Battery Industry Braces for Impact as U.S. Slaps 82

These tariffs, combined with existing duties such as the 3.4% global tariff on all lithium-ion batteries and a Section 301 tariff currently at 7.5% (set

Get Price

US Tariff Increases: What is the impact on the US

On May 14, the Biden administration announced the US will impose additional tariffs on $18 billion worth of goods from China, which includes a tariff increase

Get Price

Importing Lithium Batteries: Power for a Green World

This tariff, whatever it may be when you import your lithium batteries, will be added on to Section 301 tariffs. Due to how expensive it is to import from China, you''ll either need to

Get Price

Dutify | Duty and tax rates for lithium-ion battery

Please use our Landed Cost Calculator to get a full breakdown of the import duty, sales tax and any additional import charges payable on your import. You can also use our HS Lookup tool to

Get Price

Battery HS Code Guide for Import and Export

Learn how to classify batteries for international trade with the correct HS Code. Essential guide for smooth import and export processes.

Get Price

Battery Tariffs 2025: Impact on U.S. Energy and

Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have

Get Price

Battery Tariff & Import Duty Updates | Continental Battery

Stay updated on the latest lead-acid and battery import tariffs, trade policy changes, and duty impacts from Continental Battery. Learn how regulations affect pricing.

Get Price

Importing Lithium Batteries: Power for a Green World

This tariff, whatever it may be when you import your lithium batteries, will be added on to Section 301 tariffs. Due to how expensive it is to

Get Price

Lithium Tariff Exemptions: Strategic Impact on Global Trade

Lithium tariff exemptions have emerged as a pivotal policy tool that allows certain lithium products to enter countries without the standard import duties that would otherwise

Get Price

Indian Customs Duty on Lithium Ion Batteries under HSN

Most Updated Import Tariff in India on Lithium Ion Batteries under HSN 85076000. View Country-wise Preferential Duties, Antidumping Duties, and Regulatory Requirements.

Get Price

2025 Aug Tariff Impact on Lithium Battery Industry | Cost Analysis

Discover how the U.S. Executive Order of July 31, 2025, adjusting reciprocal tariffs effective August 7, affects lithium-ion and polymer battery raw material costs, and explore practical

Get Price

US battery market faces possible ''significant tariff

US battery market faces possible ''significant tariff impacts'': Clean Energy Associates With limited production capacity outside China, CEA''s Q4

Get Price

Battery Tariffs 2025: Impact on U.S. Energy and Trade

Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have reached levels as high

Get Price

Economic Consequences of US Tariffs on Chinese

US tariffs on Chinese lithium-ion batteries raise costs, disrupt supply chains, and challenge clean energy and EV growth, reshaping the

Get Price

How Do Import Tariffs Affect Rack Lithium Battery Costs Worldwide?

Let''s break down a typical tariff cascade: Chinese cells face 25% Section 301 duties plus 40.9% battery-specific levies. When combined with 10% logistics markups, end-users pay

Get Price

WHAT THE BIDEN TARIFFS ON LITHIUM BATTERIES COULD

On May 14, President Biden announced a wide range of tariffs on electronics-related items, as well as electric vehicles imported into the U.S. from China. In particular,

Get Price

How to Import Lithium-Ion Batteries in India?

India is a major importer of lithium-ion batteries, and the process of importing these batteries can be complex. This article provides a step-by-step guide on how to import lithium

Get Price

USA Import Duty Calculator (Battery Tariffs)

Below is an overview of the historical changes in U.S. battery tariffs, along with the current tariff rates for battery imports from key countries and a look at future expectations.

Get Price

New regulation on used lithium batteries imports in Indonesia

On December 23, 2020, the " Regulation of the Ministry of Commerce No. 100 of 2020 on the provisions for the import of used lithium batteries as raw materials for the lithium

Get Price

Lithium Tariff Exemptions: Strategic Impact on Global

Lithium tariff exemptions have emerged as a pivotal policy tool that allows certain lithium products to enter countries without the standard import

Get Price

Tariffs Resource Updates | Battery Junction

March 4, 2025 Updates On March 3, 2025, the U.S. Government began implementing tariffs on imports from Canada and Mexico under the International Emergency Economic Powers Act

Get Price

HS Code 85065090

Lithium cells and batteries (excl. spent, and in the form of cylindrical or button cells); Examples: - Lithium polymer battery (2500mAh, 7.4V) -

Get Price

How Trade Policies Affect Lithium Battery Exports and Imports

The most important materials used for lithium batteries—such as lithium, nickel, and cobalt—are often mined and exported from other countries. In order to encourage the use

Get Price

6 FAQs about [What is the tariff for imported lithium battery packs in Tajikistan ]

Can I import a lithium-ion battery?

However, there may be additional import tax and minimum threshold rules for this item. Please use our Landed Cost Calculator to get a full breakdown of the import duty, sales tax and any additional import charges payable on your import. You can also use our HS Lookup tool to get the full length HS code for your lithium-ion battery.

What are China's new tariffs on lithium-ion cells & components?

Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have reached levels as high as 104%, according to updated trade filings. This marks a significant increase compared to the average 20.8% rate recorded in 2024.

Which countries import lithium batteries?

The U.S. imports the majority of its lithium batteries from China, Singapore, Israel, Japan, and Canada. There are Section 301 tariffs on lithium battery imports from China. If you’re importing lithium batteries from China, you’ll need to factor in country specific tariffs when you budget for your goods.

What is a lithium tariff exemption?

Lithium tariff exemptions have emerged as a pivotal policy tool that allows certain lithium products to enter countries without the standard import duties that would otherwise apply to comparable goods. These exemptions reflect the mineral's growing importance to national economic and security interests worldwide.

What happens if you import lithium batteries from China?

At minimum, such imports from China could result in a tariff exceeding 145% ad valorem. This tariff, whatever it may be when you import your lithium batteries, will be added on to Section 301 tariffs. Due to how expensive it is to import from China, you’ll either need to budget accordingly or find a supplier in another country.

Will lithium tariffs jeopardize domestic manufacturing capabilities?

The United States, European Union, and several other jurisdictions have carved out specific exemptions for lithium imports, recognizing that punitive tariffs could jeopardize domestic manufacturing capabilities. Key policy developments include: The comparative approaches to lithium tariffs reveal important strategic differences:

More related information

-

What voltages are available for lithium battery packs

What voltages are available for lithium battery packs

-

What devices are lithium battery packs used in

What devices are lithium battery packs used in

-

What is the best voltage balance for lithium battery packs

What is the best voltage balance for lithium battery packs

-

Gambia where lithium battery packs are assembled

Gambia where lithium battery packs are assembled

-

What brands of lithium iron phosphate battery station cabinets are there

What brands of lithium iron phosphate battery station cabinets are there

-

Two lithium battery packs connected in parallel

Two lithium battery packs connected in parallel

-

Series and parallel connection of lithium battery packs

Series and parallel connection of lithium battery packs

-

Only lithium battery packs

Only lithium battery packs

Commercial & Industrial Solar Storage Market Growth

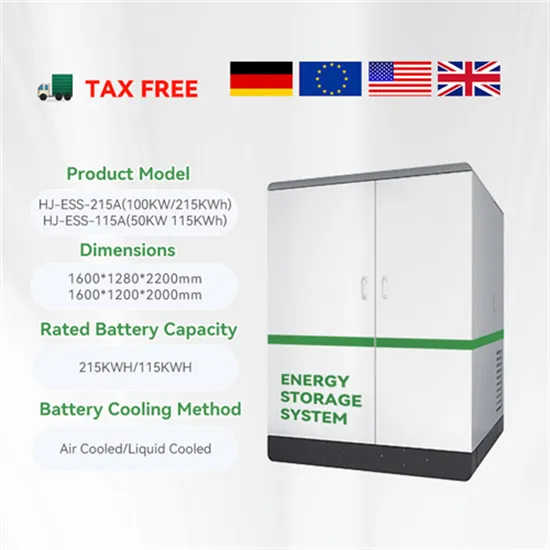

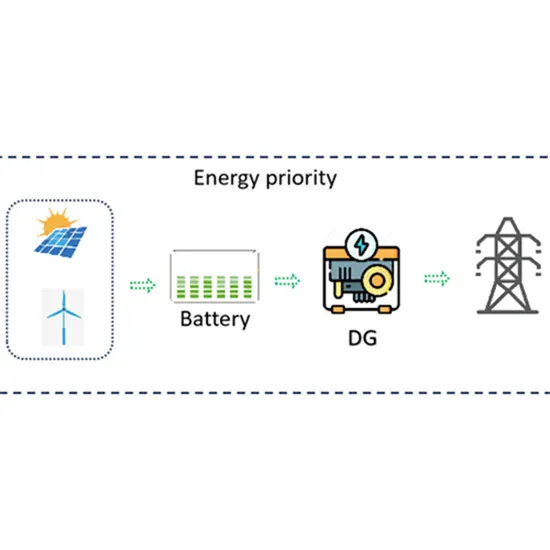

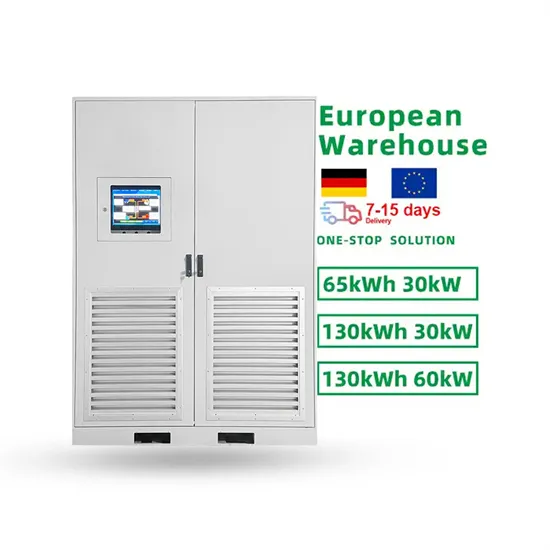

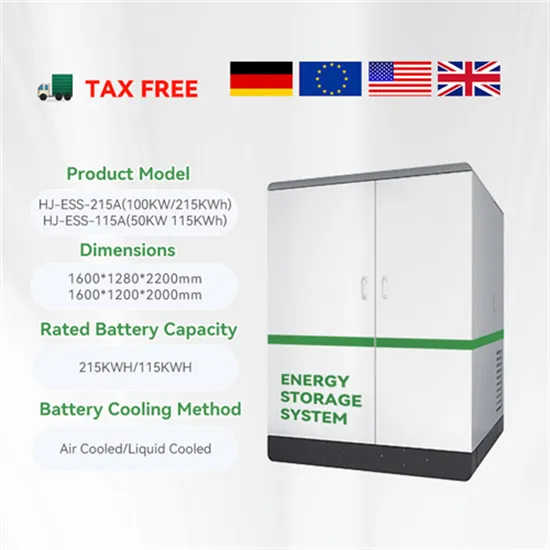

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.