How is the foreign trade of energy storage system? | NenPower

The foreign trade of energy storage systems is characterized by 1. rapid growth in demand, driven by the renewable energy sector, 2. diverse exporting countries, such as China

Get Price

How is the foreign trade business of energy storage

The foreign trade of energy storage products is not devoid of challenges, which can significantly influence market dynamics and operational

Get Price

Energy storage bracket foreign trade orders

Impact on Battery Energy Storage Projects. Tariffs and trade policies significantly influence the cost of batt ''''s push towards a net zero carbon economy. The government is investing more

Get Price

How do foreign trade companies do energy storage business?

Moreover, collaborations with research institutions or think tanks can facilitate access to cutting-edge research and developments in energy storage technologies. These

Get Price

Energy storage foreign trade yuan

How to judge the progress of energy storage industry in China? Chen Haisheng,Chairman of the China Energy Storage Alliance: When judging the progress of an industry,we must take a

Get Price

Energy technology in Bavaria – energy policy for growth

The activities are focused on four key topics: renewable energies; energy efficiency in electricity and heat generation; consumption; and energy storage

Get Price

Trends in energy storage systems in Germany

Energy storage systems are an integral part of Germany''s Energiewende("Energy Transition") project. While the demand for energy storage is growing across

Get Price

Tesla launches integrated 20MWh Megapack BESS solution

3 days ago· Tesla announced its new integrated 20MWh battery energy storage system (BESS) solution, the Tesla Megablock, on 8 September in Las Vegas, US.

Get Price

Tariffs: Analysis spells out extent of challenge

New analysis from CEA and Wood Mackenzie highlights the challenges facing the US battery storage market due to trade tariffs.

Get Price

Cairo''s Foreign Trade Energy Storage: Powering Egypt''s Green

Solar panels and battery racks quietly reshaping Egypt''s energy landscape. With Cairo foreign trade energy storage power supply initiatives gaining momentum, the city is fast becoming the

Get Price

Energy Storage Foreign Trade Products: Trends, Challenges, and

Think renewable energy developers, international traders, policymakers, or even curious investors. These folks want actionable insights—not fluff—about cross-border trade in battery

Get Price

Energy Storage Battery Foreign Trade Docking: A Gateway to

Why Energy Storage Batteries Are Redefining Global Trade Let''s face it: the world is hungry for reliable energy solutions. With countries racing to meet renewable energy targets

Get Price

How to Master Energy Storage Foreign Trade: A 2025 Guide for

Well, here''s the thing – the global energy storage market is projected to hit $50 billion by Q4 2025, with cross-border trade accounting for 63% of lithium-ion battery transactions. But why are

Get Price

How is the foreign trade business of energy storage products?

The foreign trade of energy storage products is not devoid of challenges, which can significantly influence market dynamics and operational competencies. Key hurdles

Get Price

Foreign trade energy storage product ranking

According to incomplete statistics from CNESA DataLink Global Energy Storage Database,by the end of June 2023,the cumulative installed capacity of electrical energy storage projects

Get Price

Navigating One Big Beautiful Bill and tariffs in U.S. solar PV and

The U.S. solar PV and storage sectors are entering a phase of major policy and market realignment. The One Big Beautiful Bill (OBBB), together with proposed tariffs on

Get Price

How about energy storage foreign trade batteries

The foreign trade development of energy storage batteries is marked by several crucial elements: 1.Global demand is surging, driven by the rapid expansion of renewable energy sources;

Get Price

Energy storage foreign trade company

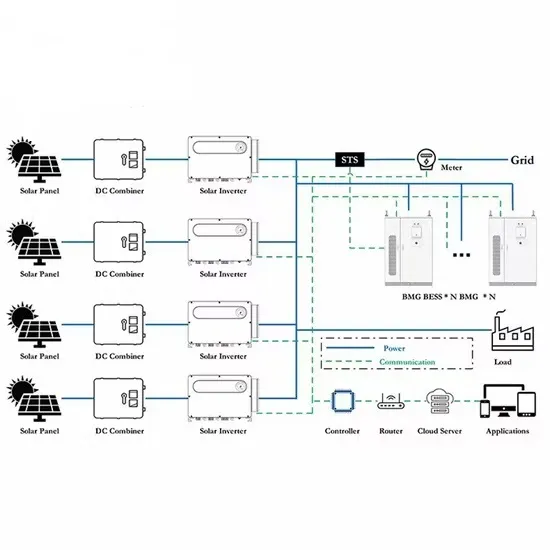

Foreign trade companies leverage energy storage solutions to optimize logistics and enhance cost-efficiency, 1. By implementing sophisticated energy management systems, 2. They

Get Price

Navigating the Foreign Trade Energy Storage Circle: Trends,

Imagine trying to sell snowboots during a heatwave – that''s what happened to some energy storage exporters when Europe''s 2022 storage frenzy suddenly cooled. The

Get Price

E.U.''s $250 Billion-A-Year U.S. Energy Buying Pledge Doesn

U.S. energy exports to the EU are already rising. But short of a trading miracle and a ditching of import diversity by the Europeans, the pledge is unlikely to be met.

Get Price

Philippines Energy Storage Market

U.S. energy storage suppliers can sell to generation companies, distribution utilities, large businesses/commercial and industrial facilities, and qualified third parties.

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply

Get Price

Energy technology in Bavaria – energy policy for growth

The activities are focused on four key topics: renewable energies; energy efficiency in electricity and heat generation; consumption; and energy storage systems and transmission and

Get Price

These are the top five energy technology trends of 2025

3 days ago· Despite US policy pivots, globally things are moving fast and there is a race between countries to establish a technology and manufacturing edge. Global energy investment in

Get Price

Navigating One Big Beautiful Bill and tariffs in U.S. solar PV and storage

The U.S. solar PV and storage sectors are entering a phase of major policy and market realignment. The One Big Beautiful Bill (OBBB), together with proposed tariffs on

Get Price

What are the energy storage foreign trade products? | NenPower

2. The energy storage market has experienced substantial growth in recent years, driven primarily by the global demand for cleaner energy solutions. Below is a comprehensive

Get Price

Addressing Tariffs and Trade in Energy Storage Projects

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply chain integrity.

Get Price

How Foreign Trade in Photovoltaic Energy Storage Is Powering

At the end of the day, foreign trade in photovoltaic energy storage isn''t just about moving products—it''s about creating an interconnected clean energy ecosystem. And with projects

Get Price

6 FAQs about [Energy Storage Project Foreign Trade]

Which international trade issues will remain a concern for energy storage projects?

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply chain integrity.

Will US tariffs affect energy storage?

There have also been indications that the US administration may consider other tariff proposals impacting energy storage, such as a 10–20% universal tariff, tariffs of up to 60% across the board on Chinese-origin goods, and tariffs of 25% on Mexican and Canadian origin goods.

How does tariff risk affect a battery energy storage system (BESS) project?

Mitigating tariff risk in battery energy storage system (BESS) projects is crucial for ensuring project financial viability, as tariff changes can significantly affect cost structures and overall project economics.

How much energy would a trading block need to be sold?

If that figure is taken as a hypothetical benchmark, an improbable 78.6% of that would need to be sold to the E.U. in order to meet the pledge. In actual fact, the trading block’s market share of U.S. energy exports last year was less than 24% or $76 billion, according to Reuters.

Are storage batteries a priority for border detentions for forced labor evaluation?

Storage batteries have been indicated as a priority for border detentions for forced labor evaluation, and we expect to continue to see those goods identified as a concern.

How does a fixed-price supply agreement protect developers from tariff increases?

Negotiating fixed-price supply agreements with suppliers and EPC contracts with contractors allows developers to shield themselves from the impact of tariff increases. In these contracts, the price of the equipment or materials is set for the duration of the agreement, protecting the developer from import costs.

More related information

-

Somalia container photovoltaic energy storage lithium battery foreign trade

Somalia container photovoltaic energy storage lithium battery foreign trade

-

New Energy Storage Foreign Trade

New Energy Storage Foreign Trade

-

United Arab Emirates Energy Storage Power Station Foreign Trade Export Company

United Arab Emirates Energy Storage Power Station Foreign Trade Export Company

-

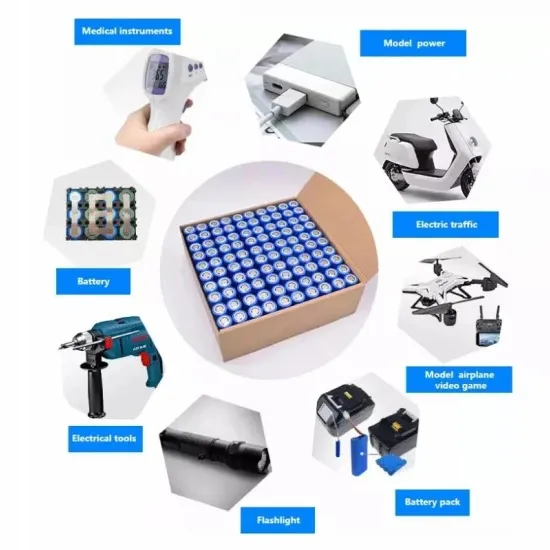

The application of energy storage battery foreign trade

The application of energy storage battery foreign trade

-

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

Timor-Leste 210 degree liquid cooling energy storage cabinet foreign trade

-

Foreign trade energy storage battery quotation

Foreign trade energy storage battery quotation

-

Turkmenistan foreign trade portable energy storage emergency power supply

Turkmenistan foreign trade portable energy storage emergency power supply

-

What is a photovoltaic independent energy storage project

What is a photovoltaic independent energy storage project

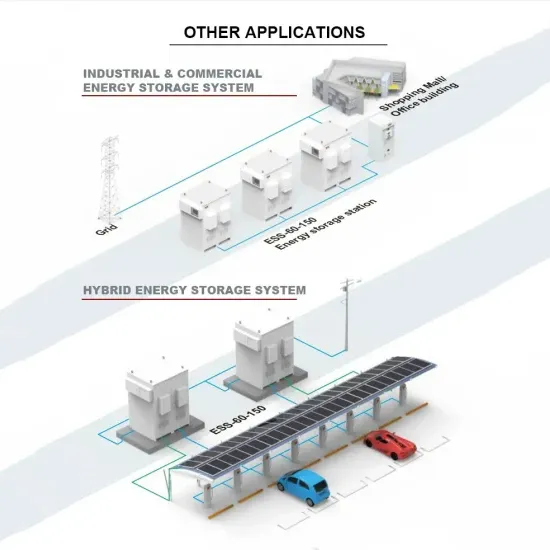

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.