Hierarchical game optimization of independent shared energy storage

However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

Get Price

New Energy Storage Profit Model

The energy storage revenue has a significant impact on the operation of new energy stations. In this paper, an optimization method for energy storage is proposed to solve the energy storage

Get Price

How is the profit of energy storage power station?

Beyond traditional revenue models, energy storage power stations can tap into various emerging market opportunities that characterize modern

Get Price

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get Price

Research on Operation Strategy Optimization of Pumped Storage Power

Based on the electricity price prediction clustering, the typical electricity price scenario is generated, and the operation strategy optimization model supporting the pumped

Get Price

Capacity investment decisions of energy storage power stations

Design/methodology/approach Based on the research framework of time-of-use pricing, this paper constructs a profit-maximizing electricity price and capacity investment

Get Price

Economic Analysis of Energy Storage Stations: Costs, Profits,

Imagine your smartphone battery deciding when to charge itself based on electricity prices - that''s essentially what modern energy storage stations do for power grids.

Get Price

How much is the profit of energy storage power station

The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

Get Price

Analysis and Comparison for The Profit Model of Energy Storage

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get Price

Profit analysis of energy storage power stations

With the development of the electricity spot market, pumped-storage power stations are faced with the problem of realizing flexible adjustment capabilities and limited profit margins under

Get Price

Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

How is the profit model of energy storage power station

During periods of excess energy supply, often driven by renewables like wind or solar, energy storage stations can store the energy generated at lower prices. Conversely,

Get Price

Power storage profit model analysis report

On this basis,an optimal energy storage configuration model that maximizes total profitswas established,and financial evaluation methods were used to analyze the corresponding

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

How Energy Storage Power Stations Generate Operating

From California to Guangdong, operators are cracking the code on energy storage power station operating income using four primary models: capacity leasing, spot market arbitrage, grid

Get Price

Optimal revenue sharing model of a wind–solar

It also enhances the operating revenue of energy storage power stations by considering the contributions of both energy storage and

Get Price

How Energy Storage Power Stations Generate Operating Income: Key Models

From California to Guangdong, operators are cracking the code on energy storage power station operating income using four primary models: capacity leasing, spot market arbitrage, grid

Get Price

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get Price

Investment Insights into Energy Storage Power Stations: Cost

12 hours ago· Energy storage power stations have become vital pillars of the renewable energy transition. By storing excess electricity during low-demand periods and releasing it during peak

Get Price

How much profit does an energy storage power station make?

The financial success of energy storage power stations is significantly influenced by market dynamics. Energy markets can differ considerably between regions, affecting the

Get Price

Simulation Analysis of Profit and Loss of Pumped Storage Units

Under the new electricity price policy mechanism, China''s pumped storage units will enter the spot market to participate in mediation and profit. At present, pumped storage units are strictly

Get Price

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get Price

Analysis and Comparison for The Profit Model of Energy Storage Power

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get Price

Several profit models of energy storage stations

The concept of shared energy storage in power generation side has received significant interest due to its potential to enhance the flexibility of multiple renewable energy stations and optimize

Get Price

Capacity Allocation Method of Pumped-Storage

With the development of the electricity spot market, pumped-storage power stations are faced with the problem of realizing flexible

Get Price

Simulation Analysis of Profit and Loss of Pumped Storage Units

Starting from a weekly forecasted market clearing price curve, an algorithm to maximize the profit of a pumped-storage unit considering reserve bids is developed.

Get Price

Optimal price-taker bidding strategy of distributed energy storage

A novel approach has been provided to enhance the profitability and reduce the payback period of DESSs. This paper is divided into two parts: 1) A clearing model for DESS

Get Price

6 FAQs about [Profit model and market price of energy storage power stations]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

More related information

-

Sri Lanka energy storage power station profit model

Sri Lanka energy storage power station profit model

-

Profit model of UK energy storage power station

Profit model of UK energy storage power station

-

Price Standards for Energy Storage Power Stations Connected to the Grid

Price Standards for Energy Storage Power Stations Connected to the Grid

-

Standard price for containerized energy storage power stations

Standard price for containerized energy storage power stations

-

Brunei Power Plant Energy Storage Profit Model

Brunei Power Plant Energy Storage Profit Model

-

Icelandic energy storage power station profit model

Icelandic energy storage power station profit model

-

Profit model of mobile energy storage power station

Profit model of mobile energy storage power station

-

Advantages and disadvantages of energy storage power stations on the power consumption side

Advantages and disadvantages of energy storage power stations on the power consumption side

Commercial & Industrial Solar Storage Market Growth

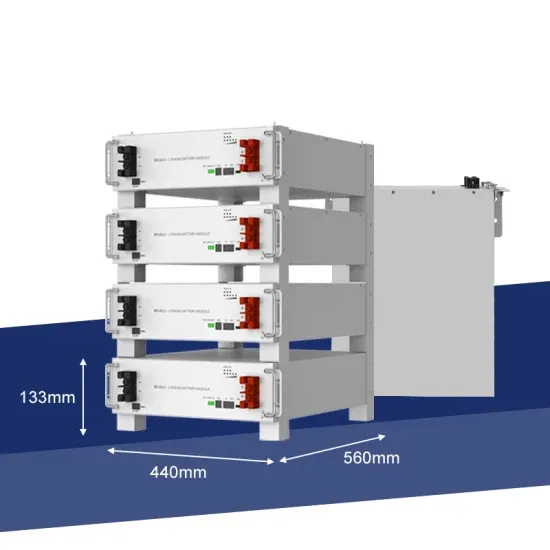

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.