

How is the foreign trade business of energy storage products?

The foreign trade business of energy storage products is a rapidly evolving landscape characterized by 1. increasing global demand for renewable energy storage

Get Price

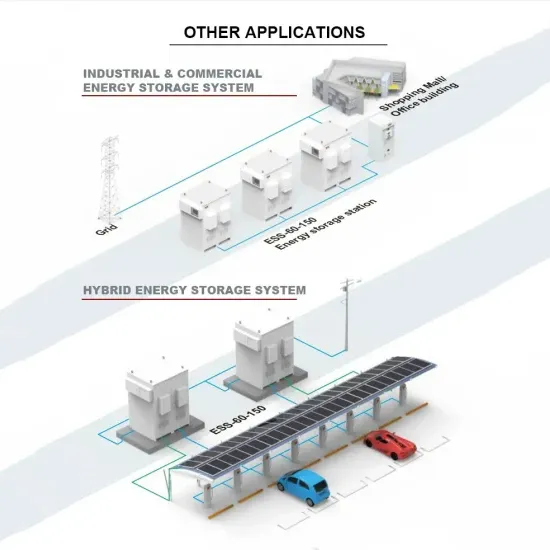

ARMENIA ENERGY STORAGE PROGRAM

Define the rights and responsibilities of the companies engaged in the activity of electricity storage as a participant of thewholesale electricity market that will enable the operation of energy

Get Price

Re-exporting Armenia: Why Has the Foreign Trade

The indirect consequences of the conflict have affected Armenia''s foreign trade, resulting in a drastic shift in the structure of Armenia''s foreign trade turnover.

Get Price

How much is the foreign trade income of energy storage products?

The foreign trade income of energy storage products is significant and continues to grow rapidly. This growth can be attributed to several factors: 1. Increasing global demand for

Get Price

Azerbaijan

Through a series of production sharing agreements (PSAs) signed in the mid-1990s, Azerbaijan succeeded in attracting significant foreign investment from major

Get Price

Armenia Exports

Exports in Armenia decreased to 738.80 USD Million in July from 780.30 USD Million in June of 2025. This page provides the latest reported value for - Armenia Exports - plus previous

Get Price

Armenia Solar Energy and Battery Storage Market (2025-2031)

Historical Data and Forecast of Armenia Solar Energy and Battery Storage Market Revenues & Volume By >500 kWh for the Period 2021-2031 Armenia Solar Energy and Battery Storage

Get Price

Re-exporting Armenia: Why Has the Foreign Trade Landscape

The company''s sole shareholder is Alexey Spirikov, a Russian citizen from Vladimir. In 2023, Neltax Holding LTD was identified in schemes involving the import of gold from Russia to

Get Price

How about energy storage foreign trade | NenPower

How about energy storage foreign trade Energy storage foreign trade refers to the international exchange of products and services related to energy storage technologies. 1.

Get Price

Armenia | Imports and Exports | World | ALL COMMODITIES | Value

Armenia''s exports 2023 by country Top export destinations of commodities from Armenia in 2023: Russia with a share of 40% (3.38 billion US$) United Arab Emirates with a

Get Price

Armenia Thermal Energy Storage Market (2024

Armenia Thermal Energy Storage Import Export Trade Statistics Market Opportunity Assessment By Product Market Opportunity Assessment By Technology Market Opportunity Assessment

Get Price

Armenia Thermal Energy Storage Market (2024

Armenia Thermal Energy Storage Market (2024-2030) | Companies, Outlook, Value, Size & Revenue, Competitive Landscape, Growth, Industry, Segmentation, Trends, Forecast, Share,

Get Price

Energy industry in Armenia

Armenia has no proven crude oil and natural gas reserves, all fossil fuels need to be imported whereby natural gas represents the largest share of Armenia''s energy imports,

Get Price

Armenia''s Energy Security and Regional Cooperation

Armenia''s energy security faces a critical crossroads: balancing regional dependencies, advancing renewables, and mitigating geopolitical risks. As 2024-2025

Get Price

DRAFT Croatia Country Strategy

With these considerations in mind, during the next country strategy period the Bank will focus on strengthening Armenia''s economic diversification by supporting companies in high-potential

Get Price

6 FAQs about [Armenia Foreign Trade Export Energy Storage Company]

Why is Armenia a heavily dependent on energy imports?

This makes Armenia a country heavily dependent on energy imports. According to the Review by the International Energy Agency, the energy mix of Armenia was dominated by natural gas (58.8% of total energy supply in 2022), and Armenia’s domestic energy production comes mostly from nuclear and hydro resources. Figure 2.

Which country imports natural gas to Armenia?

Natural gas is imported primarily from Russia through Georgia, with a limited volume of natural gas imported from Iran in an electricity-for-gas swap arrangement. Nuclear fuel is imported from Russia. Armenia’s energy consumption efficiency is low compared to developed countries.

Does Armenia have energy resources?

Armenia has limited energy resources and can meet only a fraction of the total demand for energy from domestic resources. Armenia does not have oil or natural gas reserves and is thus highly dependent on imported energy resources. It imports oil and petroleum products from Russia, Georgia, Iran, and Europe.

Does Armenia have oil and natural gas reserves?

Since Armenia has no significant fossil fuel reserves, the country's positions in crude oil and natural gas remain blank in the chart above. The strongest indicators reflected on the graph are Combination production-consumption for coal (0.76) and Combination of electricity production-consumption (0.61).

How has the energy sector changed in Armenia?

Armenia’s energy sector has moved from a state of severe crisis in the early 1990s to relative stability today. A combination of policy, legal, regulatory, and institutional reforms have had good results.

How much electricity does Armenia produce?

Armenia produces almost as much electricity from nuclear power as from hydroelectricity. According to the U.S. Energy Information Administration data, gross electricity generation was dominated by fossil fuels (43.4%), followed by hydroelectricity (22.8%), nuclear energy (30.0%), and other renewable sources (3.8%).

More related information

-

United Arab Emirates Energy Storage Power Station Foreign Trade Export Company

United Arab Emirates Energy Storage Power Station Foreign Trade Export Company

-

Turkmenistan foreign trade portable energy storage emergency power supply

Turkmenistan foreign trade portable energy storage emergency power supply

-

Somalia container photovoltaic energy storage lithium battery foreign trade

Somalia container photovoltaic energy storage lithium battery foreign trade

-

Guinea s energy storage export company

Guinea s energy storage export company

-

Energy Storage Project Foreign Trade

Energy Storage Project Foreign Trade

-

Kyrgyzstan container energy storage cabinet foreign trade

Kyrgyzstan container energy storage cabinet foreign trade

-

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

-

The application of energy storage battery foreign trade

The application of energy storage battery foreign trade

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.