TenneT''s position on Battery Energy Storage Systems (BESS)

There is a wide variety of revenue streams to be realized by generating explicit value with storage. At the same time, BESS provide opportunities for TenneT by responding to TenneT''s needs in

Get Price

Backup power for Europe – part 6: Dutch BESS capacity

The Dutch market offers strong revenue potential for BESS, driven by volatile electricity prices and growing flexibility needs. Deployment is accelerating, but challenges

Get Price

TenneT''s position on Battery Energy Storage Systems (BESS)

Overview of decision moments and products where BESS create revenue *Activation of reserved power is determined (near) real time

Get Price

Unlocking BESS revenues in Europe''s key markets

By following a transparent, conservative, and standardised methodology, the Storage Index offers a valuable reference for investors, developers, and policymakers looking

Get Price

The Roadmap to 9 GW of Dutch Energy Storage Capacity by 2030

Dutch Transmission Service Operator (TSO) TenneT has projected that The Netherlands will need to have at least 9 GW of large-scale battery energy storage system

Get Price

BESS arbitrage revenue ranked by country & duration

Timera Energy set out a ranked analysis of BESS day-ahead arbitrage revenue capture across European markets in 2022 vs 2023 & look at

Get Price

Battery energy storage systems in the Netherlands

DNV has been commissioned by Invest-NL to examine the Dutch wholesale and balancing market developments and opportunities for BESS. This white paper highlights the current and future

Get Price

BESS in Germany 2025 and Beyond: Use Cases,

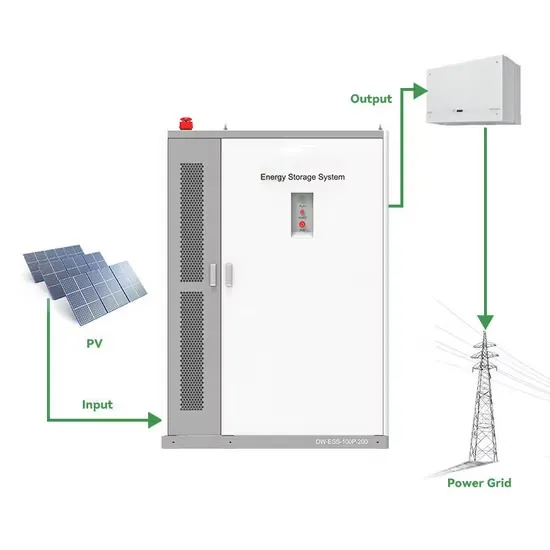

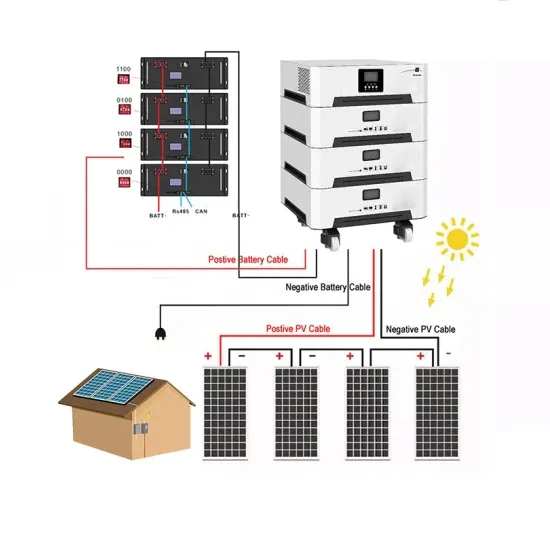

Introduction to BESS Battery Energy Storage Systems (BESS) are advanced technologies designed to store energy generated from various

Get Price

2024 BESS revenue performance: a tale of 3 markets

A comprehensive & flexible BESS investment tool with revenue projections to 2050, revenue distribution data (e.g. P10, P90), degradation &

Get Price

BESS in the Netherlands

This article examines the structure of the Dutch energy market, focusing on renewables and BESS (battery energy storage systems) and identifying opportunities and

Get Price

Backup power for Europe

Battery Energy Storage Systems (BESS) are key to integrating variable renewable energy sources like solar and wind. This report examines the factors influencing BESS

Get Price

2024 BESS revenue performance: a tale of 3 markets

A comprehensive & flexible BESS investment tool with revenue projections to 2050, revenue distribution data (e.g. P10, P90), degradation & cycling data across multiple

Get Price

Did you know that the Netherlands is a small but expanding

Flexibility needs in the Netherlands are high, and opportunities arise as grid operators continue to look for new ways to address power grid congestion.

Get Price

The Energy Storage Market in Germany

The German Energy Revolution The German energy storage market has experienced a mas-sive boost in recent years. This is due in large part to Ger-many''s ambitious energy transition

Get Price

Netherlands largest battery storage project put into

The battery storage project in southeast Netherlands. Image: SemperPower. Battery storage developer and operator SemperPower has

Get Price

Maximising BESS Revenues

Insights into the changing outlook for different BESS revenue streams and its impact on investors from a panel of experts convened by Tamarindo''s Energy Storage Report, in

Get Price

Battery Energy Storage Systems (BESS): How They

Battery Energy Storage Systems (BESS), also referred to in this article as "battery storage systems" or simply "batteries", have become

Get Price

Dentons

BESS can generate strong revenue in the Dutch market according to Björn, driven by the potential to stack revenues, for example from trading on wholesale markets and

Get Price

Balancing the Dutch electricity grid with battery energy

Battery energy storage systems (BESS) are vital for managing market volatility and capitalizing on price fluctuations. We highlight the economic opportunities

Get Price

Balancing the Dutch electricity grid with battery energy storage

Battery energy storage systems (BESS) are vital for managing market volatility and capitalizing on price fluctuations. We highlight the economic opportunities for BESS assets within one of the

Get Price

The Energy Storage Report 2024

The Energy Storage Report is now available to download. In it, you''ll find the best of our content from Energy-Storage.news Premium and PV Tech Power, as well as new

Get Price

BESS Market Size & Growth: Trends Shaping the

A battery energy storage system (BESS) is an integrated system that uses rechargeable batteries to store electrical energy for later use. With

Get Price

Battery energy storage systems in the Netherlands

DNV has been commissioned by Invest-NL to examine the Dutch wholesale and balancing market developments and opportunities for BESS. This white paper

Get Price

Autel Energy Completes First U.S. EV Charging + Battery Storage

3 days ago· PORT WASHINGTON, N.Y., Sept. 9, 2025 /PRNewswire/ -- Autel Energy, a global leader in electric vehicle (EV) charging and smart energy solutions, today announced the

Get Price

''Europe''s biggest BESS'' earns nearly US$3 million

Europe''s biggest battery storage system earned £2.3 million (US$2.85 million) revenues in the first quarter of 2023.

Get Price

Battery storage revenues and routes to market

As covered briefly in our previous article, the "route to market" / offtake arrangements/ revenue contracts are perhaps the key difference

Get Price

Unlocking BESS revenues in Europe''s key markets

By following a transparent, conservative, and standardised methodology, the Storage Index offers a valuable reference for investors,

Get Price

Return, N2OFF embark on Germany BESS projects

12 hours ago· Return was an early mover in the Dutch energy storage market with its platform SemperPower, now rebranded under its own name, which it is using going forward. Via

Get Price

6 FAQs about [BESS revenue for Dutch energy storage power stations]

What are the economic opportunities for Bess assets within a Dutch electricity market?

We highlight the economic opportunities for BESS assets within one of the Dutch electricity markets in this article. The Dutch electricity market is undergoing a significant shift towards renewable energy, primarily solar, wind, and other sustainable sources.

Is the Netherlands a good place to invest in battery energy storage?

The Netherlands offers attractive revenue potential for Battery Energy Storage System (BESS) projects, thanks to a growing share of cheap renewable power sources combined with expensive gas-powered plants, resulting in relatively high price volatility on the electricity markets.

Will Dutch Bess capacity reach 5GW by 2030?

By 2030, total Dutch BESS capacity could potentially reach up to 5GW. This, however, will depend on investor confidence regarding the revenue potential and developments in the Dutch regulatory environment. Revenues from ancillary services are still relatively stable, but the threat of cannibalization is looming.

Why do Dutch Bess projects face high grid fees?

Dutch BESS projects face high grid fees and lack access to contracted revenue streams through capacity markets. Moreover, the limited availability of new grid connections due to severe grid congestion poses additional challenges for potential BESS investors.

What drives Bess revenue stack performance in 2021-22?

There are some important common drivers across all European power markets that have shaped BESS revenue stack performance across the last 3 years. All markets generated exceptional BESS returns in 2021-22 driven by a parallel: Power crisis – power market tightness given e.g. major French nuclear outages.

Is the Dutch Bess market a good investment?

This document is for information purposes only and is not, and should not be construed as, an offer, invitation or recommendation. The Dutch BESS market offers strong potential amid rising flexibility needs, but faces grid and policy hurdles. Still, investor interest and regulatory innovation grow.

More related information

-

Is there a 5-year BESS for energy storage power stations

Is there a 5-year BESS for energy storage power stations

-

BESS Standard for Energy Storage Power Stations in Kyrgyzstan

BESS Standard for Energy Storage Power Stations in Kyrgyzstan

-

What are the equipments of wind solar and energy storage power stations

What are the equipments of wind solar and energy storage power stations

-

Is there any height restriction for energy storage power stations

Is there any height restriction for energy storage power stations

-

How many companies are involved in energy storage power stations in Uzbekistan

How many companies are involved in energy storage power stations in Uzbekistan

-

How many companies in Sweden are doing energy storage power stations

How many companies in Sweden are doing energy storage power stations

-

Profit model and market price of energy storage power stations

Profit model and market price of energy storage power stations

-

Main uses of energy storage power stations

Main uses of energy storage power stations

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.