Solutions for energy storage systems (ESS)

In 2021, StorEn signed an agreement on the exclusive distribution of products on the territory of MENA (Middle East and North Africa region) and Russia for the preparation of energy storage

Get Price

Middle East Archives

Last summer, a Texas energy storage operator watched in frustration as their battery system missed a golden trading opportunity during

Get Price

Middle East energy storage market set to skyrocket: Jinko Solar

In addition, Jinko Solar is also focusing on the energy storage market in Egypt. They argue that the agricultural energy storage market in Egypt is particularly critical because

Get Price

Powering the Future: Energy Storage Solutions in the Middle East

The Middle East''s journey towards energy diversification and sustainability is a story of vision, innovation, and collaboration. Energy storage solutions are at the heart of this

Get Price

The Battery Show at Middle East Energy 2025

Over 1,600 exhibitors will present cutting-edge solutions in Transmission & Distribution, Renewable & Clean Energy, Critical & Backup Power, Energy Consumption & Management,

Get Price

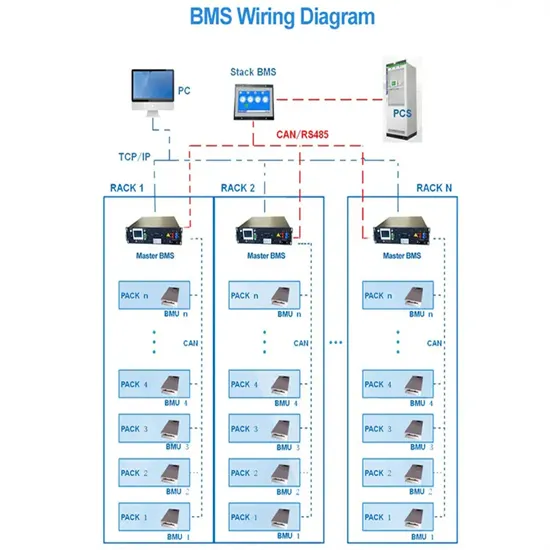

Chapter 15 Energy Storage Management Systems

Abstract Over the last decade, the number of large-scale energy storage deployments has been increasing dramatically. This growth has been driven by improvements in the cost and

Get Price

Middle East Energy | Energy series Energy Storage in MENA

What to expect: Examination of the challenges posed by the intermittency of renewable energy sources in the MENA region. Overview of current energy storage technologies, including

Get Price

MENA Solar and Renewable Energy Report

In collaboration with: The Middle East and North Africa saw 2019 again confirm the growth and importance of commissioning large projects and launching additional phases of their

Get Price

Energy Series Advancing Energy Storage in the MENA Region

To date, the most popular way to store excess energy has been pumped storage hydropower plants, but battery energy storage systems (BESS) and thermal storage in the form of molten

Get Price

Why battery storage investment is vital to the Middle East''s clean

MENA countries must rapidly deploy Battery Energy Storage Systems (BESS) into their power grids if they are to meet their national renewable energy targets. According to

Get Price

MEA Battery Energy Storage System Market

The Middle-East and Africa Battery Energy Storage System Market is growing at a CAGR of greater than 5.2% over the next 5 years.

Get Price

Middle East Energy Storage System Market Size and Forecasts

Residential Storage: Small-scale systems for solar energy storage, backup power, and self-consumption in Middle East. Commercial and Industrial Storage: Energy management

Get Price

Battery Storage in the Middle East: Powering the Energy Shift

As the Middle East intensifies its shift to renewable energy, battery storage is becoming a vital part of its infrastructure. Countries like Saudi Arabia and the United Arab

Get Price

ANALYSIS: The role of energy storage in

Through new management and orchestration systems, large energy users can be rewarded for their storage and resupply capabilities, as

Get Price

Middle East & Africa Energy Storage Systems Market

The energy storage systems market in Middle East & Africa is expected to reach a projected revenue of US$ 15,383.1 million by 2030. A compound annual

Get Price

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of

Get Price

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Ten key regulatory, financial, and market policy action steps are suggested to achieve the objective of successfully integrating energy storage systems in the power markets in MENA

Get Price

Powering the Future: Energy Storage Solutions in the

The Middle East''s journey towards energy diversification and sustainability is a story of vision, innovation, and collaboration. Energy storage

Get Price

How Middle East Energy Transition Will Stimulate

The initiatives and pathways announced to reach the ambitious aim of the energy transition are to limit global average temperature rise to less than 2°C and achieve a zero-emissions energy

Get Price

Why battery energy storage systems are the future of the UAE''s

These storage systems can effectively delay or avoid expensive transmission upgrades, reducing the cost of renewable projects. Having sufficient battery storage systems is

Get Price

Finding the right role for battery storage in the Middle

Based in the United Arab Emirates (UAE), Dr Imran Syed is head of industrial power for Enerwhere, designing and implementing hybrid systems

Get Price

MEA Advanced Battery Energy Storage System Market Size, Share

The Middle East and Africa Advanced Battery Energy Storage System Market is projected to grow from USD 249.46 million in 2023 to an estimated USD 471.80 million by 2032, with a CAGR of

Get Price

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of the MEA region.

Get Price

Middle East & Africa Energy Storage System Market Outlook, 2029

Within the Middle East & Africa (MEA) energy management system (ems) market, the commercial and industrial (c&i) segment is projected to retain dominance for the foreseeable future, driven

Get Price

ANALYSIS: The role of energy storage in

Through new management and orchestration systems, large energy users can be rewarded for their storage and resupply capabilities, as well as demand side management to

Get Price

Middle East Energy | Exhibit | Product Sectors

Energy Consumption & Management at Middle East Energy supports visitors for their need to establish systems that support the increase in energy

Get Price

Middle East and Africa Energy Storage System Market Size and

Battery Energy Storage Systems (BESS): Expected to dominate the market due to widespread adoption in residential, commercial, and utility applications in Middle East and

Get Price

Middle East & Africa Energy Storage System Market

Within the Middle East & Africa (MEA) energy management system (ems) market, the commercial and industrial (c&i) segment is projected to retain dominance

Get Price

6 FAQs about [Middle East Energy Storage System Energy Management System]

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What is energy storage system deployment in MENA?

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Can energy storage be integrated in MENA?

Although the energy storage market in MENA is bound to grow, several barriers exist that hinder the integration of ESS and the ramping up of investments. Financial, regulatory, and market barriers need to be addressed via policy tools that lay the foundations for an evolved power market to integrate the deployed ESS.

What is energy storage Alliance in MENA?

Create an Energy Storage Alliance in MENA supported by governments and the private sector to foster the development of ESS in the region, by enhancing public-private partnerships. A key objective of this alliance is to foster the development of ESS in the region through experience sharing and standardization.

What is an energy storage system?

An energy storage system is charged from the grid or by on-site generation to be used at a later time to take advantage of price diferentials. Energy storage is used instead of upgrading the transmission network infrastructure. The storage system provides the grid with the necessary output to ensure the voltage level on the network remains steady.

More related information

-

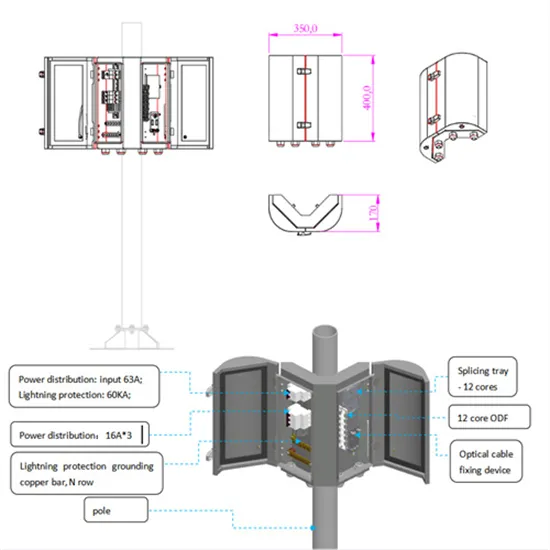

Tender for energy storage batteries for Middle East communication base stations

Tender for energy storage batteries for Middle East communication base stations

-

Latest on Middle East Energy Storage Implementation Plan

Latest on Middle East Energy Storage Implementation Plan

-

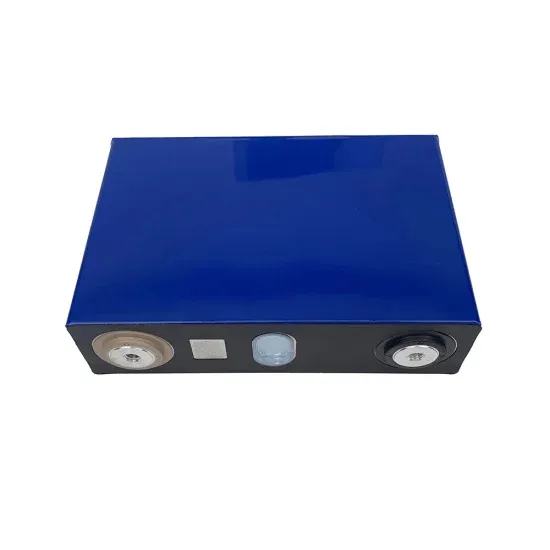

Rechargeable Energy Storage Battery Assembly in the Middle East

Rechargeable Energy Storage Battery Assembly in the Middle East

-

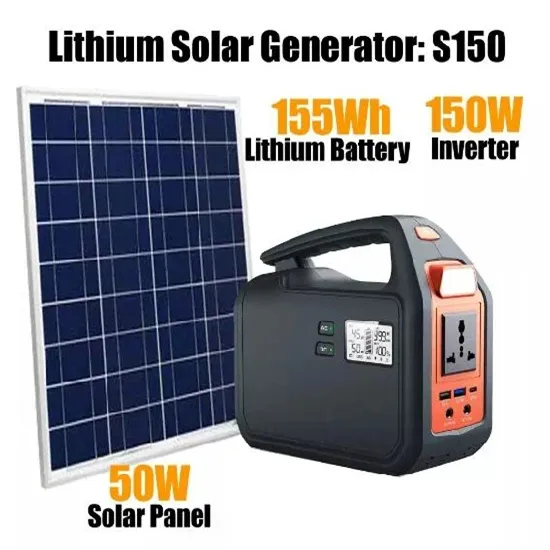

Middle East energy storage solar power prices

Middle East energy storage solar power prices

-

BESS energy storage equipment for Middle East office buildings

BESS energy storage equipment for Middle East office buildings

-

Are there energy storage power stations in the Middle East

Are there energy storage power stations in the Middle East

-

Middle East Industrial and Commercial Energy Storage Project

Middle East Industrial and Commercial Energy Storage Project

-

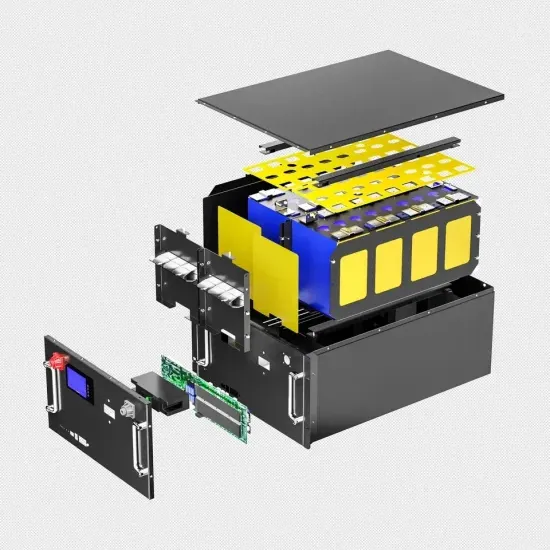

Middle East Energy Storage Battery Factory

Middle East Energy Storage Battery Factory

Commercial & Industrial Solar Storage Market Growth

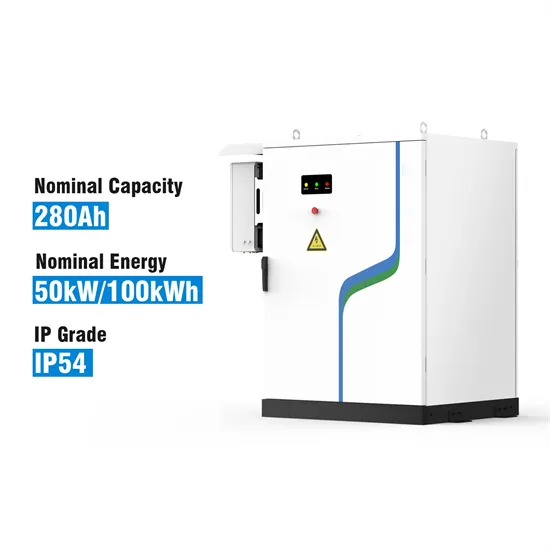

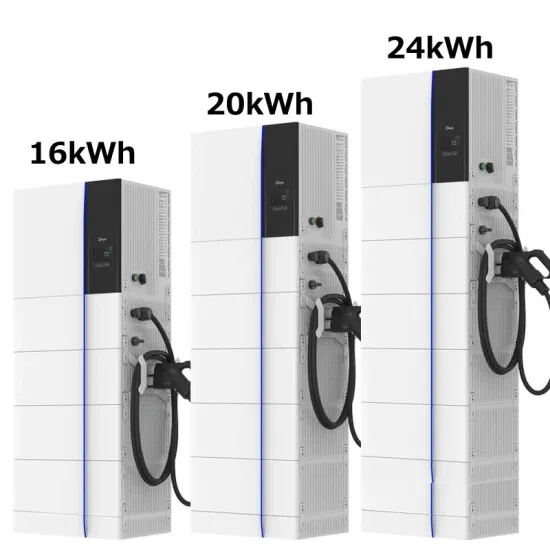

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

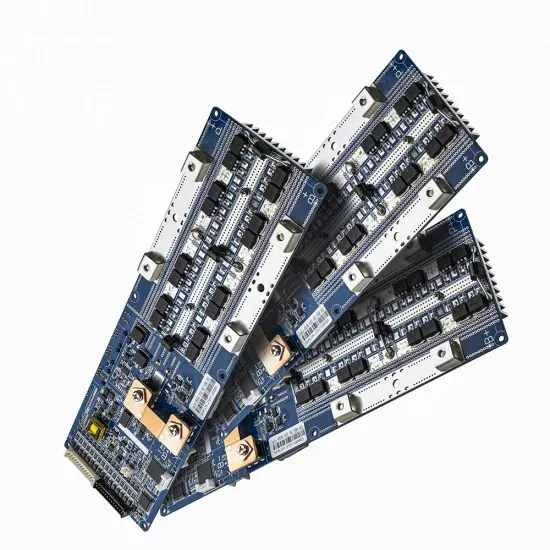

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.