Middle-East and Africa Battery Energy Storage System Market

Conclusion The Middle-East and Africa battery energy storage system market is experiencing robust growth driven by factors such as increasing renewable energy deployment, grid

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for

Get Price

MENA Round-Up: Saudi Arabia Among Top 10

Saudi Arabia is now ranked among the world''s top ten energy storage markets, its growth driven by the launch of the 2,000 MWh Bisha

Get Price

Why battery storage investment is vital to the Middle East''s clean

According to reports, there are 30 BESS projects planned in MENA between 2021 and 2025 with a total capacity/energy of 653 MW/3,382 MWh. The share of batteries out of

Get Price

Middle East Energy Storage Market Outlook

This article delves into the outlook for energy storage in the Middle East, emphasizing the potential of solid-state batteries to support the region''s energy transformation.

Get Price

Battery Storage in the Middle East: Powering the Energy Shift

As the Middle East intensifies its shift to renewable energy, battery storage is becoming a vital part of its infrastructure. Countries like Saudi Arabia and the United Arab

Get Price

Recharging Energy Storage Future

Beyond regional focus, Enercap plans to expand globally through licensing and joint ventures, localising manufacturing while maintaining technology quality—continuing its

Get Price

Saudi Arabia ranks among top 10 in global energy storage

Saudi Arabia has established itself as a leading player among the top ten global markets in the area of energy storage in Saudi Arabia, coinciding with the launch of the Bisha

Get Price

Middle East Green Hydrogen Market | Industry Report, 2033

The Middle East green hydrogen market size was estimated at USD 168.4 million in 2024 and is projected to reach USD 1,254.8 million by 2033, growing at a CAGR of 22.8% from 2025 to 2033.

Get Price

Navigating Renewable Energy Challenges

Saudi Arabia invests in energy storage infrastructure, with projects like ACWA Power''s 1.2 GWh system at the Red Sea Project and plans for a 600 GWh BESS in Neom.

Get Price

WFES 2024

AN EXCLUSIVE REPORT FOR THE WORLD FUTURE ENERGY SUMMIT BY Grid connected solar PV capacity in the Middle East is expected to grow at a CAGR of 12.9% by 2030, one of

Get Price

Middle East and Africa energy storage outlook 2025

The Middle East and Africa (MEA) Energy Storage Outlook analyses key market drivers, barriers, and policies shaping energy storage adoption across grid-scale and

Get Price

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for

Get Price

Middle East Investments Surge as Global Energy

This rapid growth positions the Middle East as a leading contributor to global energy storage expansion in 2025, with new installations anticipated

Get Price

Why battery storage investment is vital to the Middle

According to reports, there are 30 BESS projects planned in MENA between 2021 and 2025 with a total capacity/energy of 653 MW/3,382

Get Price

Middle East Residential Energy Storage Status and Outlook!

The residential energy storage market in the Middle East has developed rapidly in recent years, driven by energy transformation, policy drive, and technological progress.

Get Price

Middle East Energy Storage Market Outlook

This article delves into the outlook for energy storage in the Middle East, emphasizing the potential of solid-state batteries to support the region''s

Get Price

The MENA region – the next hot market for energy

The MENA region is starting to witness a drastic increase in large-scale battery energy storage systems ("BESS") projects, accompanying a

Get Price

The MENA region – the next hot market for energy storage

The MENA region is starting to witness a drastic increase in large-scale battery energy storage systems ("BESS") projects, accompanying a soaring penetration of renewable

Get Price

UAE utility announces EOI for 400MW battery storage

Utility EWEC has invited developers to submit expressions of interest (EOI) for a 400MW BESS project in the UAE.

Get Price

Middle East Investments Surge as Global Energy Storage Market

This rapid growth positions the Middle East as a leading contributor to global energy storage expansion in 2025, with new installations anticipated to reach 20 GWh, a

Get Price

The MENA region – the next hot market for energy

The rapid growth rate of energy storage in the MENA region, led by the GCC, is surprising many analysts. Saudi Arabia, in particular, is set to

Get Price

MEA Battery Energy Storage System Market

The Middle-East and Africa Battery Energy Storage System Market is growing at a CAGR of greater than 5.2% over the next 5 years.

Get Price

Middle East Energy | Market Outlook Report

Download the Market Outlook Report 2025The " Middle East and North Africa 2025 Energy Industry Outlook " powered by Middle East Energy, offers a comprehensive analysis of the

Get Price

Middle East and North Africa

Instead of bringing the oil era to a halt, Middle East producers would prefer to see greater emphasis on carbon capture and storage, to create a ''circular carbon economy''. At the same

Get Price

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Ten key regulatory, financial, and market policy action steps are suggested to achieve the objective of successfully integrating energy storage systems in the power markets in MENA

Get Price

Saudi Arabia: 2GWh BESS project ''marks

A 2GWh battery energy storage system (BESS) project has gone into operation in Saudi Arabia, according to the EPC firm which delivered it.

Get Price

MEED | Middle East business intelligence, news, data, analysis

A MEED Subscription... Subscribe or upgrade your current MEED package to support your strategic planning with the MENA region''s best source of business information. Proceed to our

Get Price

Role of Energy Storage

The energy storage market in Oman and Kuwait, including batteries, is expected to grow in the coming years due to the increasing demand for renewable energy and the need for backup

Get Price

Middle East and Africa energy storage outlook 2025

The Middle East and Africa (MEA) Energy Storage Outlook analyses key market drivers, barriers, and policies shaping energy storage

Get Price

More related information

-

Middle East Industrial and Commercial Energy Storage Project

Middle East Industrial and Commercial Energy Storage Project

-

Middle East Sodium Battery Energy Storage Project

Middle East Sodium Battery Energy Storage Project

-

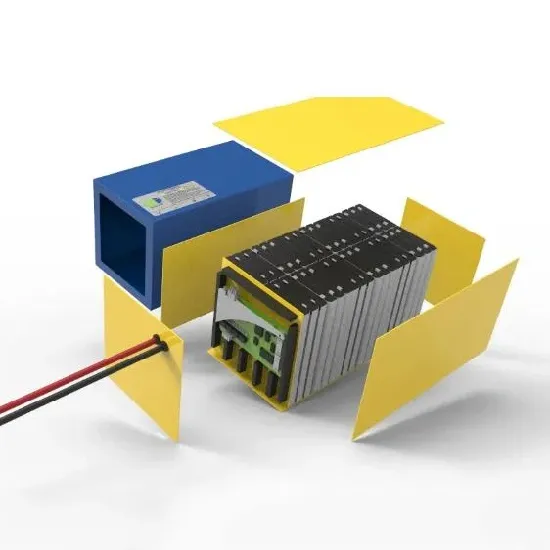

Rechargeable Energy Storage Battery Assembly in the Middle East

Rechargeable Energy Storage Battery Assembly in the Middle East

-

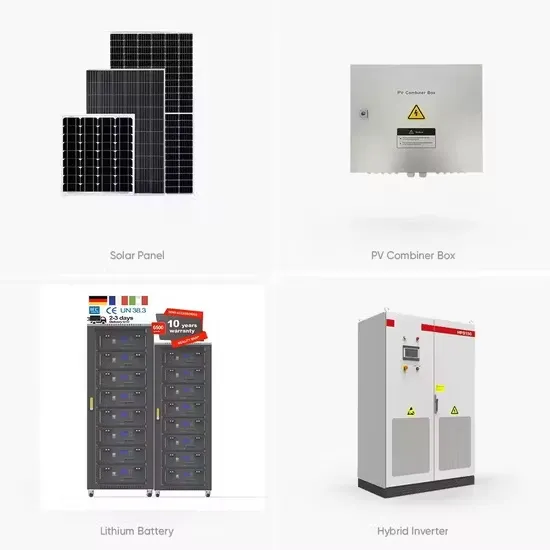

East Timor Energy Storage Photovoltaic Power Generation Project

East Timor Energy Storage Photovoltaic Power Generation Project

-

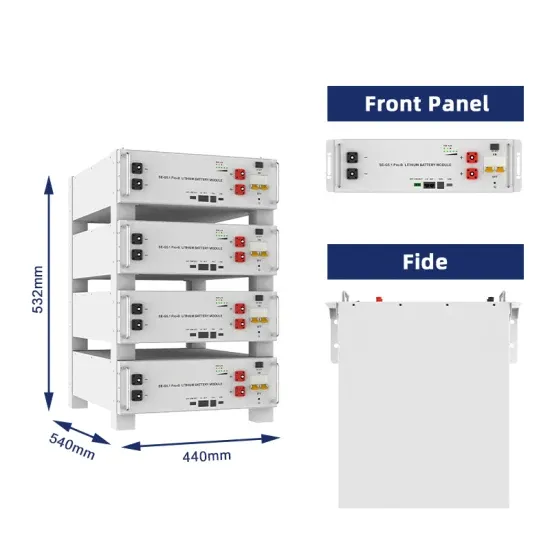

Tender for energy storage batteries for Middle East communication base stations

Tender for energy storage batteries for Middle East communication base stations

-

East African Mining Energy Storage Project

East African Mining Energy Storage Project

-

Developing energy storage projects in the Middle East

Developing energy storage projects in the Middle East

-

Middle East Energy Storage Power Station Franchise Agent

Middle East Energy Storage Power Station Franchise Agent

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.