Top 10 Battery Manufacturers In Bolivia

In this article, we''ll explore the top 10 battery manufacturers in Bolivia and their contributions to strengthening the battery supply chain at both

Get Price

Lithium battery factories inaugurated in Los Angeles

Start-up Romeo Power has opened a lithium battery pack factory in Los Angeles, aimed at the EV and stationary energy storage markets,

Get Price

Lithium Battery Manufacturer | Lithium Batteries

Lithium Werks is a subsidiary of Reliance and is a fast-growing global lithium-ion battery company with production facilities in China and offices in the USA and

Get Price

Bolivia''s first lithium battery factory begins operations

The first lithium battery factory began operations in Bolivia and will soon start sales in Paraguay and Peru.

Get Price

American Lithium Battery Manufacturing | Custom

Advanced lithium-ion battery solutions for defense, medical, marine, and industrial applications, manufactured in our Tampa, FL facility.

Get Price

Bolivia taps Chinese battery giant CATL to help develop lithium

The partnership would give CBC, which also includes mining giant CMOC, rights to develop two lithium plants, which could each produce annually up to 25,000 tonnes of battery

Get Price

Top 10 Battery Manufacturers In Bolivia

In this article, we''ll explore the top 10 battery manufacturers in Bolivia and their contributions to strengthening the battery supply chain at both the local and global levels.

Get Price

Inside A Gigafactory: What Goes On in Battery

Inside A Gigafactory: What Goes On in Battery Production Powerhouses Here''s how lithium-ion battery gigafactories work and why these operations are more

Get Price

Quantum Motors Opens Lithium Battery Factory in Bolivia

The complex is located in the city of Cochabamba, in central Bolivia. The 5,000 square meter factory assembles two models of electric vehicles, E2 and E3, equipped with lead-acid

Get Price

Bolivia''s first lithium battery factory

Quantum Motors established the first electric car factory in Bolivia in 2019. Early last July, its CEO, José Carlos Márquez, inaugurated the country''s first lithium battery plant. A

Get Price

LIB About Us | LIB INDIA

Lib India lithium ion battery manufacturing setup in Supa near Pune, Under Make in India initiative we have built India's first GIGA Factory. Establish a complete Indian Value

Get Price

CATL''s $1.4 Billion Investment: A New Chapter For The Bolivian Lithium

In a significant move towards the development of Bolivia''s largely untapped lithium reserves, Chinese battery giant CATL has confirmed a $1.4 billion investment. The deal, which

Get Price

Lithium-ion Battery Pack Manufacturing Process

This guide discussed the lithium battery pack anufacturing process, battery pack design, and the impact of technological advancements.

Get Price

Bolivia announces $1 bn deal with China to build lithium plants

La Paz (AFP) – Bolivia said Tuesday it had signed a $1 billion deal with China''s CBC, a subsidiary of the world''s largest lithium battery producer CATL, to build two lithium

Get Price

Lithium Nearing Production

In mid-September, Uranium One Group (part of Rosatom) and the Bolivian state-run company Yacimientos de Litio Bolivianos (YLB, ''Bolivian

Get Price

Bolivia shortlists four companies to develop lithium pilot plants

In late 2023, Bolivia opened its first industrial-scale lithium plant. The $100 million facility is expected to produce as much as 15,000 tons of lithium carbonate a year. Initial output...

Get Price

Quantum Motors Opens Lithium Battery Factory in

Quantum Motors Opens Lithium Battery Factory in Bolivia During the global race for vehicle electrification and energy transition, natural resources play a

Get Price

Battery Manufacturer CATL''s $1.4 Billion Lithium Investment In Bolivia

Bolivia, famous for its salt flats, received its first large lithium production investment as a result of years of work. Chinese battery giant CATL announced that it will build lithium

Get Price

Battery Manufacturer CATL''s $1.4 Billion Lithium Investment In

Bolivia, famous for its salt flats, received its first large lithium production investment as a result of years of work. Chinese battery giant CATL announced that it will build lithium

Get Price

CATL is planning two lithium plants in Bolivia

The Chinese battery giant CATL plans to invest €1.27 billion to develop Bolivia''s large but largely untapped lithium deposits. And CATL has the backing of the Bolivian

Get Price

Energy Equipment Near Bolivia

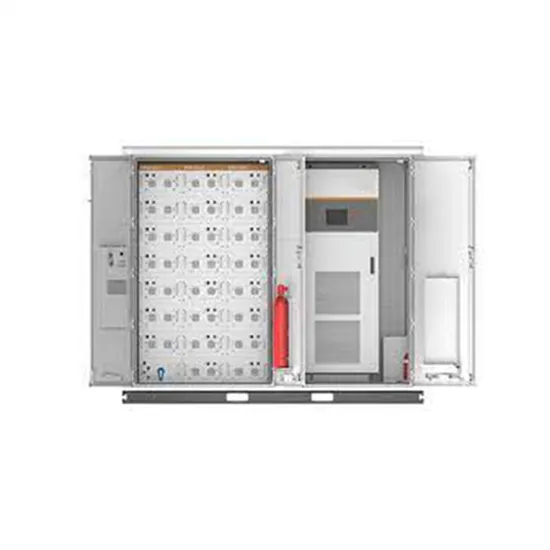

Lithium battery module is composed of a certain number of single cells in series and parallel. Battery Pack is formed by adding BMS, output and input terminals, battery pack case and

Get Price

Bolivia shortlists four companies to develop lithium

In late 2023, Bolivia opened its first industrial-scale lithium plant. The $100 million facility is expected to produce as much as 15,000 tons of

Get Price

CATL''s $1.4 Billion Investment: A New Chapter For The Bolivian

In a significant move towards the development of Bolivia''s largely untapped lithium reserves, Chinese battery giant CATL has confirmed a $1.4 billion investment. The deal, which

Get Price

Battery Equipment Near Bolivia

PACK consists of battery module, bus bar, soft connection, protective plate, outer case, output, highland barley paper, plastic support and other auxiliary materials most cases, Pack is a

Get Price

CATL is planning two lithium plants in Bolivia

The Chinese battery giant CATL plans to invest €1.27 billion to develop Bolivia''s large but largely untapped lithium deposits. And CATL has

Get Price

Quantum Motors Opens Lithium Battery Factory in

The complex is located in the city of Cochabamba, in central Bolivia. The 5,000 square meter factory assembles two models of electric vehicles, E2 and E3,

Get Price

6 FAQs about [Bolivia pack lithium battery factory]

Will CATL build a lithium plant in Bolivia?

The Chinese battery giant CATL plans to invest €1.27 billion to develop Bolivia’s large but largely untapped lithium deposits. And CATL has the backing of the Bolivian government to build two plants to extract lithium from brine.

Will Bolivia build a lithium battery plant in China?

La Paz (AFP) – Bolivia said Tuesday it had signed a $1 billion deal with China's CBC, a subsidiary of the world's largest lithium battery producer CATL, to build two lithium carbonate production plants in the country's southwest.

What's going on with Bolivia's largely untapped lithium reserves?

Sources In a significant move towards the development of Bolivia's largely untapped lithium reserves, Chinese battery giant CATL has confirmed a $1.4 billion investment. The deal, which was cemented on Sunday, is a continuation of a partnership with the Bolivian government that was established in January.

Will Bolivia build a lithium plant in the salt flats?

The agreement focuses on Bolivia’s salt flats, known for their vast lithium resources. Bolivian President Luis Arce confirmed the plan to build two lithium plants in the country’s Uyuni and Oruro salt flats after meeting with CATL executives. He announced a $1.4 billion investment and hinted at possible future investments up to 2028.

Where will Bolivian lithium be processed?

At present, it is unknown in which CATL plants the Bolivian lithium will be processed – for example, in China or North America. In October 2019, Bolivia’s government stopped a joint venture for lithium extraction with the German company ACI Systems Alemania (ACISA) by decree.

Does Bolivia have a lithium industry?

The development of Bolivia’s lithium industry holds promise but faces challenges. The extraction and production of lithium have proven complex, leading to less lucrative outcomes for local communities. The Bolivian government seeks to build partnerships with foreign companies to develop technology and boost lithium production.

More related information

-

Bolivia pack battery factory

Bolivia pack battery factory

-

Huawei Slovakia pack lithium battery factory

Huawei Slovakia pack lithium battery factory

-

Pack lithium battery factory cost

Pack lithium battery factory cost

-

Dominican lithium battery pack processing factory

Dominican lithium battery pack processing factory

-

Qatar good lithium battery pack factory price

Qatar good lithium battery pack factory price

-

San Marino 32650 lithium battery pack factory

San Marino 32650 lithium battery pack factory

-

Lithium battery assembly double pack

Lithium battery assembly double pack

-

Can I use a 48v lithium battery pack if one is missing

Can I use a 48v lithium battery pack if one is missing

Commercial & Industrial Solar Storage Market Growth

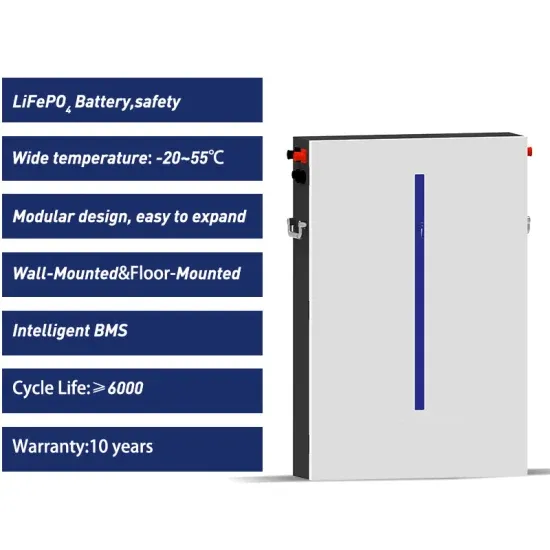

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.