5G Base Station Equipment Market Report 2025: 5G Base

The 5G base station equipment market is set to grow from $29.87 billion in 2025 to $52.73 billion by 2030, at a 12.0% CAGR. Increasing urbanization, rising...

Get Price

Worldwide: 5G base stations in selected markets

In data collected between July 2022 and June 2024, China was reported to have had around *** million 5G base stations installed across the

Get Price

Global 5G Base Station Growth Analysis

5G Base Station Market Size 2024-2028 The 5g base station market size is forecast to increase by USD 120.98 billion at a CAGR of 38.81% between 2023 and 2028. The market is

Get Price

du now has near 100% 5G network coverage – and higher traffic

Dubai: The UAE telco du isn''t just satisfied with hitting 98.5 per cent network coverage when it comes to 5G services. "We also have the biggest traffic in the UAE when it

Get Price

5G base station rollout in the U.S. and China 2021

The United States (U.S.) and China are both rolling out ** infrastructure at a rapid rate, growing approximately *** times in size from

Get Price

A guide to choosing Base Station Antennas

5G as a reality is already well underway. Most operators worldwide have already adopted 5G as their main technology to support the increased network traffic and new mobile

Get Price

5G regulation and law in the UAE | CMS Expert Guides

The UAE is estimated to have approximately 7,000 5G base stations, representing seven stations per 10,000 residents. The two principal network operators (Etisalat by e& and

Get Price

du launches region''s first live 5G-Advanced network in UAE with

du, UAE''s telecom and digital services provider, has announced the successful deployment of 5G-Advanced (5G-A) technology on its live network, making it the first operator

Get Price

China claims first 5G base stations for military use

The 5G base station was developed by China Mobile Communications Group and the Chinese People''s Liberation Army China has

Get Price

du Spearheads Commercial Deployment of 5G-Advanced

du achieved speeds of 10 Gbps during the 5G-Advanced trial in 2023, remaining focused on surpassing technical milestones and ensuring that users across the UAE benefit from

Get Price

5G | The Official Portal of the UAE Government

According to telecom service provider Du, the ''fifth generation'' (5G) or International Mobile Telecommunications-2020 (IMT-2020) is the next generation of cellular network technology for

Get Price

What is a base station and how are 4G/5G base

The architecture of the 5G network must enable sophisticated applications, which means the base stations design required must also be

Get Price

5G Base Station Market Share and Growth Forecast, 2023-2031

5G Base Station Market Outlook 2031 The global industry was valued at US$ 14.7 Bn in 2022 It is estimated to advance at a CAGR of 31.3% from 2023 to 2031 and reach US$ 167.3 Bn by the

Get Price

5G adoption and its implications in the Gulf states

As many of the Gulf states pivot away from oil and gas, they have turned to digital development as a way to attract foreign investment and spur

Get Price

5.5G Innovation Paves the Way to an Intelligent World

5.5G has also triggered research into the standardization of harmonized communication and sensing (HCS). 5.5G base stations will adopt integrated

Get Price

e& UAE Consolidates its Position as the Fastest 5G Operator in

e& UAE is the top-performing 5G operator in the UAE and globally: e& UAE recorded the highest median 5G download speed globally at 749.63 Mbps and an upload

Get Price

5G Companies: 12 Players are leading the Research

The top 5G companies leading the research are Samsung, Huawei, Nokia, LG, Ericsson, and Qualcomm. Other players that are providing 5G

Get Price

Tracking 5G Deployments in the Middle East and Africa

The first full commercial 5G mobile service in the MEA region was introduced by Etisalat in the United Arab Emirates (UAE) in May 2019,

Get Price

Du parent company to build 700 5G base stations in UAE by year

Emirates Integrated Telecommunications Company, the parent company of Dubai operator Du, will set up more than 700 5G-enabled stations by the end of this year, the

Get Price

4G & 5G Base Station Antennas Market Analysis and Forecast

The report delves into recent significant developments in the 4G & 5G Base Station Antennas Market, highlighting leading vendors and their innovative profiles. These

Get Price

du has already deployed ''hundreds'' of 5G-A base stations in UAE

The executive noted that du has already deployed hundreds of 5G-A base stations while its plans for the whole country stipulate the deployment of thousands of base stations.

Get Price

Superfast Internet Everywhere! UAE''s Big 5G Expansion Plan

Leading telecom providers like Etisalat and du have been actively expanding their 5G infrastructure. With towers and base stations strategically placed across urban centers and

Get Price

5G Base Station Market Size, Share & Growth Report,

5G Base Station Market Summary The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD

Get Price

du now has near 100% 5G network coverage – and higher traffic in UAE

Dubai: The UAE telco du isn''t just satisfied with hitting 98.5 per cent network coverage when it comes to 5G services. "We also have the biggest traffic in the UAE when it

Get Price

Tracking 5G Deployments in the Middle East and Africa

The first full commercial 5G mobile service in the MEA region was introduced by Etisalat in the United Arab Emirates (UAE) in May 2019, followed closely by its domestic rival

Get Price

What is 5G base station architecture?

The higher the frequency, the more data it transmits. 5G core network architecture operates on different frequency bands, but it''s the higher

Get Price

6 FAQs about [Which UAE communication company has more 5G base stations ]

How many 5G stations are there in the UAE?

5G is well-deployed in major urban areas and along main transport routes, but less so in more rural areas. The UAE is estimated to have approximately 7,000 5G base stations, representing seven stations per 10,000 residents. The two principal network operators (Etisalat by e& and Du) as well as the main VMNO Virgin Mobile offer 5G connectivity.

Which UAE telco has the biggest 5G network usage?

Image Credit: Supplied Dubai: The UAE telco du isn’t just satisfied with hitting 98.5 per cent network coverage when it comes to 5G services. “We also have the biggest traffic in the UAE when it comes to 5G network usage,” said Fahad Al Hassawi, CEO, and delivering an emphatic point.

How many 5G networks are there in the Middle East?

This includes eight in the Middle East and 10 in Africa. The first full commercial 5G mobile service in the MEA region was introduced by Etisalat in the United Arab Emirates (UAE) in May 2019, followed closely by its domestic rival Du the following month.

When did 5G start in the UAE?

The first full commercial 5G mobile service in the MEA region was introduced by Etisalat in the United Arab Emirates (UAE) in May 2019, followed closely by its domestic rival Du the following month. Etisalat switched on the region’s first pre-commercial 5G networks in select Abu Dhabi and Dubai locations in January 2018.

Which 5G provider in the UAE has the highest speed?

e& UAE is the top-performing 5G operator in the UAE and globally: e& UAE recorded the highest median 5G download speed globally at 749.63 Mbps and an upload speed of 43.52 Mbps in Q1-Q2 2024. This performance has earned e& UAE the highest Speed Score ®, showcasing continuous and steady improvements since 2022.

Are UAE smartphone users holding back on 5G?

UAE smartphone users are definitely not holding back on 5G. As 5G handsets become available at multiple price points, owners are upgrading their data packages too. Image Credit: Supplied Dubai: The UAE telco du isn’t just satisfied with hitting 98.5 per cent network coverage when it comes to 5G services.

More related information

-

Which 5G baseband is suitable for 5G communication base stations

Which 5G baseband is suitable for 5G communication base stations

-

Which is the best wind power lightning protection company for communication base stations

Which is the best wind power lightning protection company for communication base stations

-

Which company has the most inverters for communication base stations in Azerbaijan

Which company has the most inverters for communication base stations in Azerbaijan

-

Which company is bidding for Asia Communications 5G base stations

Which company is bidding for Asia Communications 5G base stations

-

Grid-connected cost of inverter for UAE communication base stations

Grid-connected cost of inverter for UAE communication base stations

-

Which companies are producing inverters for communication base stations in Laos

Which companies are producing inverters for communication base stations in Laos

-

How many lead-acid batteries are there in the UAE 5G communication base station

How many lead-acid batteries are there in the UAE 5G communication base station

-

Which companies are producing flow batteries for Burundi communication base stations

Which companies are producing flow batteries for Burundi communication base stations

Commercial & Industrial Solar Storage Market Growth

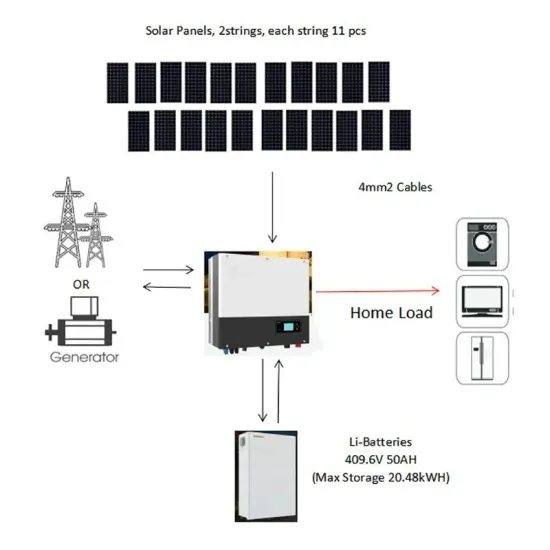

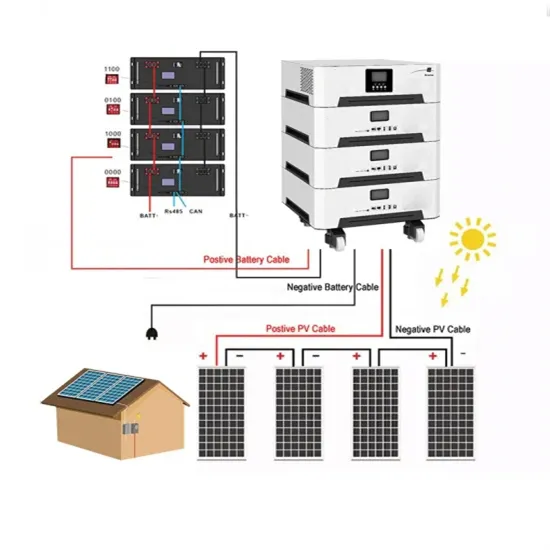

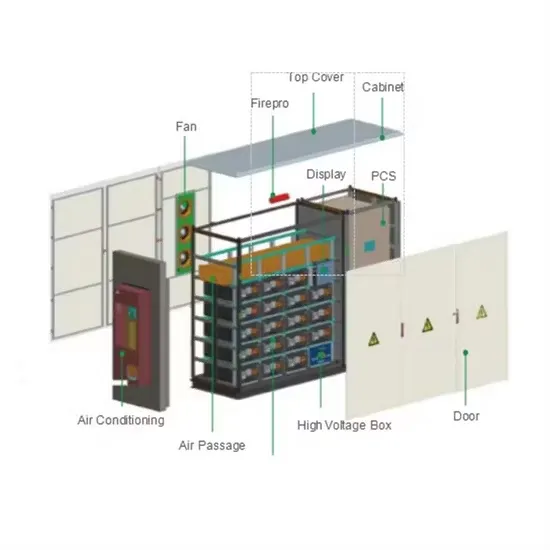

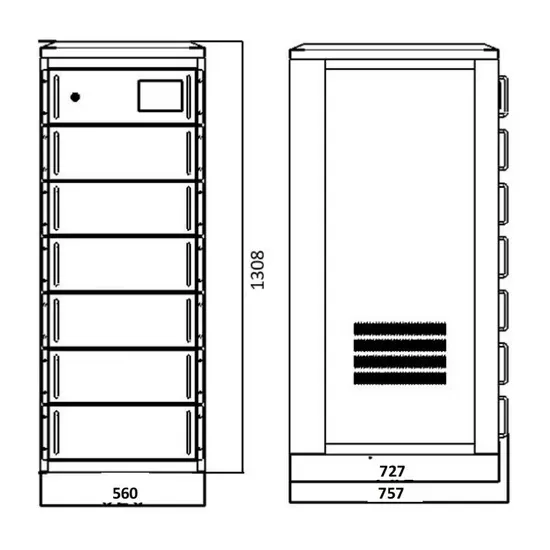

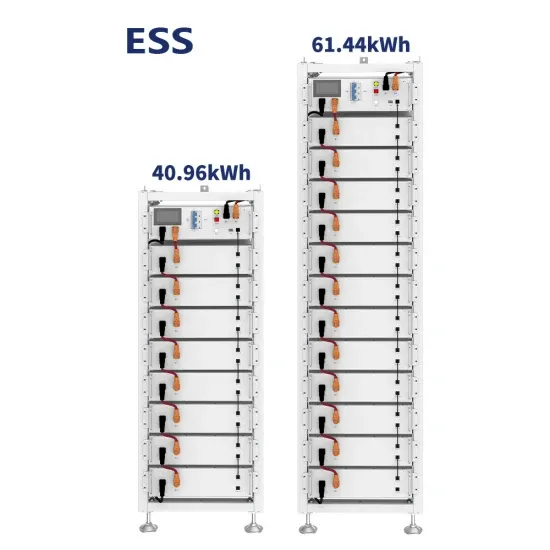

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.