Innovation and Pricing Pressures Drive 5G Base

Innovation continues for 5G and the next generation of wireless networks, but price pressure from the MNOs is becoming more challenging for

Get Price

Innovation and Pricing Pressures Drive 5G Base Station Power

Innovation continues for 5G and the next generation of wireless networks, but price pressure from the MNOs is becoming more challenging for OEMs and chip makers.

Get Price

Temporal and Spatial Optimization for 5G Base Station

For one thing, the power con‐sumption of the 5G BS will increase the peak load of the DN, which affects the safety and stability of the power sys‐tem [6]; for another, the dispersive

Get Price

Coordination of Macro Base Stations for 5G Networkwith

To solve this problem, a two-step energy management method that coordinates 5G macro BSs for 5G networks with user clustering is proposed.

Get Price

Base Station Microgrid Energy Management in 5G Networks

The 5G BSs powered by microgrids with energy storage and renewable generation can significantly reduce the carbon emissions and operational costs. The base

Get Price

Multi‐objective interval planning for 5G base station virtual

As an emerging load, 5G base stations belong to typical distributed resources [7]. The in‐depth development of flexi-bility resources for 5G base stations, including their internal energy

Get Price

Economic research on 5G base station peak regulation

Finally, this paper analyzes the economy of 5G communication base station energy storage taking part in power grid peak regulation, providing valuable reference for the

Get Price

Energy consumption optimization of 5G base stations considering

The explosive growth of mobile data traffic has resulted in a significant increase in the energy consumption of 5G base stations (BSs). However, the e

Get Price

Efficient virtual power plant management strategy and Leontief

Abstract Amidst high penetration of renewable energy, virtual power plant (VPP) technology emerges as a viable solution to bolster power system controllability. This paper

Get Price

Massive 5G electricity costs are in focus ahead of the global build

These 5G base stations will also support 2/3/4G as well, in as many as seven different bands from 700MHz up to 3.5GHz. These "all the G''s" base stations average 10kW,

Get Price

Two-Stage Robust Optimization of 5G Base Stations Considering

Aimed at 5G base stations with renewable energy sources, the TSRO model proposed in this paper can effectively addresses the uncertainties of renewable energy and

Get Price

What is 5G base station architecture?

Before you can think about 5G network components, you need to consider the base station. To get started, find out what you need to know about the architecture.

Get Price

Case Study: China Tower & Huawei

Case Study: China Tower & Huawei Intelligent Peak Staggering Maximizes Site Battery Value, Reducing Electricity Cost by 17.1% As the deployment of 5G

Get Price

An optimal dispatch strategy for 5G base stations equipped with

Since 5G BS and BSC are electricity users, under the Time-of-Use (TOU) tariff mechanism, they can save on electricity costs by charging during off-peak pricing periods to

Get Price

Cooperative game-based solution for power system dynamic

The uncertainty of renewable energy necessitates reliable demand response (DR) resources for power system auxiliary regulation. Meanwhile, the widespread deployment of

Get Price

(PDF) The business model of 5G base station energy

5G base station energy storage participates in demand response business model. The number of battery cycles under different DOD.

Get Price

Aggregation and scheduling of massive 5G base station backup

This paper proposes a price-guided orientable inner approximation (OIA) method to solve the frequency-constrained unit commitment (FC-UC) with massive 5G base station

Get Price

Base Stations

This report provides an in-depth analysis of the market for base stations in Micronesia. Within it, you will discover the latest data on market trends and opportunities by country, consumption,

Get Price

What is the Power Consumption of a 5G Base Station?

These 5G base stations consume about three times the power of the 4G stations. The main reason for this spike in power consumption is the addition of massive MIMO and

Get Price

5G Base Station Power Supply Market

With 5G base stations consuming up to 3–4 times more power than 4G systems due to higher frequency bands and denser network architectures, operators face surging electricity

Get Price

Two-Stage Robust Optimization of 5G Base Stations

Aimed at 5G base stations with renewable energy sources, the TSRO model proposed in this paper can effectively addresses the

Get Price

Economic research on 5G base station peak regulation

As 4G enters the 5G era, 5G communication technology is growing quickly, and the amount of 5G communication base stations is also growing rapidly. However, the high

Get Price

What is the Power Consumption of a 5G Base Station?

Compared to its predecessor, 4G, the energy demand from 5G base stations has massively grown owing to new technical requirements needed to support higher data rates

Get Price

Murata-Base-station-app-guide

Moving up the mast In the era of 4G, network installations typically relied upon heavy duty infrastructure such as large power masts and passive cables and antennas, with much of the

Get Price

5G Base Stations: The Energy Consumption Challenge

Although the energy consumption of 5G base stations is higher than any previous generations, technology and strategy innovations mentioned above would help MNOs stabilize or even

Get Price

Optimal capacity planning and operation of shared energy

A bi-level optimization problem is formulated to minimize the capacity planning and operation cost of shared energy storage system and the operation cost of large-scale 5G base

Get Price

6 FAQs about [Micronesia 5G base station peak electricity price]

Which countries are leading the 5G base station market?

Globally, 5G is being deployed at two different paces, with China supporting half of the base transceiver station (BTS) market while the rest of Asia, Europe, the U.S. and late 5G entrant India dominate the balance of the market. Figure 1 shows our latest base station forecast by region. Figure 1 Macro/Micro regional BTS forecast.

Is 4G a 5G era?

As 4G enters the 5G era, 5G communication technology is growing quickly, and the amount of 5G communication base stations is also growing rapidly. However, the

What percentage of MNOs invest in 5G?

Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023. We estimate that 5G comprises more than 70 percent of the investment from the MNOs. MNOs are expected to continue investing massively in 5G in the upcoming years and this will continue to expand the 5G footprint.

How does 5G improve network capacity?

5G is bringing massive network capacity improvements by using new spectrum in the sub-6 GHz frequency band while reusing legacy 4G bands. 5G architectures leverage traditional remote radio heads (RRHs) and active antenna systems (AAS). The use of massive MIMO (mMIMO) is a crucial technology to improve AAS spectral efficiency and throughput.

What is 5G & how does it work?

MARKET DRIVERS COME OUT OF MNO REQUIREMENTS 5G is bringing massive network capacity improvements by using new spectrum in the sub-6 GHz frequency band while reusing legacy 4G bands. 5G architectures leverage traditional remote radio heads (RRHs) and active antenna systems (AAS).

Who are the major 5G suppliers in India?

India is a new and important market for 5G and the country has chosen to turn toward the Western supply chain, with Nokia and Ericsson as the main suppliers. The growth in the RAN market is mainly supported by the five big established players: Huawei, Ericsson, Nokia, ZTE and Samsung.

More related information

-

Paraguay 5G base station electricity price subsidies

Paraguay 5G base station electricity price subsidies

-

Afghanistan 5G base station electricity price subsidies

Afghanistan 5G base station electricity price subsidies

-

Cape Verde 5G base station electricity fee standards

Cape Verde 5G base station electricity fee standards

-

Israel 5G base station electricity subsidies

Israel 5G base station electricity subsidies

-

5g base station electricity fee transaction

5g base station electricity fee transaction

-

Turn off 5G base station electricity charges

Turn off 5G base station electricity charges

-

5G base station electricity costs as a percentage of costs

5G base station electricity costs as a percentage of costs

-

Germany 5G base station electricity subsidy

Germany 5G base station electricity subsidy

Commercial & Industrial Solar Storage Market Growth

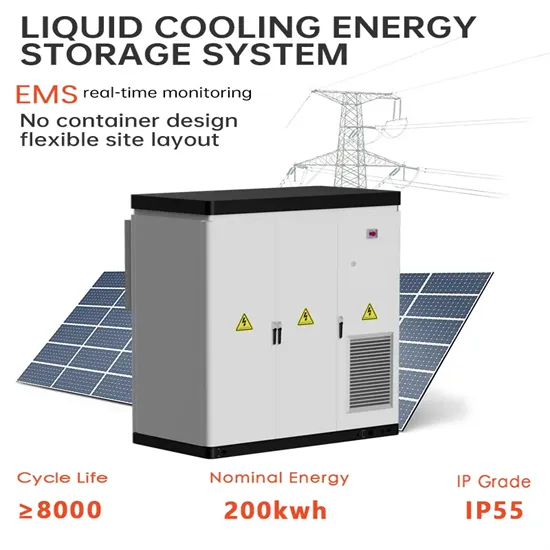

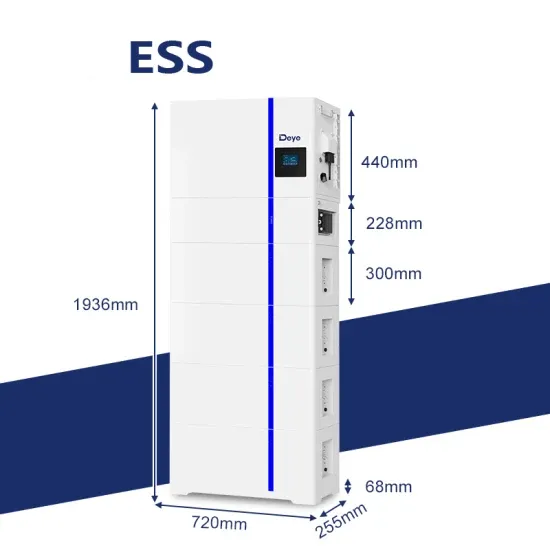

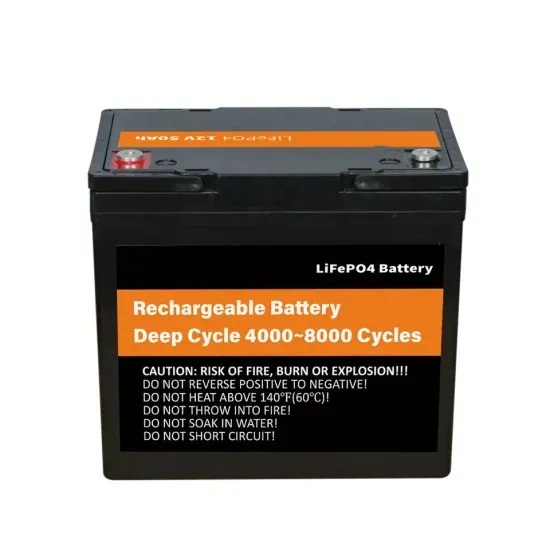

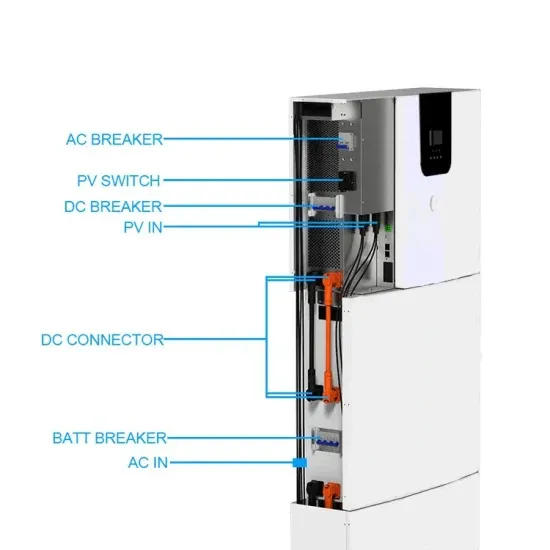

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.