RECAI 63 | EY

Our new ranking of the top global markets for BESS investment can guide strategies, and four factors can help potential investors frame their approach.

Get Price

India''s battery storage to reach 66 GW by 2032, ₹5 lakh crore

New Delhi: India''s battery energy storage system (BESS) market is projected to expand to 66 GW by 2032 from less than 0.2 GW currently, reflecting a sevenfold increase in

Get Price

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an

Get Price

Top Emerging Markets for Battery Storage Growth

In this article, we highlight the top 10 emerging markets that are set to attract significant investment in battery storage, based on their policy landscape, energy demand

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

Read on to learn about some of the top energy storage stocks on the market and why you should consider investing in them. As the world shifts towards renewable energy,

Get Price

Battery Energy Storage System Market Size

The Battery Energy Storage System (BESS) Market is expected to reach USD 76.69 billion in 2025 and grow at a CAGR of 17.56% to reach USD

Get Price

Battery Energy Storage System Market Size

Rapid cost declines in lithium-ion cells, supportive procurement mandates, and rising grid-modernization spending are turning large-scale

Get Price

Energy Storage Market Is Expected To Reach

The Battery Energy Storage (BSE) market is being led by lithium-ion batteries because of technological improvements in terms of functionality,

Get Price

India''s battery storage boom: Getting the execution right

The government can also encourage RE + BESS contracts for Corporate PPAs to expedite energy storage deployment and increase the share of renewable energy. Unlocking

Get Price

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get Price

6 Best Battery Stocks to Buy and Hold | Investing

6 Best Battery Stocks to Buy and Hold Rising energy storage demand is a catalyst for battery stocks, as is innovation in transportation.

Get Price

Private equity targets battery energy storage, driven largely by

Private equity and venture capital investments in the battery energy storage system, energy management and energy storage sector so far in 2024 have exceeded 2023''s levels and are

Get Price

The 13 Best Energy Storage Stocks To Buy For September 2025

Private equity and venture capital investments in the battery energy storage system, energy management and energy storage sector so far in 2024 have exceeded 2023''s levels and are

Get Price

US Energy Storage Market Size & Industry Trends 2030

United States Energy Storage Market Analysis by Mordor Intelligence The United States Energy Storage Market size in terms of

Get Price

Battery Energy Storage System Market Size

Rapid cost declines in lithium-ion cells, supportive procurement mandates, and rising grid-modernization spending are turning large-scale storage from a niche reliability tool into

Get Price

Top Battery Storage Companies to Watch in 2025

The battery storage sector stands at the nexus of global energy transition, presenting a compelling investment opportunity driven by an accelerating shift to renewables,

Get Price

Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get Price

Investing in the grid: PE''s battery storage strategy

As investment in energy infrastructure continues to grow, PE firms are turning to large-scale battery storage to solve the issue of storing

Get Price

Battery Energy Storage Market Set to Triple by 2030,

With increasing deployments of battery energy storage systems, several disruptive trends are emerging that are reshaping the traditional energy framework.

Get Price

U.S. Energy Storage Industry Commits $100 Billion

WASHINGTON, D.C., April 29, 2025 – Today the American Clean Power Association (ACP), on behalf of the U.S. energy storage industry, announced

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid-scale storage and other

Get Price

Navigating energy storage financing amidst rising interest rates

Battery energy storage projects face distinct technical challenges that complicate their development and financing. A key concern is the degradation of battery systems over time.

Get Price

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid

Get Price

RECAI 63 | EY

Our new ranking of the top global markets for BESS investment can guide strategies, and four factors can help potential investors frame their approach. The US, China Mainland and

Get Price

Investment trends in grid-scale battery storage

Recent trends in Early-Stage Funding for Battery Storage Companies The IEA, in its World Energy Investment 2021 report claimed that although clean energy startups

Get Price

Lithium-ion battery demand forecast for 2030 | McKinsey

Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be comparable to the GWh needed for

Get Price

10 Best Electric Battery Stocks in India 2025

Discover the 10 best electric battery stocks in India 2025. Explore EV leaders, growth drivers, risks, and future opportunities in India''s energy revolution.

Get Price

Global Energy Storage Market Records Biggest Jump

The global energy storage market almost tripled in 2023, the largest year-on-year gain on record, and that growth is expected to continue.

Get Price

UBS is bullish on LG Energy Solution on U.S. battery storage growth

1 day ago· Investing -- UBS upgraded LG Energy Solution to Buy, saying U.S. policy support and trade barriers will hand Korean battery makers a dominant share of the fast-growing

Get Price

More related information

-

Laos energy storage battery market price

Laos energy storage battery market price

-

Danish energy storage battery investment

Danish energy storage battery investment

-

Photovoltaic energy storage battery market

Photovoltaic energy storage battery market

-

Energy storage battery investment projects under construction

Energy storage battery investment projects under construction

-

Investment prospects of battery energy storage companies

Investment prospects of battery energy storage companies

-

Market energy storage battery price trend

Market energy storage battery price trend

-

Energy storage battery production investment

Energy storage battery production investment

-

Vanuatu Energy Storage Battery Investment Project

Vanuatu Energy Storage Battery Investment Project

Commercial & Industrial Solar Storage Market Growth

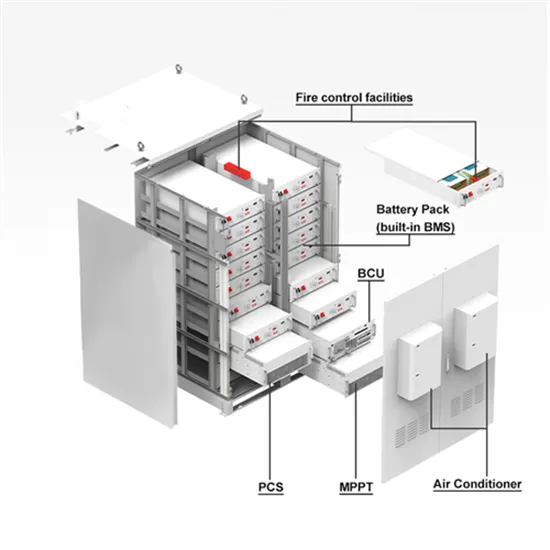

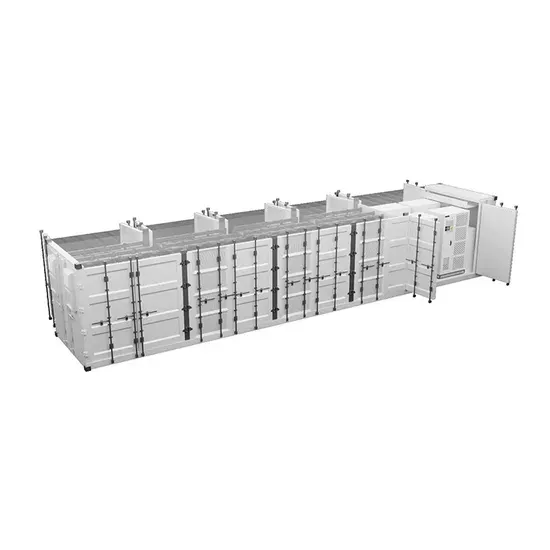

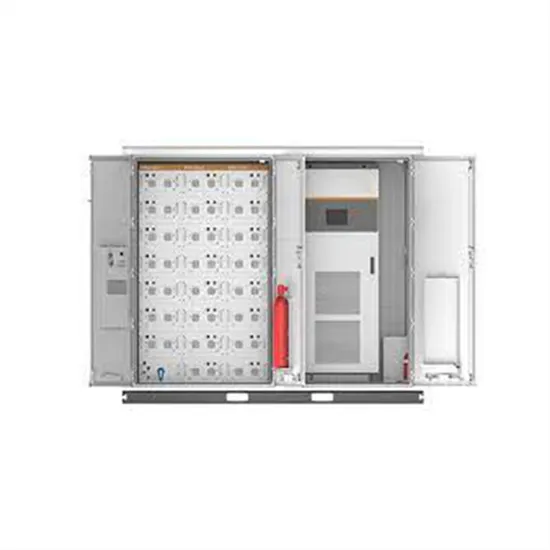

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

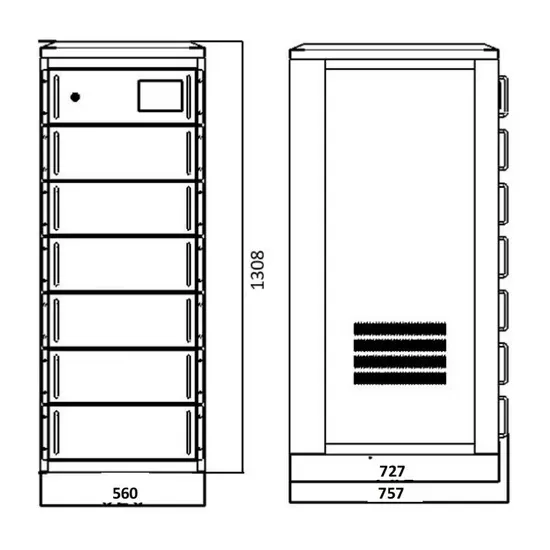

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.