Energetik Energija d.o.o.

Energetik.si – Your trusted partner for hybrid and grid inverters, solar batteries, and photovoltaic systems. Register on our B2B platform for access to prices

Get Price

Slovenian Solar Photovoltaic (PV) Power Market with Stellar

The country scored its best year in 2022 regarding the YoY growth in new solar PV capacity additions. The residential solar market accounted for almost all of the new capacity

Get Price

Slovenia – pv magazine International

Slovenia''s solar market slowed in 2024, but the residential segment maintained the largest share as it adjusted to the phase-out of net

Get Price

Slovenian Solar Photovoltaic (PV) Power Market with Stellar

By the end of 2009, the Slovenian photovoltaic market was underdeveloped, with only 9.5MW of cumulative installed capacity. The favourable renewable energy law with a very attractive feed

Get Price

Slovenia adds 298.8 MW of solar in 2024

Slovenia''s solar market slowed in 2024, but the residential segment maintained the largest share as it adjusted to the phase-out of net metering and a new electricity tariff system.

Get Price

Slovenia Solar PV Panels Market (2024-2030) | Trends, Industry

Market Forecast By Technology (Thin Film, Crystalline Silicon, Others), By Grid Type (On Grid, Off Grid), By Application (Residential, Commercial, Industrial) And Competitive Landscape

Get Price

TOP SOLAR PANEL WHOLESALERS SUPPLIERS IN SLOVENIA

Who is building solar panels on Slovenia''s biggest motorway? Soške Elektrarne Nova Gorica is working with Slovenia highway operator Dars to build several PV arrays along Slovenia''s

Get Price

Africa Market Outlook for Solar PV 2025-2028

The Africa Market Outlook for Solar PV 2025-2028 provides an in-depth analysis of the region''s solar growth, investment landscape, and policy frameworks. The report examines key markets,

Get Price

Pv in energy Slovenia

What is Slovenia''s new solar energy plan? The plan envisages opening the Slovenian energy market to large-scale solar plantsand is intended to reduce the country''s dependence on fossil

Get Price

Slovenia Solar Panel Manufacturing | Market Insights Report

Explore Slovenia solar panel manufacturing with market analysis, production statistics, and insights on capacity, costs, and industry growth trends.

Get Price

Slovenia installs 298.8 MW of solar capacity in 2024 amid market

The 2024 installation marked a significant decrease compared to the 486 MW added in 2023, bringing Slovenia''s cumulative solar capacity to 1.4 GW. The residential

Get Price

Pv in energy Slovenia

''''Solar Photovoltaic (PV) in Slovenia, Market Outlook to 2030, Update 2016 - Capacity, Generation, Levelized Cost of Energy (LCOE), Investment Trends, Regulations and Company

Get Price

Top Solar Panel Distributors Suppliers in Slovenia

Solar Market Outlook in Slovenia There is a solar power boom in Slovenia and it mirrors the rapid growth of the renewable energy sector in most parts of Europe. In 2019, there were 2,496

Get Price

Slovenia Residential Solar PV Panels Market (2025-2031)

Historical Data and Forecast of Slovenia Residential Solar PV Panels Market Revenues & Volume By Rooftop Installation for the Period 2021-2031 Slovenia Residential Solar PV Panels Import

Get Price

Slovenia installs 298.8 MW of solar capacity in 2024 amid market

In October 2024, Slovenia introduced a new tariff system that replaced peak and off-peak pricing with network fees that vary by time of day and season. This new system aims

Get Price

Slovenia – pv magazine International

Slovenia''s solar market slowed in 2024, but the residential segment maintained the largest share as it adjusted to the phase-out of net metering and a new electricity tariff system.

Get Price

European solar market 2024-2025: balancing growth,

The EU solar PV market in 2024-2025 stands at a pivotal moment, influenced by policy-driven growth, persistent pricing pressures, and shifting

Get Price

Slovenia Solar Panel Manufacturing | Market Insights

Explore Slovenia solar panel manufacturing with market analysis, production statistics, and insights on capacity, costs, and industry growth trends.

Get Price

Slovenia Solar PV Construction Trends Benefits Future Outlook

Solar photovoltaic panel construction in Slovenia is reshaping the nation''s renewable energy landscape. This article explores current projects, government incentives, and how companies

Get Price

Slovenia solar energy: Impressive 85 MW Growth in 2025

Slovenia''s solar market is experiencing significant growth, with 85 MW of new capacity installed in the first half of 2025, according to PV Magazine. This expansion is driven

Get Price

1Q 2024 Global PV Market Outlook

The photovoltaic industry added about 444 gigawatts of new capacity in 2023, a 76% growth on 2022 build. Prices of solar modules are at record lows, and supply of

Get Price

Solar Energy Market Size, Forecast, Share & Report

Solar Energy Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Solar Energy Market Report is Segmented by

Get Price

Slovenia Solar Photovoltaic Panel Market (2025-2031) | Industry

Market Forecast By Type (Monocrystalline, Polycrystalline, Thin Film, Others), By Technology (PERC, Bifacial, Thin Film Solar, Others), By End Use (Residential, Commercial, Industrial,

Get Price

Solar panel farms Slovenia

The plan envisages opening the Slovenian energy market to large-scale solar plantsand is intended to reduce the country''s dependence on fossil fuels. The Slovenian solar manufacturer

Get Price

Slovenia adds 298.8 MW of solar in 2024

Slovenia''s solar market slowed in 2024, but the residential segment maintained the largest share as it adjusted to the phase-out of net

Get Price

6 FAQs about [Slovenia s new solar photovoltaic panel trading market]

Does Slovenia have a solar market?

Slovenia’s solar market is experiencing significant growth, with 85 MW of new capacity installed in the first half of 2025, according to PV Magazine. This expansion is driven by the increasing adoption of both residential and commercial and industrial (C&I) solar projects.

When will solar subsidy applications open in Slovenia?

Applications for the subsidy will open Mar. 18, 2025. Slovenia’s solar market slowed in 2024, but the residential segment maintained the largest share as it adjusted to the phase-out of net metering and a new electricity tariff system.

Why are solar projects growing in Slovenia?

This expansion is driven by the increasing adoption of both residential and commercial and industrial (C&I) solar projects. The cumulative capacity of solar installations in Slovenia now stands at 1.2 GW, according to data from the Energy Agency of Slovenia.

How much solar power does Slovenia have?

This total includes 191.5 MW from residential systems, 100.8 MW from commercial and industrial projects, and 6.5 MW from municipal installations. The 2024 installation marked a significant decrease compared to the 486 MW added in 2023, bringing Slovenia’s cumulative solar capacity to 1.4 GW.

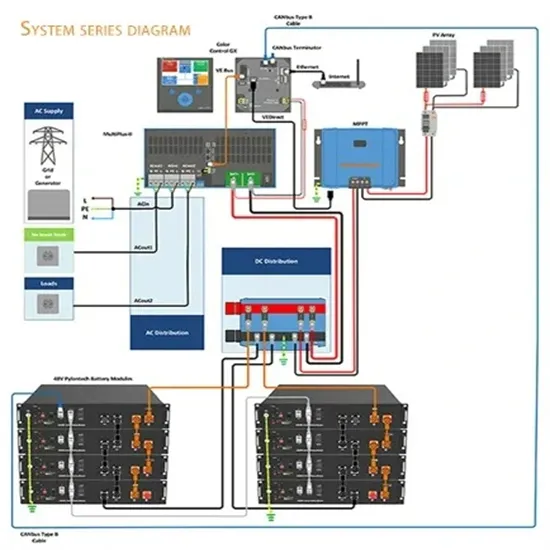

What does Slovenia's new tariff system mean for solar?

In October 2024, Slovenia introduced a new tariff system that replaced peak and off-peak pricing with network fees that vary by time of day and season. This new system aims to encourage active consumption and is expected to boost investments in hybrid solar solutions.

How much money does Slovenia need to build a solar project?

The researchers noted the importance of realistic construction methods, including factors such as anchors, adhesives, membrane welding, and ballast use. Slovenia has set aside €16 million ($16.7 million) to support solar energy communities, requiring projects to include at least 100 kW of PV capacity, with or without storage.

More related information

-

250w new solar photovoltaic panel price

250w new solar photovoltaic panel price

-

New solar photovoltaic panel installation in Sudan

New solar photovoltaic panel installation in Sudan

-

New solar photovoltaic panel products

New solar photovoltaic panel products

-

New solar photovoltaic panel factory in West Africa

New solar photovoltaic panel factory in West Africa

-

New Zealand local solar photovoltaic panel manufacturers

New Zealand local solar photovoltaic panel manufacturers

-

Solar photovoltaic panel 450w

Solar photovoltaic panel 450w

-

Bolivia s new photovoltaic solar panels

Bolivia s new photovoltaic solar panels

-

48v photovoltaic solar panel production solar integrated machine

48v photovoltaic solar panel production solar integrated machine

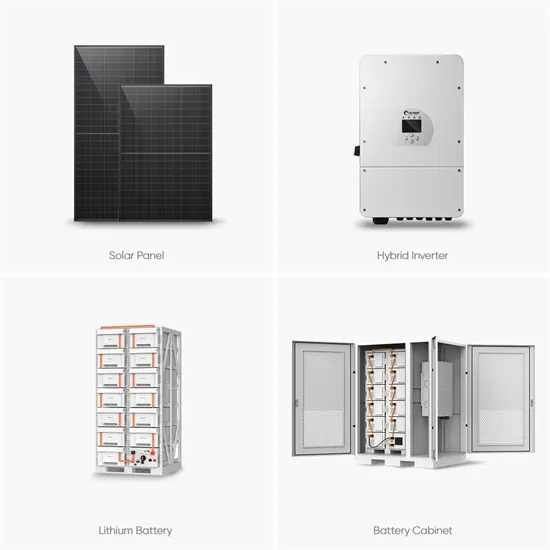

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.