Top five energy storage projects in Japan

Given the fundamental direction of Japan''s energy landscape, energy storage technology is set to play an integral part in Japan''s energy future due to energy storage technology''s role in both

Get Price

Map of Power Plants In Japan

Overview of Power Plants in Japan Energy Mix: Japan relies on a combination of natural gas, nuclear, coal, oil, hydropower, solar, wind, and geothermal power. Following the Fukushima

Get Price

price of energy storage power station in japan

Japan Solar Energy Market Japan Solar Energy Market is poised to grow at a CAGR of 9.2% by 2028. The growing focus on achieving various capacity targets is likely to drive the growth of

Get Price

Hydroelectricity in Japan

The large capacity of pumped storage hydropower was built to store energy from nuclear power plants, which until the Fukushima disaster constituted a large part of Japan electricity

Get Price

Japan scales up batteries but companies worry rule changes may

2 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Get Price

Pumped Hydro: The Emerging Backbone of Japan''s Energy

Japan NRG looks at how pumped hydro capacity, a relatively simple energy storage method, is being developed, deployed and traded in new ways to meet Japan''s 21st

Get Price

Detailed explanation of the development process of energy storage power

For example, optimizing the operation strategy of energy storage power plants, improving equipment efficiency, and reducing unnecessary energy consumption; Monitor and manage

Get Price

Hydrogen is developing fast in Japan, closer to societal use

Japan is a global leader in hydrogen technology development, largely due to its strategic emphasis on hydrogen as a next-generation energy source.

Get Price

Why Japan lacks energy storage | NenPower

Rugged terrains, dense urbanization, and a multitude of islands pose logistical challenges that must be addressed when planning energy storage facilities. Conventional

Get Price

Japan''s Pumped Storage Power Station Projects: Powering the

Japan is pushing the envelope with AI-driven optimization to predict energy demand and reservoir levels. Drones now survey sites 10x faster than human teams, while

Get Price

Japan on cusp of energy storage boom

During normal times, household power outages in Japan are extremely rare. But it is not unusual for earthquakes and other disasters to

Get Price

The Electric Power Industry in Japan

Research and Information Activities JEPIC conducts research on the electric power industry in foreign countries in light of situations and issues facing the industry in Japan currently. We

Get Price

Japan on cusp of energy storage boom

During normal times, household power outages in Japan are extremely rare. But it is not unusual for earthquakes and other disasters to cause widespread outages.

Get Price

Here''s more about the 6th Strategic Energy Plan

Let us look at potential paths to this goal in detail. How will thermal power generation be curbed? Japan''s basic energy policy is referred

Get Price

Location of energy storage power stations in Japan

Originality/value. This paper creatively introduced the research framework of time-of-use pricing into the capacity decision-making of energy storage power stations, and considering the

Get Price

Top five energy storage projects in Japan

Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData''s power database. GlobalData uses proprietary data and analytics to

Get Price

Pumped Hydro: The Emerging Backbone of Japan''s

Japan currently has three major pumped hydro projects in various stages of completion, including one serving Tokyo that will have the world''s

Get Price

The 7th Strategic Energy Plan

The 7th Strategic Energy Plan February 2025 Agency of Natural Resources and Energy Progress after the Accident at TEPCO''s Fukushima Daiichi Nuclear Power Station Almost fourteen

Get Price

Energy industry in Japan

The country has a significant number of stations for the production of electricity from hydrocarbons, including ten oil stations with a capacity of

Get Price

Pumped Hydro: The Emerging Backbone of Japan''s

Japan NRG looks at how pumped hydro capacity, a relatively simple energy storage method, is being developed, deployed and traded in

Get Price

Hydrogen Society Promotion Act Enacted. Toward a

In May 2024, the Hydrogen Society Promotion Act was enacted to strongly support the popularization and utilization of hydrogen as a source of

Get Price

The Energy Storage Landscape in Japan

Given the fundamental direction of Japan''s energy landscape, energy storage technology is set to play an integral part in Japan''s energy future due to energy storage technology''s role in both

Get Price

Japan Energy Storage Policies and Market Overview

Japan''s energy storage policies, market statistics, and trends—from METI''s strategic plans and subsidy programs to deployment challenges.

Get Price

Japan Confirms Five New Battery Storage Projects

Battery storage is viewed as an important part of Japan''s decarbonization plans. Storage systems like BESS help keep power systems stable, especially when more electricity

Get Price

Report: Energy Storage Landscape in Japan | EU-Japan

The aim of this report is to provide an overview of the energy storage market in Japan, address market''s characteristics, key success factors as well as challenges and opportunities in this

Get Price

6 FAQs about [Basic situation of energy storage power stations in Japan]

What role does energy storage technology play in Japan's Energy Future?

Given the fundamental direction of Japan’s energy landscape, energy storage technology is set to play an integral part in Japan’s energy future due to energy storage technology’s role in both smart grid technology and in renewable energy’s integration into Japan’s energy landscape.

How big is Japan's energy storage capacity?

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Japan had 1,671MW of capacity in 2022 and this is expected to rise to 10,074MW by 2030. Listed below are the five largest energy storage projects by capacity in Japan, according to GlobalData’s power database.

How is Japan's energy storage landscape changing?

Japan’s energy storage landscape is shifting, pushed by household demand, corporate ESG mandates, and domestic battery manufacturing. The residential lithium-ion market, projected to grow at a CAGR of 33.9% through 2030, remains one of the fastest-expanding segments.

What is the future of energy storage in Japan?

Other small-scale uses, such as data center backup energy storage are projected by NEDO to become commercially widespread in Japan before 2020. Overall, large and centralized storage technologies have been mature for a longer period of time. In Japan and in the EU, research and development efforts are heavily focusing on batteries.

Will pumped storage hydropower bring balance and stability to Japan's grid?

Pumped storage hydropower, a late 19th century technology that was largely ignored by the markets for decades, is now emerging as pivotal to bringing balance and stability to Japan’s grid as the nation both reboots nuclear energy and moves to rely more on solar and wind generation.

How many battery storage projects will Stonepeak and CHC develop in Japan?

Stonepeak and CHC’s energy storage platform will develop five new battery storage projects in Japan. These projects have a combined capacity of 348 megawatts (MW). The deals were finalized under Japan’s Long-term Decarbonization Auction. These projects were selected as part of Japan’s latest long-term auction focused on low-carbon energy.

More related information

-

Main uses of energy storage power stations

Main uses of energy storage power stations

-

How many companies are involved in energy storage power stations in Uzbekistan

How many companies are involved in energy storage power stations in Uzbekistan

-

Future prices of energy storage power stations

Future prices of energy storage power stations

-

How much money can energy storage power stations make

How much money can energy storage power stations make

-

Eastern European energy storage power stations participate in frequency regulation

Eastern European energy storage power stations participate in frequency regulation

-

Is there a 5-year BESS for energy storage power stations

Is there a 5-year BESS for energy storage power stations

-

Large-scale application of energy storage power stations

Large-scale application of energy storage power stations

-

Foreign-funded energy storage power stations

Foreign-funded energy storage power stations

Commercial & Industrial Solar Storage Market Growth

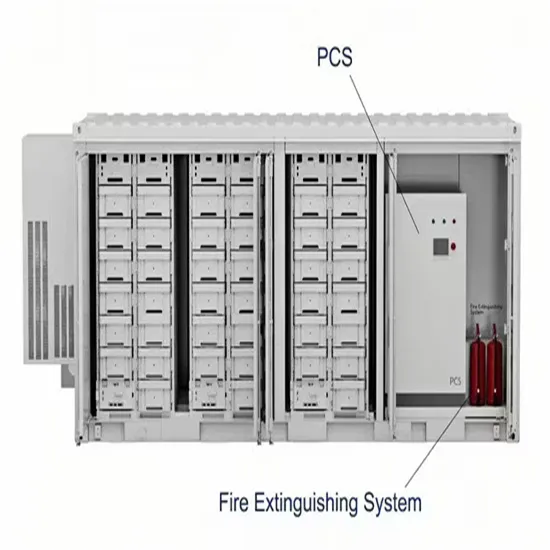

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.