Zimbabwe has the lithium

American and European sanctions have impacted Zimbabwe''s development trajectory, but its lithium resources are proving to be a vital source of income,

Get Price

Africa''s largest lithium producer to ban concentrate

Zimbabwe, Africa''s largest producer of lithium, a key mineral used in batteries for electric vehicles and renewable energy storage, has emerged

Get Price

Zimbabwe''s lithium is in demand for making batteries:

Between now and 2027, lithium mining companies in Zimbabwe will try to extract as much lithium as possible before the ban comes into effect.

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

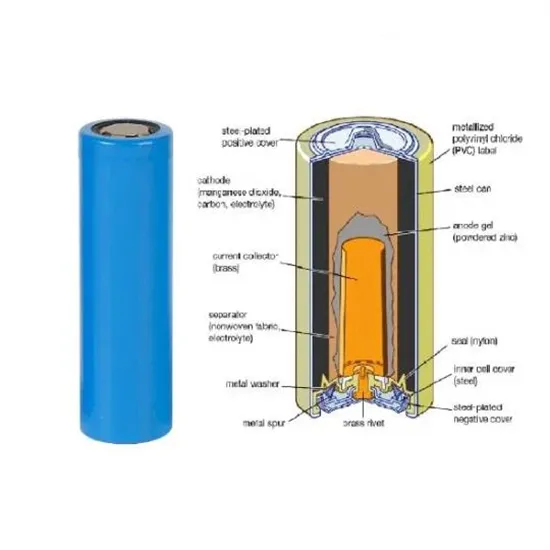

Zimbabwe has the largest lithium reserves on the African continent. Lithium has been mined since the colonial period in the 1950s. It''s a critical part of rechargeable lithium-ion

Get Price

Unlocking value: Zimbabwe''s path to becoming a lithium battery

Ensuring the safety and reliability of batteries requires rigorous testing and quality assurance processes. Continuous innovation is needed to improve battery performance, safety, and cost

Get Price

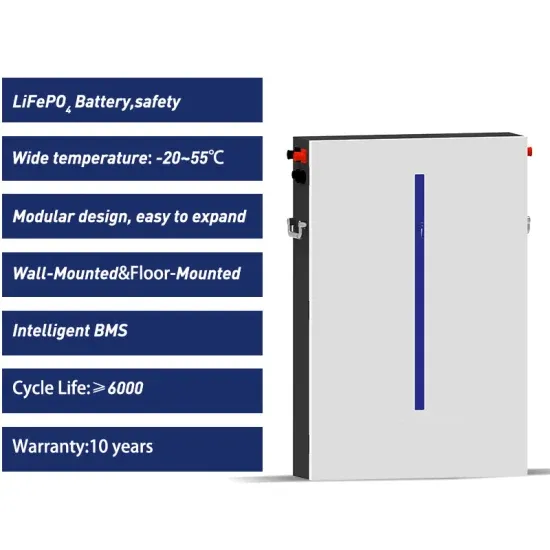

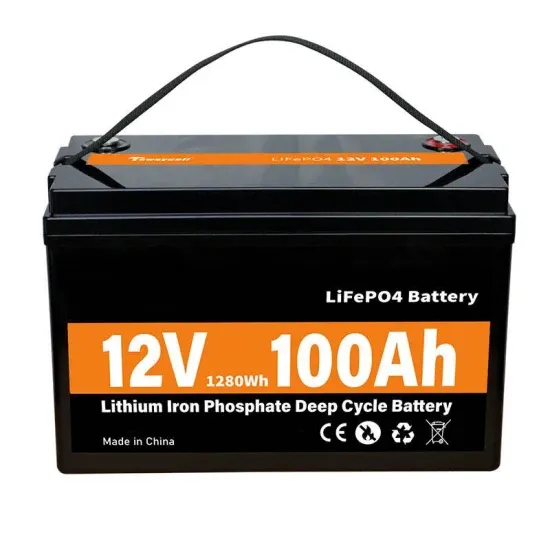

The Sako Lithium Battery Pack 24 Volts (100Ah

The Sako Lithium Battery Pack (24V, 100Ah - LiFePO4) is a revolutionary product that meets the growing energy demands of Zimbabwe. With its advanced technology, safety features, and

Get Price

Zimbabwe''s Lithium Export Ban: Economic Strategy

Discover how Zimbabwe''s 2027 lithium export ban aims to transform the nation from raw material supplier to battery chain player.

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to

Lithium-ion batteries aren''t made in Zimbabwe. Instead, the country exports the mineral as a raw resource. Much of the value of Zimbabwe''s lithium – 480,000 metric tonnes mined since

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

Lithium-ion batteries aren''t made in Zimbabwe. Instead, the country exports the mineral as a raw resource. Much of the value of Zimbabwe''s lithium – 480,000 metric tonnes mined since

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

Between now and 2027, lithium mining companies in Zimbabwe will try to extract as much lithium as possible before the ban comes into effect. This could deplete the lithium

Get Price

Zimbabwe''s lithium is in demand for making batteries: How to make

Zimbabwe, home to Africa''s largest lithium reserves, faces challenges in ensuring its lithium wealth benefits the local economy. Despite the global demand for lithium-ion

Get Price

Zimbabwe celebrates lithium-ion battery breakthrough

Well done Zimbabwe!" Verify Engineering chief executive Engineer Pedzisai Tapfumaneyi told The Herald that after the lithium-ion battery test run''s success, focus is now

Get Price

Zimbabwe''s Lithium Is in Demand for Making Batteries: How to

In 2021, there was a new lithium rush in Zimbabwe because of increased global demand for the mineral. Today, most of Zimbabwe''s lithium mines are owned by Chinese

Get Price

Zimbabwe''s Lithium Is in Demand for Making Batteries

Much of the value of Zimbabwe''s lithium - 480,000 metric tonnes mined since 2015 - is reaped by companies in China which make the raw lithium into batteries and other goods.

Get Price

Zimbabwe''s Lithium Is in Demand for Making Batteries

Analysis - Zimbabwe has the largest lithium reserves on the African continent. Lithium has been mined since the colonial period in the 1950s. It''s a critical part of

Get Price

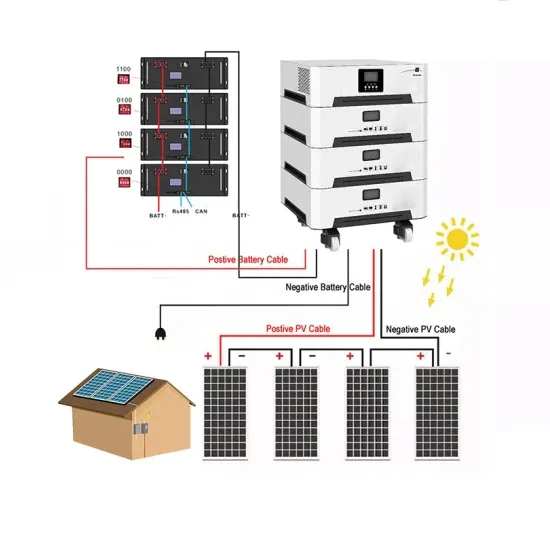

Zimbabwe to produce solar panels, lithium batteries

Zimbabwe, which boasts large deposits of lithium - a key component in battery storage - stands to benefit immensely from adding value

Get Price

Zimbabwe''s lithium boom gains pace – DailyNews

In July 2025, state-owned Verify Engineering successfully piloted a domestically manufactured lithium-ion battery, marking a step toward value addition and industrialisation.

Get Price

Zimbabwe to Ban Lithium Concentrate Exports by 2027 to Boost

Zimbabwe has announced that it will ban the export of lithium concentrates starting in January 2027, as part of efforts to build more value within its borders and drive local

Get Price

Zimbabwe has the lithium

American and European sanctions have impacted Zimbabwe''s development trajectory, but its lithium resources are proving to be a vital source of income, circumventing American or

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to

Lithium-ion batteries aren''t made in Zimbabwe. Instead, the country exports the mineral as a raw resource. Much of the value of Zimbabwe''s lithium – 480,000 metric tonnes

Get Price

Zimbabwe''s lithium is in demand for making batteries:

Zimbabwe has the largest lithium reserves on the African continent. Lithium has been mined since the colonial period in the 1950s. It''s a critical

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

ZIMBABWE has the largest lithium reserves on the African continent. Lithium has been mined since the colonial period in the 1950s. It''s a critical part of rechargeable lithium-ion

Get Price

Zimbabwe''s Lithium Is in Demand for Making Batteries: How to Make

In 2021, there was a new lithium rush in Zimbabwe because of increased global demand for the mineral. Today, most of Zimbabwe''s lithium mines are owned by Chinese

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

Lithium-ion batteries aren''t made in Zimbabwe. Instead, the country exports the mineral as a raw resource. Much of the value of Zimbabwe''s lithium – 480,000 metric tonnes

Get Price

Zimbabwe''s Lithium Export Ban: Economic Strategy by 2027

Discover how Zimbabwe''s 2027 lithium export ban aims to transform the nation from raw material supplier to battery chain player.

Get Price

Zimbabwe''s lithium is in demand for making batteries: how to make

Posted on 16th July 2025 by TSA Press Main image: Two men at work at the Sabi Star lithium mine. Photo: REUTERS / Philimon Bulawayo Zimbabwe has the largest lithium reserves on

Get Price

6 FAQs about [Zimbabwe Wuxu Street is making lithium battery packs]

Does Zimbabwe export lithium concentrate?

Yes, Zimbabwe currently permits the export of lithium concentrate (an intermediate product) following its December 2022 ban on raw lithium ore exports. This intermediate processing stage will continue until the 2027 ban takes effect. How significant is Zimbabwe's lithium production globally?

What is Zimbabwe's new lithium export policy?

This two-stage approach—first banning raw ore exports in 2022, and now scheduling a concentrate export ban for 2027—demonstrates Zimbabwe's methodical progression toward becoming a producer of higher-value lithium products rather than merely supplying raw materials.

Will Zimbabwe reshape the global battery supply chain?

Zimbabwe's government has made a strategic policy shift that will reshape the nation's role in the global battery supply chain. Starting January 2027, the country will implement a comprehensive ban on lithium concentrate exports—a move that follows its December 2022 ban on unprocessed lithium ore exports.

Will Zimbabwe ban lithium concentrate in 2022?

The forthcoming ban represents a significant evolution in Zimbabwe's mineral resource strategy. Between 2022 and 2026, mining companies can continue exporting lithium concentrate (an intermediate product created after initial processing).

How much lithium does Zimbabwe produce in 2024?

Zimbabwe produced 22,000 metric tons of lithium in 2024, representing nearly 50% growth year-over-year. The country ranks among the top 10 global producers and is Africa's largest lithium producer, with potential to supply up to 5% of global demand by 2030.

Will Zimbabwe supply 5% of global lithium demand by 2030?

Industry analysts at Benchmark Mineral Intelligence project that Zimbabwe could supply up to 5% of global lithium demand by 2030 if processing capacity development remains on track—making the country an increasingly important player in critical energy transition materials. How Will Global Supply Chains Be Affected?

More related information

-

Is there anyone making lithium battery packs in Estonia

Is there anyone making lithium battery packs in Estonia

-

Lithium battery packs used in series and parallel

Lithium battery packs used in series and parallel

-

Where can I find 64V lithium iron phosphate battery packs

Where can I find 64V lithium iron phosphate battery packs

-

Series and parallel connection of lithium battery packs

Series and parallel connection of lithium battery packs

-

Lithium battery packs and battery packs

Lithium battery packs and battery packs

-

Iceland makes lithium battery packs

Iceland makes lithium battery packs

-

What is the tariff for imported lithium battery packs in Tajikistan

What is the tariff for imported lithium battery packs in Tajikistan

-

Making a lithium battery station cabinet

Making a lithium battery station cabinet

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.