South Korea Aerospace Power Inverter Market 2026: Size

Investment Opportunities in the Market South Korea''s aerospace sector is an attractive area for investment, particularly in power inverter technologies.

Get Price

South Korea Single-In Microinverter Market: Market Size, Share

This comprehensive market report provides a detailed analysis of the single-in microinverter market in South Korea, encompassing various aspects such as market size, segmentation,

Get Price

South Korea PV Inverter Market Size & Outlook, 2030

This country databook contains high-level insights into South Korea pv inverter market from 2018 to 2030, including revenue numbers, major trends, and

Get Price

South Korea PV Inverter Market Size & Outlook, 2030

This country databook contains high-level insights into South Korea pv inverter market from 2018 to 2030, including revenue numbers, major trends, and company profiles.

Get Price

South Korea Residential Energy Storage Inverter Market Size,

South Korea Residential Energy Storage Inverter Market size was valued at USD 0.9 Billion in 2024 and is projected to reach USD 2.

Get Price

South Korea Micro Inverter Market By Type | Future Insights 2031

The South Korea micro inverter market is primarily segmented by type, reflecting the diverse applications and technologies that cater to varying consumer needs. Grid-tied micro

Get Price

South Korea Solarpanel Microinverter Market By Application

The South Korea Solarpanel Microinverter Market is poised for significant growth, driven by technological innovation, government support, and evolving consumer preferences.

Get Price

LG unveils AC module with own microinverter

The South Korean manufacturer has launched a new 60-cell panel with a power output of up to 365 W. The 21.1%-efficient module features a 320

Get Price

Is Flextronics Becoming the TSMC of the Solar Industry;Wins

Enphase takes advantage of Ontario FiT, as Flextronics ramps microinverter production in province – PV-Tech Ontario''s lucrative guaranteed pricing structure for renewable energy

Get Price

Top 9 Solar Inverter Companies in South Korea (2025) | ensun

As South Korea continues to expand its renewable energy capacity, the solar inverter market is expected to grow, driven by increasing energy demand and a commitment to reducing carbon

Get Price

South Korea Solar Microinverter and Power Optimizer Market

South Korea Solar Microinverter and Power Optimizer Top Companies Market Share South Korea Solar Microinverter and Power Optimizer Competitive Benchmarking By Technical and

Get Price

Korea Solar Plant Project Case Study

The Maejeon Solar Plant in Wonju, South Korea, serves as a shining example of how innovative technology, supportive policies, and forward-thinking companies like Growatt

Get Price

Top Microinverter Manufacturers Suppliers in South Korea

It is also worth noting that South Korea boasts of several solar equipment producers and distributors. In addition to that, it has a healthy network of ports and logistical infrastructure.

Get Price

South Korea Micro-inverter Market (2024-2030) Outlook | Analysis

The South Korea micro-inverter market is driven by the rising adoption of solar PV systems across residential, commercial, and industrial sectors. Micro-inverters play a critical role in enhancing

Get Price

South Korea Single Phase Micro Inverter Market Size 2026

The South Korea Single Phase Micro Inverter industry exhibits concentrated regional activity, with key hubs such as Seoul, Incheon, and Busan leading in production,

Get Price

Absolute Reports®

3.8.1 South Korea Solar Microinverter Production Growth Rate (2016-2021) 3.8.2 South Korea Solar Microinverter Production, Revenue, Price and Gross Margin (2016-2021)

Get Price

Solar Microinverter Market Report Key Business Segment Booming

This report elaborates the market size, market characteristics, and market growth of the Solar Microinverter industry, and breaks down according to the type, application, and consumption

Get Price

Global MicroInverter Market Research Report 2024

Global MicroInverter Market Research Report 2024 The research report includes specific segments by region (country), by manufacturers, by Type and by Application. Each type

Get Price

Where Are Microwaves Made?

Samsung Electronics – based in Suwon, South Korea. Midea Group – based in Guangdong, China. Guangdong Galanz Enterprises Co. Ltd

Get Price

South Korea Grid-Off Solar Microinverter Market Size 2026-2033

The South Korea Grid-Off Solar Microinverter industry exhibits concentrated regional activity, with key hubs such as Seoul, Incheon, and Busan leading in production,

Get Price

South Korea

A highly developed country, South Korea''s economy is ranked 12th and 14th largest in the world by nominal GDP and PPP-adjusted GDP, respectively; it is

Get Price

South Korea Dual-module Microinverter Market Size, Automation

The South Korea Dual-Module Microinverter market has witnessed considerable growth over the past few years, emerging as a critical segment in the country''s renewable energy sector.

Get Price

Global Grid-Off Solar Microinverter Market Recent Trends, In

The research team projects that the Grid-Off Solar Microinverter market size will grow from XXX in 2021 to XXX by 2030, at an estimated CAGR of XX. The base year considered for the study is

Get Price

More related information

-

South Korean heavy industry energy storage cabinet manufacturer

South Korean heavy industry energy storage cabinet manufacturer

-

South American photovoltaic energy storage power supply production

South American photovoltaic energy storage power supply production

-

South Korean smart solar system manufacturer

South Korean smart solar system manufacturer

-

South Korean telecom operator base stations

South Korean telecom operator base stations

-

Solar photovoltaic module production in South Korea

Solar photovoltaic module production in South Korea

-

South Korean manufacturer inverter

South Korean manufacturer inverter

-

South Korean inverter prices

South Korean inverter prices

-

South Korean container energy storage system manufacturer

South Korean container energy storage system manufacturer

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

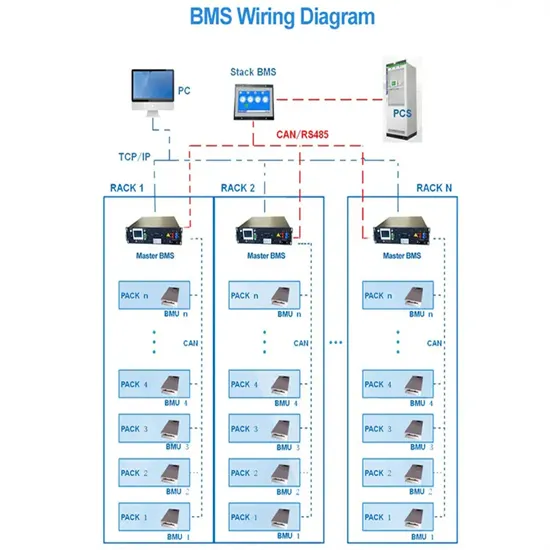

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.