Analysis and Comparison for The Profit Model of Energy Storage Power

Download Citation | On Nov 5, 2020, Xuyang Zhang and others published Analysis and Comparison for The Profit Model of Energy Storage Power Station | Find, read and cite all the

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get Price

Study on profit model and operation strategy optimization of energy

With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency modulation and

Get Price

Czech Republic Energy Storage Market (2025-2031) | Industry

How does 6Wresearch market report help businesses in making strategic decisions? 6Wresearch actively monitors the Czech Republic Energy Storage Market and publishes its comprehensive

Get Price

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

Czech Energy Storage Station Profit Model Picture

In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three aspects of

Get Price

Photovoltaic Power Group Czech Energy Storage

The integrated energy storage unit can not only adjust the solar power flow to fit the building demand and enhance the energy autonomy, but also regulate the frequency of utility grid for

Get Price

Czech Power Energy Storage Bidding Information Network

Strategic bidding of an energy storage agent in a joint energy This work presents a bi-level optimization model for a price-maker energy storage agent, to determine the optimal hourly

Get Price

Exploration of Shared Energy Storage Business Model

Using Hunan Province shared energy storage power plant economic analysis was done, and recommendations for the future advancement of shared energy storage were

Get Price

Analysis and Comparison for The Profit Model of Energy Storage Power

The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the deepening of

Get Price

How is the investment profit of energy storage power station?

1. The investment profit of energy storage power stations is determined by several factors including initial costs, operational efficiency, market demand, and regulatory

Get Price

Czech Base Station Energy Storage Company

An energy storage allocation method for renewable energy stations It can be seen from Fig. 2 that the trend of the standardized supply curve is consistent with that of the system load curve.

Get Price

How is the profit of Hunan energy storage power station?

The profit of Hunan energy storage power station can be analyzed through several key aspects: 1. Revenue generation from energy sales, 2. Operational cost efficiencies, 3.

Get Price

Czech Independent Energy Storage Capacity Compensation

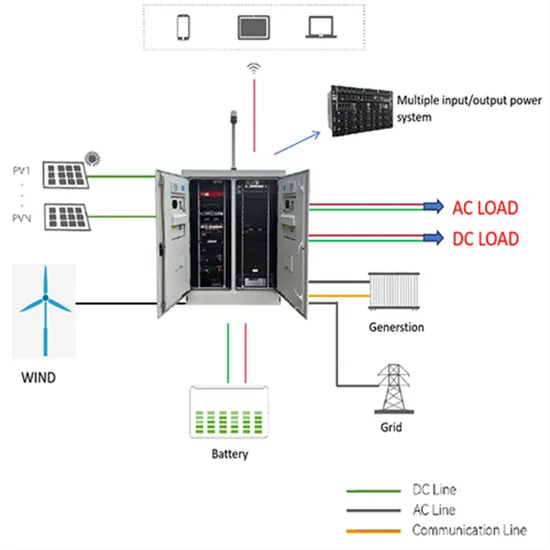

Optimization configuration of energy storage capacity based Fig. 1 shows the main components of microgrid power station (MPS) structure including energy generation sources,

Get Price

EU approves €279m state aid for BESS rollout in Czech Republic

This event will bring together key stakeholders from across the region to explore the latest trends in energy storage, with a focus on the increasing integration of energy storage

Get Price

EU approves €279m state aid for BESS rollout in

This event will bring together key stakeholders from across the region to explore the latest trends in energy storage, with a focus on the

Get Price

Czech Republic Smart Grid Storage: Powering the Energy

As the Czech Republic smart grid storage sector grows, the nation faces a critical question: How can a country with 18% renewable energy penetration (2023 data) achieve its 2030 target of

Get Price

Hierarchical game optimization of independent shared energy storage

However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

Get Price

Czech Republic energy storage market report | Wood Mackenzie

The Czech Republic energy storage market report analyzes the drivers, barriers, and policy frameworks shaping storage adoption across residential, C&I, and grid-scale

Get Price

Czech Republic

Due to EU regulations, the share of coal energy will decrease but be largely replaced by both one (and possibly more) large nuclear reactors. The deployment of a series

Get Price

How much profit does an energy storage power station have?

An energy storage power station typically generates profit through various avenues, which can vary widely based on market conditions, location, and size.2. These avenues

Get Price

Energy Storage in the Booming Czech Market

How can Czech organisations make the most of their renewable generation assets? Here''s a review of energy storage in the Czech market.

Get Price

How is the profit model of energy storage power station

The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Get Price

6 FAQs about [Czech energy storage power station profit model]

Will a battery storage system help Czech companies achieve net zero?

The high penetration of renewable generation projects in the region could deliver a large amount of clean energy and really accelerate the journey to net zero, but at the moment Czech companies are not in a position to reap the full benefits of solar and other renewable energy sources. To do so, battery storage will be essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why are Czech businesses investing in renewable projects without subsidies?

The subsidy increases to cover up to 75% of costs for community projects. But what we noticed at Wattstor is that Czech businesses are investing in renewable projects even in the absence of subsidies, because they have realised the strong business case for generating clean energy on site.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

More related information

-

Sri Lanka energy storage power station profit model

Sri Lanka energy storage power station profit model

-

Icelandic energy storage power station profit model

Icelandic energy storage power station profit model

-

Profit model of UK energy storage power station

Profit model of UK energy storage power station

-

Profit model of mobile energy storage power station

Profit model of mobile energy storage power station

-

Origin model of energy storage power station

Origin model of energy storage power station

-

Business model of industrial and commercial energy storage power station

Business model of industrial and commercial energy storage power station

-

Energy Storage Power Station Revenue Model

Energy Storage Power Station Revenue Model

-

Czech centralized energy storage power station

Czech centralized energy storage power station

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.