Huawei Wins Tech Contract for Over Half of China Mobile''s Base Stations

Huawei Technologies has scored an agreement with China Mobile to supply tech to 5G wireless base stations. YiCai Global reported that Huawei has contracted with China

Get Price

China to accelerate 5G revolution, 6G innovation in 2025

China plans to build 4.5 million 5G base stations and develop more future industries in 2025, said the Ministry of Industry and Information Technology at

Get Price

5G Base Station Equipment Market 2025

The global 5G base station equipment market is witnessing unprecedented growth as telecommunications providers accelerate infrastructure deployments to meet rising demand for

Get Price

Infrastructure and equipment

5G base stations are equipped with multiple antennas that can transmit and receive signals simultaneously, significantly increasing network capacity. These stations are often installed on

Get Price

Secure, open 5G networks for defense missions

The factory is the first and largest US factory for manufacturing 5G base station radios and is currently manufacturing ~100 percent of the demand for the newest 5G basebands, mmwave

Get Price

China Mobile launches a new round of 5G base station procurement

China Mobile has launched a new round of centralized procurement for 5G wireless main equipment from 2023 to 2024, according to official information from China Mobile.

Get Price

What is a base station and how are 4G/5G base

What is a base station and how are 4G/5G base stations different? Base station is a stationary trans-receiver that serves as the primary hub for

Get Price

5G Base Station Equipment Market Report 2025: 5G Base

5G base stations form the backbone of next-generation wireless networks, enabling enhanced bandwidth, ultra-low latency, and broader coverage to support rising

Get Price

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Get Price

Long Term Evolution Base Station Market

1 day ago· Despite challenges such as the ongoing rollout of 5G technologies, the LTE base station market continues to thrive, bolstered by the enduring demand for reliable and efficient

Get Price

Huawei Wins Over Half of China''s Biggest 5G Base Station

(Yicai Global) June 12 -- Huawei Technologies has gained over half of the procurement of China''s largest fifth-generation wireless base station tender this year organized by China Mobile.

Get Price

5G Base Station Chips: Driving Future Connectivity by 2025

The evolution of wireless technology has brought the world to the brink of a connectivity revolution. As 5G networks become the backbone of modern communication, 5G

Get Price

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This work studies the optimization of

Get Price

China Mobile And China Broadcast Network Start Centralized Procurement

Recently, according to the release of China Radio and Television, China Radio and Television and China Mobile have agreed that the centralized procurement bidding for

Get Price

HS Code 85176100

Base stations of apparatus for the transmission or reception of voice, images or other data; Examples: - Base stations for cellular network

Get Price

5G Base Station

5G base station is the core equipment of 5G network, which provides wireless coverage and realizes wireless signal transmission between

Get Price

5G Network Equipment Manufacturers: Modem, Base Station,

Explore leading 5G equipment manufacturers for modems, base stations, RAN, and core networks. Discover vendors enhancing network speed and efficiency.

Get Price

Communication Base Station Financing Options | We Group

Have you ever wondered how telecom giants fund those towering communication base stations powering our digital world? With 5G deployment costs projected to hit $1.1 trillion

Get Price

Huawei Wins Over Half of China''s Biggest 5G Base

(Yicai Global) June 12 -- Huawei Technologies has gained over half of the procurement of China''s largest fifth-generation wireless base station tender

Get Price

China Mobile''s 5G 700M base station centralized procurement

4 days ago· Similar to the previous 5G base station procurement results, Huawei became the biggest winner, accounting for 60% of the market. In addition to Huawei and ZTE, Shanghai

Get Price

Huawei wins huge share of China Mobile''s 5G base station

The contracts have been split into two projects, with the first covering 63,800 base stations using 2.6GHz to 4.9GHz spectrum, while the second covers 23,141 in the 700MHz

Get Price

China Mobile launches a new round of 5G base station procurement

This procurement involves self-built 5G 2.6GHz/4.9GHz base station equipment and co-built and shared 5G 700MHz base station equipment, all of which are procured through a single source

Get Price

China Mobile And China Broadcast Network Start Centralized

Recently, according to the release of China Radio and Television, China Radio and Television and China Mobile have agreed that the centralized procurement bidding for

Get Price

Comprehensive Guide to Procuring Base Station Antennas for

Understanding Base Station Antennas Base station antennas are pivotal in ensuring seamless communication within cellular networks. These antennas, used in cell towers and

Get Price

Huawei Wins Tech Contract for Over Half of China Mobile''s Base

Huawei Technologies has scored an agreement with China Mobile to supply tech to 5G wireless base stations. YiCai Global reported that Huawei has contracted with China

Get Price

Optimization of 5G base station deployment based on quantum

In previous research on 5 G wireless networks, the optimization of base station deployment primarily relied on human expertise, simulation software, and algorithmic optimization. The

Get Price

Huawei wins huge share of China Mobile''s 5G base

The contracts have been split into two projects, with the first covering 63,800 base stations using 2.6GHz to 4.9GHz spectrum, while the

Get Price

6 FAQs about [Communication 5G base station procurement]

What are 5G base stations?

5G base stations form the backbone of next-generation wireless networks, enabling enhanced bandwidth, ultra-low latency, and broader coverage to support rising connectivity demands. Driven by surging smartphone adoption (78% global mobile ownership in 2023, per ITU) and escalating internet usage, the market is poised for robust growth.

Which telco will supply 5G base stations in 2023 & 2024?

Huawei Technologies has secured a major contract that will see it supply over half of the 5G base stations for telco China Mobile between 2023 and 2024. In total, Huawei has won 52 percent of China Mobile’s 5G base station work, as part of the largest portion of the contracts put out for tender this year, according to Yicai Global.

Which companies have been awarded a 5G contract?

Smaller contracts were also awarded to Datang Mobile Communications Equipment, Ericsson, and Nokia Shanghai Bell. China Mobile plans to operate more than 1.6 million 5G base stations this year, increase its number of cloud servers by more than 240,000 units, and add 40,000 external data center racks.

How many 5G base stations will China Mobile have this year?

China Mobile plans to operate more than 1.6 million 5G base stations this year, with 360,000 new additions. It aims to increase its number of cloud servers by more than 240,000 units and add 40,000 external data center racks. Editor: Emmi Laine

How many 5G base stations does Huawei have?

The contracts have been split into two projects, with the first covering 63,800 base stations using 2.6GHz to 4.9GHz spectrum, while the second covers 23,141 in the 700MHz band. Huawei is estimated to have secured 45,426 5G base stations worth an estimated 4.1 billion yuan (US$574 million).

Who won a 5G contract in China?

Huawei wasn't the only Chinese vendor to win a sizeable chunk of the tender, with ZTE the second-largest winner with around 26 percent of the contract, equivalent to 23,227 5G base stations. Smaller contracts were also awarded to Datang Mobile Communications Equipment, Ericsson, and Nokia Shanghai Bell.

More related information

-

5g base station number communication

5g base station number communication

-

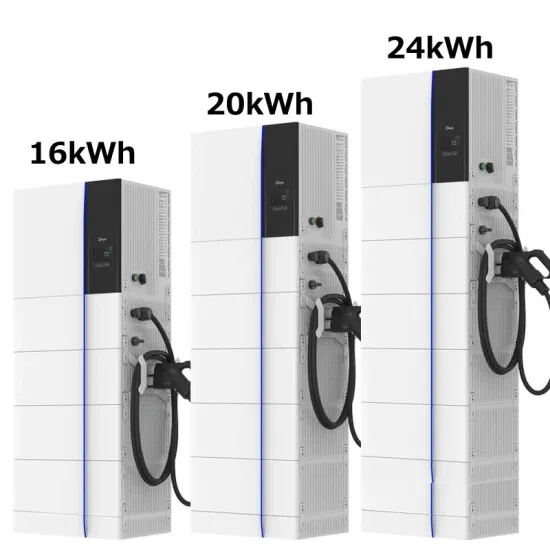

5g communication base station energy storage system and outdoor cabinet

5g communication base station energy storage system and outdoor cabinet

-

Huawei 5G communication base station wind power bidding

Huawei 5G communication base station wind power bidding

-

The components of the 5G communication base station inverter include

The components of the 5G communication base station inverter include

-

5G communication energy method base station energy method

5G communication energy method base station energy method

-

Nigeria 5g communication green base station equipment cabinet manufacturer

Nigeria 5g communication green base station equipment cabinet manufacturer

-

Communication 5G broadband base station

Communication 5G broadband base station

-

Iraq 5G communication base station wind power solution

Iraq 5G communication base station wind power solution

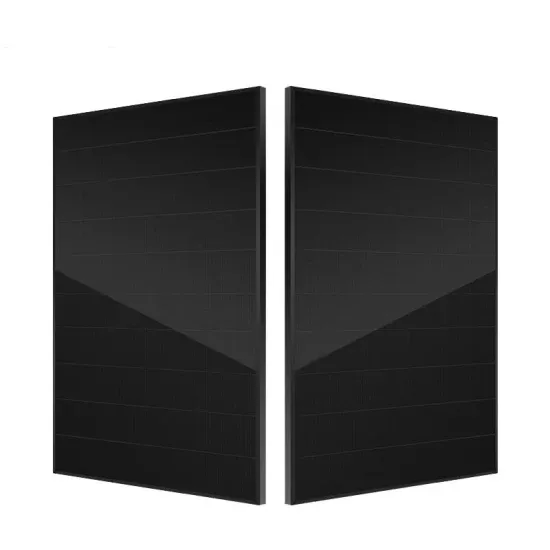

Commercial & Industrial Solar Storage Market Growth

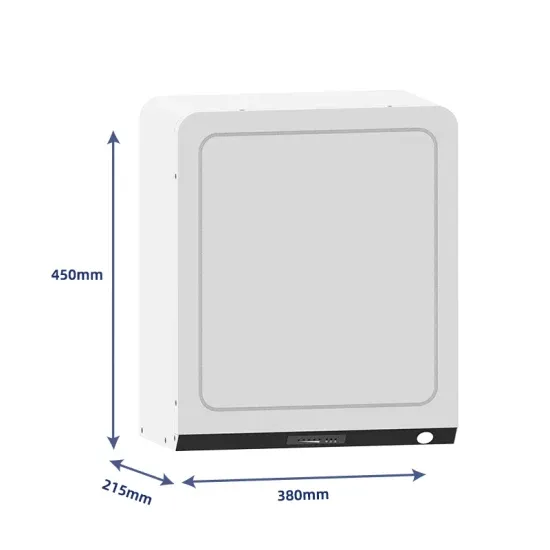

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.