Top startups in Telecom in Mongolia (Jul, 2025)

Telecom Sector in Mongolia has a total of 11 companies which include top companies like Unitel, Mobicom Corporation and LIME.

Get Price

Mongolia Telecom Power System Market (2025-2031) | Outlook

Mongolia Telecom Power System Market (2025-2031) | Industry, Outlook, Segmentation, Share, Value, Forecast, Companies, Trends, Analysis, Size, Growth & Revenue

Get Price

The Use of Solar Power for Telecom Towers

As telecom companies strive to meet growing energy demands and environmental standards, the shift towards telecom solar power systems

Get Price

5G Base Station Companies

Get access to the business profiles of top 10 5G Base Station companies, providing in-depth details on their company overview, key products and services, financials, recent developments

Get Price

Telecommunications in Mongolia

There are two landline telephone companies in Mongolia: Mongolia Telecom Company (MTC) and the Mongolian Railway Authority. [3] MTC is a joint venture with Korea Telecom and partially

Get Price

What Is A Base Station?

A base station is an integral component of wireless communication networks, serving as a central point that manages the transmission and reception of signals between

Get Price

Mongolia Telecoms Market report, Statistics and Forecast 2020

Mongolia''s liberalised and competitive telecoms market comprises of a number of operators which over the years have steadily eroded the dominance of the incumbent telco, Mongolia Telecom.

Get Price

Telecom Energy Solution

Establishing efficient power & environmental monitoring systems Base stations are the key energy consumers on any mobile network; their monitoring and upgrade are essential if operators are

Get Price

Telecommunications in Mongolia

International dialing code: +976. There are two landline telephone companies in Mongolia: Mongolia Telecom Company (MTC) and the Mongolian Railway Authority. MTC is a

Get Price

Telecommunication Power Supplies

We offer power supply products which satisfy the high reliability requirements demanded in the telecommunication power supply market, and which

Get Price

Power Architectures for Telecommunications

Keywords- Power Architecture of telecommunication, Base station Power supplies, telecom en ergy schemes, power distribution for

Get Price

Mongolia LTE Base Station System Market (2025-2031) | Strategy

Our analysts track relevent industries related to the Mongolia LTE Base Station System Market, allowing our clients with actionable intelligence and reliable forecasts tailored to emerging

Get Price

Top startups in Telecom in Mongolia (Jul, 2025)

There are 11 Telecom startups in Mongolia which include Unitel, Mobicom Corporation, LIME, GMobile, SKYtel. Out of these, 1 startup is funded and has achieved

Get Price

Telecommunications in Mongolia

There are currently five licensed WLL providers, though there only appear to be three companies actually offering service. Mongolia Telecom Company: WLL project a joint venture with LG

Get Price

Mongolia Telecoms Market report, Statistics and

Mongolia sees progress in 5G network launches Mongolia''s liberalised and competitive telecoms market comprises of a number of operators which over

Get Price

telecommunication base stations suppliers

Alibaba offers 1,275 Telecommunication Base Stations Suppliers, and Telecommunication Base Stations Manufacturers, Distributors, Factories, Companies. There are 778 OEM, 703 ODM,

Get Price

Breaking Down Base Stations – A Guide to Cellular Sites

Wondering what telecom sites really look like? Find everything you need to know about telecom sites, towers, and their components.

Get Price

inverter power Companies and Suppliers serving Mongolia

At AIMS Power, our mission is to be leaders in the design and development of off-grid and renewable energy. We sell our signature DC to AC inverters, solar panels, deep-cycle

Get Price

Top Mobile Inverters Manufacturers Suppliers in Mongolia

There are plenty of suppliers and manufacturers of solar power equipment in Mongolia. You can also find plenty of options online or globally if you find that the options are quite limited.

Get Price

Site Energy Revolution: How Solar Energy Systems

As global energy demands soar and businesses look for sustainable solutions, solar energy is making its way into unexpected

Get Price

Mongolia Telecoms Market report, Statistics and

Mongolia''s liberalised and competitive telecoms market comprises of a number of operators which over the years have steadily eroded the dominance of the

Get Price

Mongolia

The growing popularity of mobile broadband continues to underpin overall broadband and telecom sector growth, with Mongolia''s market very much being dominated by

Get Price

Top Telecommunications companies in Mongolia

Listed below are the leading companies in Mongolia by revenue as of June 2025. With $402M in revenue, Information Communications Network is ranked first on the list, followed by Mobicom

Get Price

What is Telecommunication Base Station | China Hop

What is telecommunication base station, let''s learn about communication base stations. China telecom equipment supplier.

Get Price

Telecommunication Power Supplies

We offer power supply products which satisfy the high reliability requirements demanded in the telecommunication power supply market, and which contribute to reduction of power

Get Price

5G Base Station Companies

Get access to the business profiles of top 10 5G Base Station companies, providing in-depth details on their company overview, key products and

Get Price

6 FAQs about [Which companies are there in Mongolia for telecommunication base station inverters ]

Does Mongolia have a competitive telecoms market?

Mongolia‘s liberalised and competitive telecoms market comprises of a number of operators which over the years have steadily eroded the dominance of the incumbent telco, Mongolia Telecom. Fixed-line penetration increased steadily through to 2018 as more people took on fixed-line access to make calls and to access copper-based broadband services.

What technology is used in Mongolia?

Wireless local loop is another technology that has helped Mongolia increase accessibility to telecommunications and bypass fixed-line infrastructure. For Internet, Mongolia relies on fiber optic communications with its Chinese and Russian neighbors. In 2005, Mongolia's state-run radio and TV provider converted to a public service provider.

How many landline telephone companies are there in Mongolia?

There are two landline telephone companies in Mongolia: Mongolia Telecom Company (MTC) and the Mongolian Railway Authority. MTC is a joint venture with Korea Telecom and partially publicly owned. MTC leases fiber-optic lines from the Mongolian Railway Authority and connects to all aimags and soums.

Which ICT company in Mongolia has the first 3g/4g/5g network?

Unitel (GSM)- The No.1 ICT group in Mongolia who have the first and nationwide 3G/4G/5G network. Mobicom Corporation (GSM) – The first mobile operator. service resembling that of landlines, but uses technology similar to mobile phones.

How many longwave broadcasting stations are there in Mongolia?

In the whole country there are 5 longwave broadcasting stations, the most powerful at Ulaanbaatar with 1000 KW. Mongolian TV Broadcasting started on 27 September 1967 with the start of Mongolian National Television. Mongolian National Broadcaster, the official, state-funded television channel in Mongolia.

What happened to Telecom Mongolia?

KT Corp completes sale of its 40% stake in Telecom Mongolia to the state. Unitel starts offering mobile satellite services following an access agreement with Lynk Global, launches 5G services. MobiCom expands reach of LTE-A services, sets up 5G experience zones with a view to launching commercial services later in 2023.

More related information

-

The first company to connect telecommunication base station inverters to the grid

The first company to connect telecommunication base station inverters to the grid

-

Cost price of telecommunication base station inverters in Australia

Cost price of telecommunication base station inverters in Australia

-

Which communication base station battery companies are there

Which communication base station battery companies are there

-

Which manufacturers of 5G base station distribution boxes are there in Costa Rica

Which manufacturers of 5G base station distribution boxes are there in Costa Rica

-

Ranking of Nicaragua s telecommunications base station power supply companies

Ranking of Nicaragua s telecommunications base station power supply companies

-

Which companies built Azerbaijan s 5G base stations

Which companies built Azerbaijan s 5G base stations

-

Western European Solar Base Station Companies

Western European Solar Base Station Companies

-

Which is the 5G base station for communication

Which is the 5G base station for communication

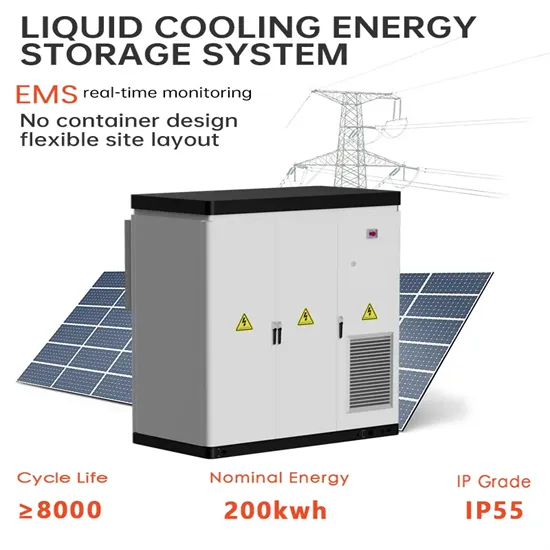

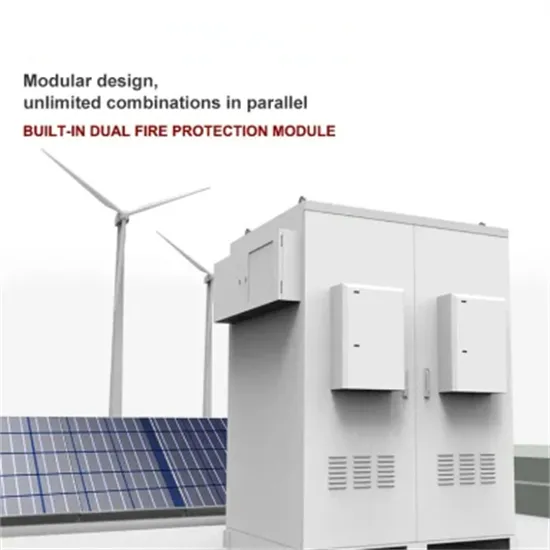

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.